Chuck Royce Adjusts Position in Hurco Companies Inc

Overview of Chuck Royce (Trades, Portfolio)'s Recent Stock Transaction

Chuck Royce (Trades, Portfolio), a notable figure in the investment community, has recently made a significant adjustment to the firm's holdings in Hurco Companies Inc (NASDAQ:HURC). On December 31, 2023, the firm reduced its stake in HURC, signaling a strategic move within its investment portfolio. This transaction reflects the firm's ongoing assessment of the value and potential of its investments.

Profile of Chuck Royce (Trades, Portfolio)

Charles M. Royce, a seasoned investor and a pioneer in small-cap investing, has been managing the Royce Pennsylvania Mutual Fund since 1972. With a bachelor's degree from Brown University and an MBA from Columbia University, Royce's investment philosophy centers on finding undervalued smaller companies with strong balance sheets and potential for profitable futures. The firm's approach is grounded in a value investing framework, seeking stocks trading below their estimated enterprise value.

Hurco Companies Inc at a Glance

Hurco Companies Inc, based in the USA, operates as an industrial technology company. Since its IPO on September 5, 1989, HURC has been designing, manufacturing, and selling advanced computerized machine tools. The company's focus on user-friendly computer control systems caters to both skilled and unskilled operators, with the majority of its revenue generated from the United States. Hurco's product offerings include 5-Axis and 3-Axis Vertical Machining Centers, Horizontal Machining Centers, and Turning Centers.

Transaction Specifics

The transaction, which took place on December 31, 2023, saw Chuck Royce (Trades, Portfolio)'s firm reduce its position in HURC by 52,000 shares, resulting in a 9.56% decrease. This adjustment had a minor impact of -0.01% on the firm's portfolio, with the trade executed at a price of $21.53 per share. Following the transaction, the firm holds 492,115 shares of HURC, accounting for 0.11% of the portfolio and 7.62% of the company's outstanding shares.

Financial Health and Market Performance of Hurco Companies Inc

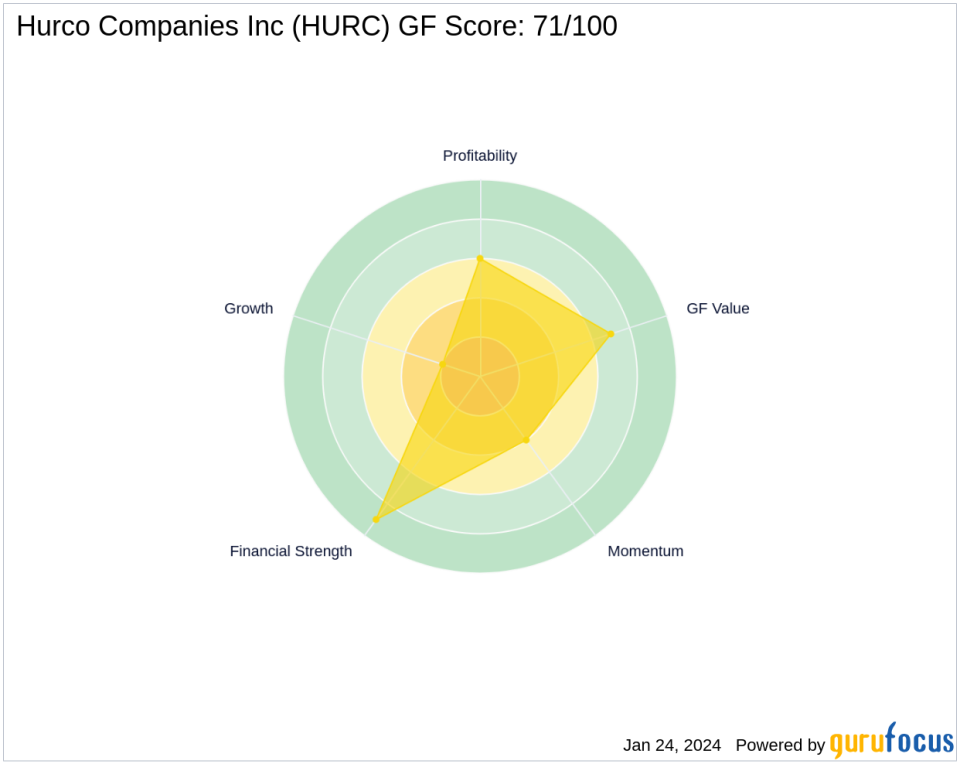

Hurco Companies Inc boasts a market capitalization of $152.088 million, with a current stock price of $23.50. The stock is considered modestly undervalued with a GF Value of $26.85 and trades at a PE Ratio of 35.61. Hurco's financial health is reflected in its high Financial Strength rank of 9/10 and a solid interest coverage ratio of 23.46. However, the company's Growth Rank stands at a lower 2/10, indicating potential areas for improvement.

