Chuck Royce Adds Richardson Electronics Ltd to Portfolio

Overview of Chuck Royce (Trades, Portfolio)'s Recent Portfolio Addition

On December 31, 2023, Chuck Royce (Trades, Portfolio)'s investment firm made a notable addition to its investment portfolio by acquiring 980,085 shares of Richardson Electronics Ltd (NASDAQ:RELL), a company specializing in engineered solutions and electronic components. This transaction, executed at a trade price of $13.35 per share, represents a 0.13% position in the firm's portfolio and an 8.02% ownership in Richardson Electronics Ltd.

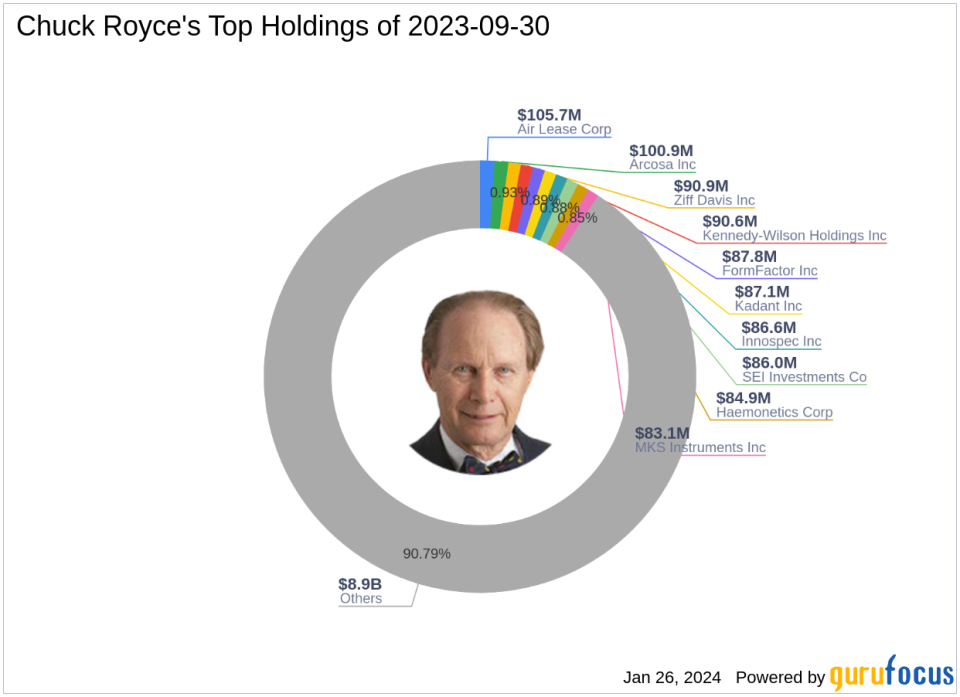

Profile of Investment Firm: Chuck Royce (Trades, Portfolio)

Charles M. Royce, a distinguished figure in the investment world, is renowned for pioneering small-cap investing. As the portfolio manager for Royce Pennsylvania Mutual Fund since 1972, Royce has built a reputation for his value investing philosophy. The firm focuses on smaller companies with strong balance sheets, a history of success, and potential for a profitable future. With a portfolio equity of $9.82 billion, the firm's top holdings include FormFactor Inc (NASDAQ:FORM), Ziff Davis Inc (NASDAQ:ZD), and Air Lease Corp (NYSE:AL), with a preference for the industrials and technology sectors.

Richardson Electronics Ltd Company Overview

Richardson Electronics Ltd, with its stock symbol RELL, operates within the hardware industry, providing a range of electronic components and solutions across various market segments. Since its IPO on October 27, 1983, the company has grown to encompass segments such as Canvys, Green Energy Solutions (GES), Healthcare, and Power and Microwave Technologies Group (PMT). With a market capitalization of $147.411 million, Richardson Electronics Ltd has established itself as a key player in its field.

Impact of the Trade on Chuck Royce (Trades, Portfolio)'s Portfolio

The recent acquisition of Richardson Electronics Ltd shares has a modest impact on Chuck Royce (Trades, Portfolio)'s portfolio, with a trade impact of 0.05%. However, the 8.02% stake in the company signifies a substantial investment in the firm's future prospects and aligns with the investment philosophy of seeking undervalued companies with strong potential.

