Chuck Royce Adjusts Position in International General Insurance Holdings Ltd

Transaction Overview

On December 31, 2023, Chuck Royce (Trades, Portfolio)'s firm made a notable adjustment to its investment portfolio by reducing its stake in International General Insurance Holdings Ltd (NASDAQ:IGIC). The transaction involved the sale of 581,229 shares at a price of $12.88 per share, resulting in a total holding of 3,750,321 shares. This move had a -0.08% impact on the portfolio, with IGIC now representing 0.49% of the total investments and the firm's ownership in IGIC standing at 8.07%.

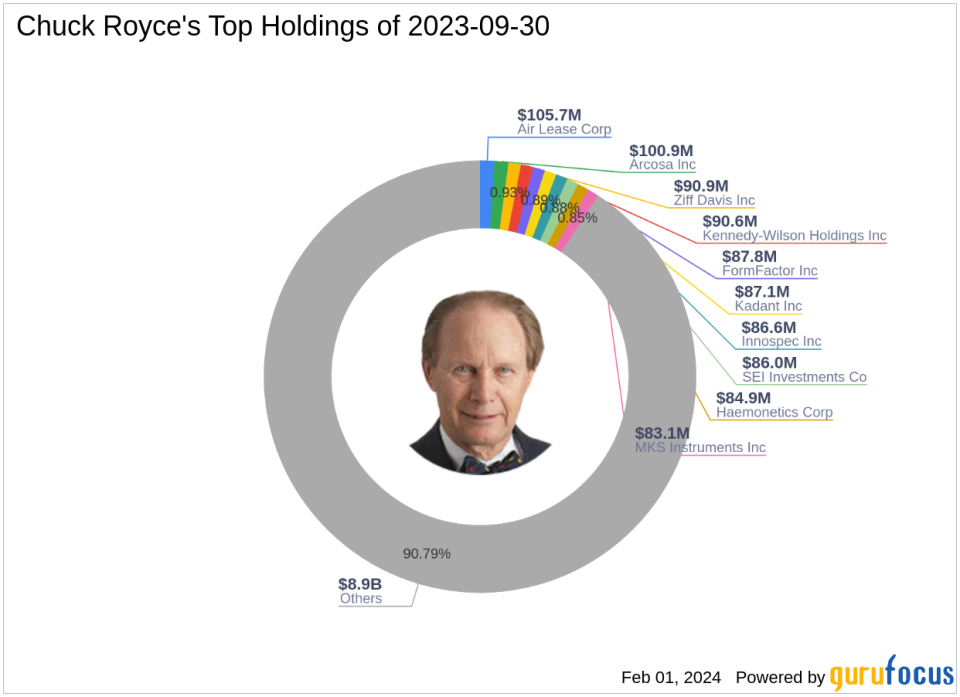

Chuck Royce (Trades, Portfolio)'s Investment Profile

Charles M. Royce, a renowned figure in the investment community, has been at the helm of Royce Pennsylvania Mutual Fund since 1972. With a focus on small-cap companies, the firm's investment philosophy is grounded in identifying undervalued stocks with strong balance sheets, successful business histories, and promising futures. The firm's portfolio is diverse, with top holdings in various sectors, including Industrials and Technology. Chuck Royce (Trades, Portfolio)'s firm manages an equity portfolio valued at $9.82 billion, with 907 stocks in its current roster.

International General Insurance Holdings Ltd at a Glance

IGIC, based in Jordan, is a specialist commercial insurer and reinsurer with a diverse portfolio of specialty lines. Since its IPO on March 18, 2020, the company has been actively involved in sectors such as Energy, Property, and Financial Institutions. With a market capitalization of $625.569 million, IGIC has demonstrated a solid financial presence. The stock is currently priced at $13.46, modestly overvalued according to the GF Value, with a GF Value of $10.84.

Impact of the Trade on Royce's Portfolio

The recent transaction by Chuck Royce (Trades, Portfolio)'s firm has slightly decreased its exposure to IGIC, which may reflect a strategic rebalancing or a response to the stock's valuation. Despite the reduction, IGIC remains a significant holding, indicating a continued belief in the company's potential. The trade's impact on the portfolio was minimal, but it underscores the firm's active management approach.

