Chuck Royce Adjusts Position in Matrix Service Co

Overview of Chuck Royce (Trades, Portfolio)'s Recent Stock Transaction

On December 31, 2023, the investment firm managed by Chuck Royce (Trades, Portfolio) reported a significant transaction involving Matrix Service Co (NASDAQ:MTRX), an engineering and construction provider. The firm reduced its holdings in MTRX by 238,500 shares, resulting in a 21.02% decrease from its previous stake. This adjustment left the firm with a total of 896,259 shares in the company, which now represents a 0.09% impact on the portfolio and a 3.29% ownership of MTRX's outstanding shares. The shares were traded at a price of $9.78 each.

Profile of Chuck Royce (Trades, Portfolio)

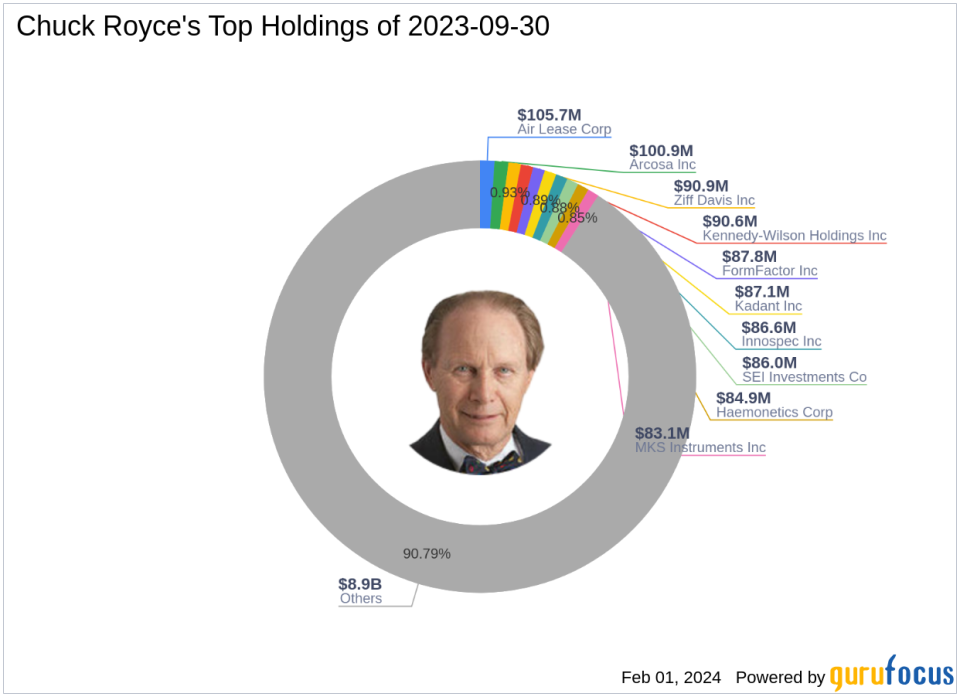

Charles M. Royce, a notable figure in the investment world, is renowned for his expertise in small-cap investing. As the portfolio manager for Royce Pennsylvania Mutual Fund since 1972, Royce has built a reputation for his value investing approach. With a focus on companies with market capitalizations up to $5 billion, the firm seeks out undervalued stocks with strong balance sheets, a history of success, and promising futures. Royce's portfolio currently comprises 907 stocks, with top holdings including FormFactor Inc (NASDAQ:FORM), Ziff Davis Inc (NASDAQ:ZD), and Air Lease Corp (NYSE:AL), predominantly in the Industrials and Technology sectors. The firm's equity stands at $9.82 billion.

Matrix Service Co's Stock Overview

Matrix Service Co, listed under the symbol MTRX in the USA, has been publicly traded since October 3, 1990. The company specializes in large industrial projects across various segments, including Utility and Power Infrastructure, Process and Industrial Facilities, and Storage and Terminal Solutions. With a market capitalization of $252.543 million, MTRX is currently priced at $9.28, reflecting a GF Value of $8.42 and a Price to GF Value ratio of 1.10, indicating the stock is fairly valued. The company's financial health and growth metrics, such as the GF Score of 63/100, suggest moderate future performance potential.

Analysis of the Trade Impact

The recent reduction in MTRX shares by Chuck Royce (Trades, Portfolio)'s firm has a minor impact on the overall portfolio, with a -0.02% change. However, the firm still maintains a significant position in the company, holding 3.29% of the outstanding shares. This move could signal a strategic adjustment based on the firm's assessment of MTRX's current market performance and future prospects.

Market Context and Stock Performance

Since the trade date, Matrix Service Co's stock has experienced a -5.11% decline, with a year-to-date performance showing a -3.33% change. The stock's current price is slightly below the trade price of $9.78, yet it has grown 128.57% since its IPO. The stock's performance metrics, including a 5-day RSI of 27.95, suggest a potential undervaluation in the short term.

Financial Health and Growth Metrics of Matrix Service Co

Matrix Service Co's financial health is reflected in its Financial Strength rank of 6/10 and a Cash to Debt ratio of 0.80. However, the company's Profitability Rank and Growth Rank stand at 4/10 and 2/10, respectively, indicating challenges in profitability and growth. The GF Value Rank of 3/10 and a Piotroski F-Score of 5 further highlight the need for cautious evaluation of the company's financial stability and performance.

Sector and Industry Perspective

The construction industry plays a significant role in Chuck Royce (Trades, Portfolio)'s investment strategy, with Matrix Service Co representing a part of this sector within the portfolio. Despite the recent reduction in MTRX shares, the firm's continued investment suggests a belief in the company's role within the broader construction market.

Conclusion

In summary, Chuck Royce (Trades, Portfolio)'s firm has adjusted its stake in Matrix Service Co, reflecting a nuanced approach to portfolio management. While the reduction in shares is notable, the firm maintains a substantial position in MTRX. The company's fair valuation, alongside mixed financial and growth metrics, presents a complex investment landscape that Royce's firm navigates with its seasoned value investing philosophy. Investors will watch closely to see how this trade influences both the stock's performance and the firm's portfolio in the future.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.