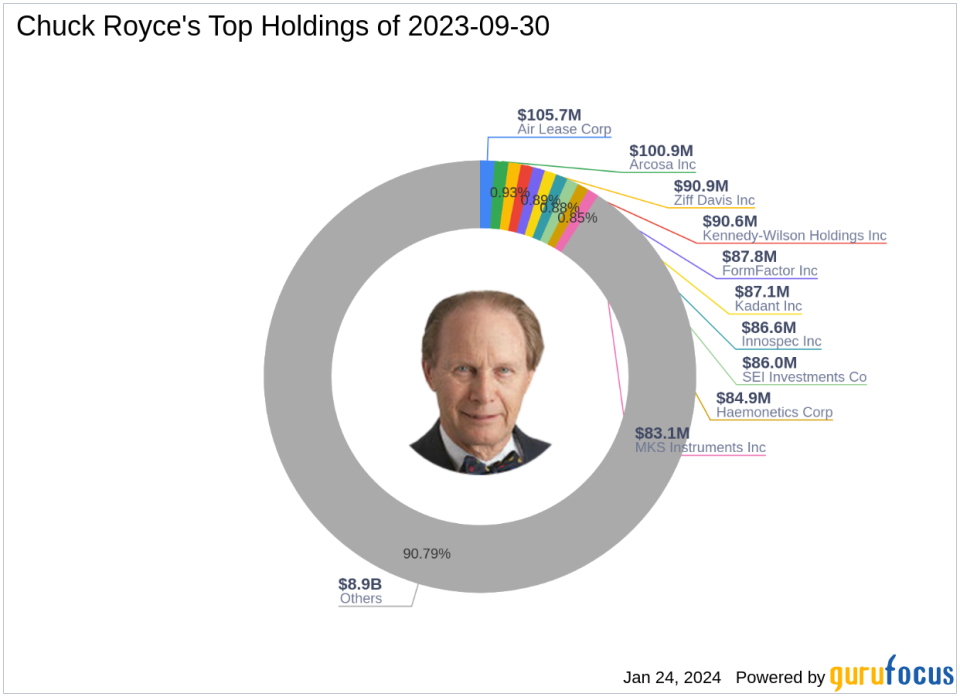

Chuck Royce (Trades, Portfolio)'s Portfolio and Top Holdings

Chuck Royce (Trades, Portfolio)'s firm manages an equity portfolio valued at $9.82 billion, with top sectors including Industrials and Technology. The firm's top holdings feature companies like FormFactor Inc (NASDAQ:FORM), Ziff Davis Inc (NASDAQ:ZD), and Air Lease Corp (NYSE:AL), showcasing a diversified investment strategy focused on value and potential growth.

Comparative Analysis

Since its IPO, Hurco's stock has seen a price change of 74.07%, with a year-to-date performance increase of 7.6%. The stock's GF Score of 71/100 suggests it has the potential for average performance in the future, while its financial ranks, including a Profitability Rank of 6/10, provide a mixed outlook.

Market Position and Future Outlook

Hurco's standing in the Industrial Products industry is bolstered by its competitive edge in computerized machine tools. The company's potential for profitability and growth is supported by current data and trends, although its growth metrics indicate areas that could be strengthened. The firm's recent transaction may reflect a strategic realignment based on these factors.

Transaction Analysis

The recent reduction in Chuck Royce (Trades, Portfolio)'s firm's stake in Hurco Companies Inc has a nuanced impact on the portfolio. While the trade itself was minor, it underscores the firm's active management and valuation-based investment decisions. With the trade price of $21.53 being lower than the current stock price of $23.50, the firm's timing and decision-making will continue to be areas of interest for value investors monitoring the firm's moves.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.