IGIC's Market Performance

IGIC's stock has seen a 4.5% gain since the trade date, with a year-to-date increase of 3.86%. The stock has also experienced a significant rise of 91.19% since its IPO, showcasing strong market performance. The current stock price exceeds the GF Value, suggesting a higher market valuation than the intrinsic value estimated by GuruFocus.

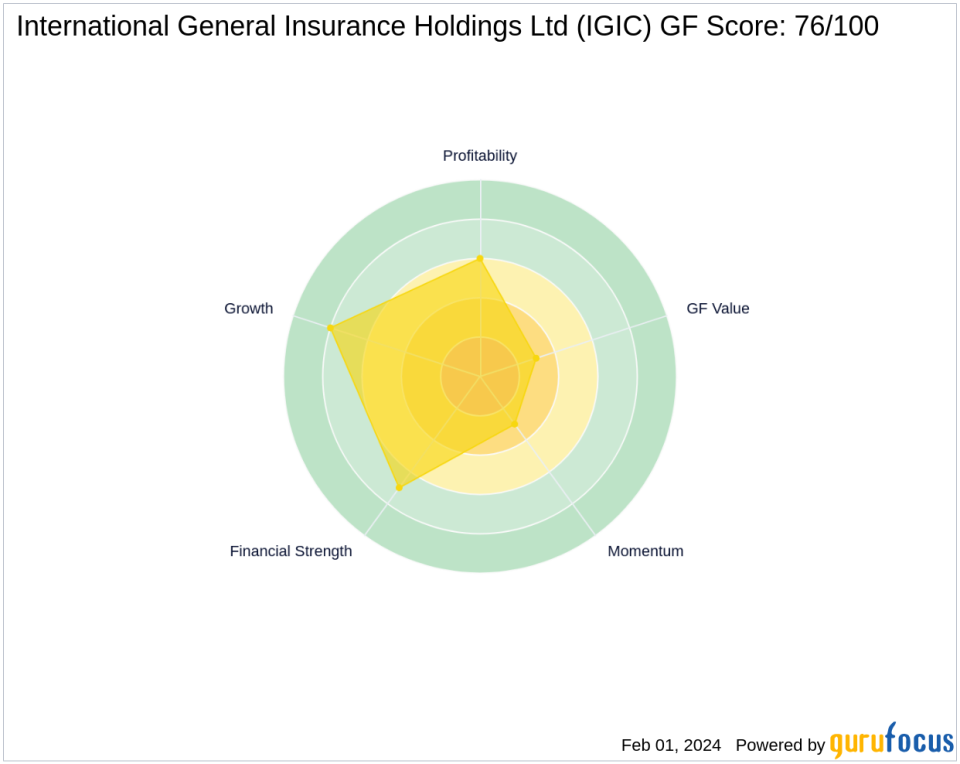

Financial Health and Valuation Metrics

IGIC's financial health is robust, with a Financial Strength rank of 7/10 and a Profitability Rank of 6/10. The company's growth is impressive, reflected in its Growth Rank of 8/10. However, its GF Value Rank and Momentum Rank are lower at 3/10, indicating potential concerns about its current valuation and momentum.

Insurance Industry Context

Chuck Royce (Trades, Portfolio)'s firm has a history of investing in the insurance industry, and IGIC's role within this strategy is significant. The company's performance is compared with industry standards and competitors to ensure alignment with the firm's investment philosophy. IGIC's strong ROE of 23.65% and ROA of 6.39% are competitive within the insurance sector, reinforcing its position in the firm's portfolio.

Conclusion

In summary, Chuck Royce (Trades, Portfolio)'s recent trade reflects a strategic adjustment in the firm's investment in International General Insurance Holdings Ltd. While the reduction in shares has a minor impact on the portfolio, it highlights the firm's active management and valuation considerations. IGIC's solid financial health, growth prospects, and industry standing continue to make it a noteworthy component of the firm's investment strategy. Value investors will be watching closely to see how this trade influences the firm's performance and IGIC's future market trajectory.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.