Financial Health and Market Performance of Richardson Electronics Ltd

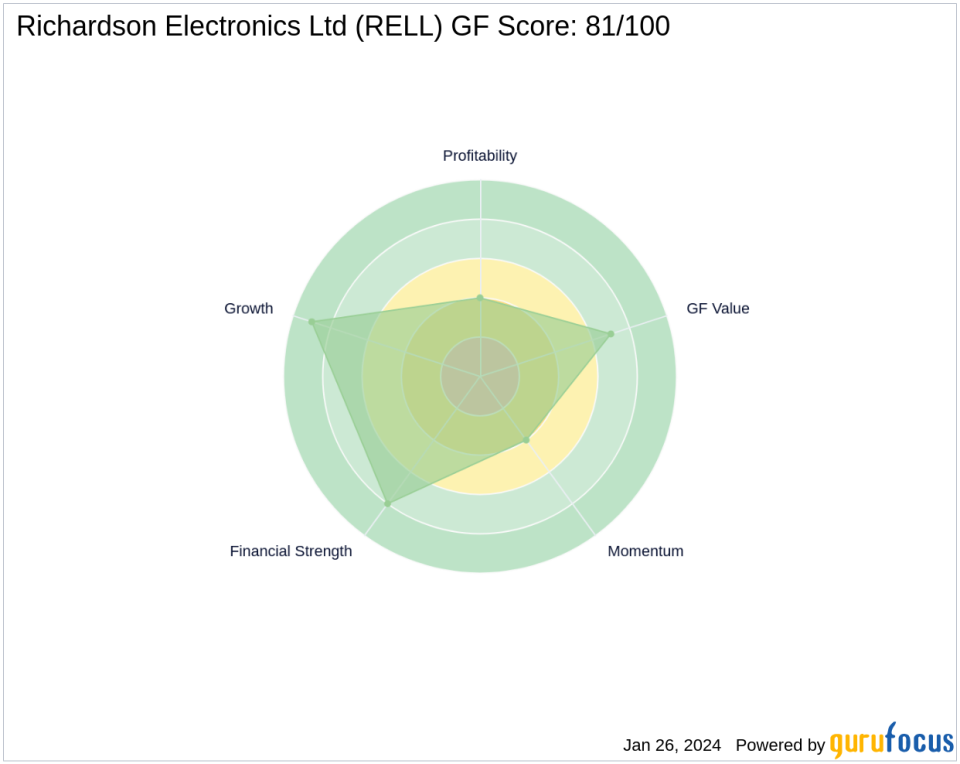

Richardson Electronics Ltd's current stock price stands at $10.324, reflecting a PE Ratio of 15.41. The company is considered modestly undervalued with a GF Value of $12.36 and a price to GF Value ratio of 0.84. Despite a recent price decline of 22.67% since the transaction, the company maintains a solid GF Score of 81/100, indicating good outperformance potential.

Valuation and Comparative Analysis

When assessing Richardson Electronics Ltd's valuation, the stock's GF Value suggests that it is trading below its intrinsic value. The company's financial health, as indicated by its Financial Strength and Profitability Rank, along with its Growth Rank and GF Value Rank, supports the notion that the stock may be undervalued, presenting a potential opportunity for value investors.

Industry Outlook and Company's Future Prospects

The hardware industry is known for its competitive and innovative nature, and Richardson Electronics Ltd has carved out a niche with its specialized offerings. The company's growth prospects appear promising, with a strong Growth Rank of 9/10 and a Revenue Growth 3 Year rate of 14.90%. These factors, combined with the company's strategic market segments, position it well for future performance.

Chuck Royce (Trades, Portfolio)'s Investment Strategy and Top Holdings

Chuck Royce (Trades, Portfolio)'s investment strategy is reflected in the firm's top holdings and sector focus. The addition of Richardson Electronics Ltd to the portfolio is consistent with the firm's approach to investing in undervalued companies with strong growth potential. This strategic move may indicate confidence in the company's future and its alignment with the firm's investment criteria.

Conclusion: Analyzing the Transaction's Influence

The acquisition of Richardson Electronics Ltd by Chuck Royce (Trades, Portfolio)'s firm is a strategic investment that aligns with the firm's value investing philosophy. The company's solid financial health, market position, and growth prospects make it an attractive addition to the portfolio. As the hardware industry continues to evolve, Richardson Electronics Ltd's specialized solutions and market segments could drive its future success, potentially benefiting the firm's investment in the long term.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.