Chuck Royce Adjusts Position in Preformed Line Products Co

Recent Transaction Overview

On December 31, 2023, Chuck Royce (Trades, Portfolio)'s investment firm made a notable adjustment to its holdings in Preformed Line Products Co (NASDAQ:PLPC), a company specializing in products for energy and telecommunication networks. The firm reduced its stake by 14,703 shares, which resulted in a -4.23% change in the position. The shares were traded at a price of $133.86, leaving the firm with a total of 332,518 shares in PLPC. This transaction slightly impacted the portfolio by -0.02%, with PLPC now representing 0.45% of the firm's holdings and 6.80% of the company's shares.

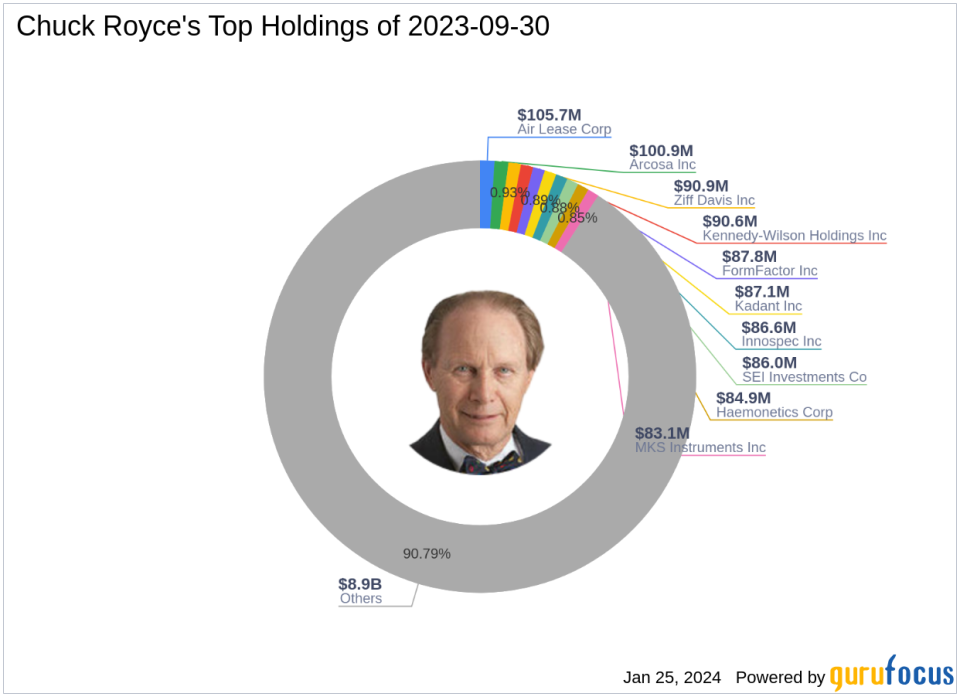

Chuck Royce (Trades, Portfolio)'s Investment Firm Profile

Charles M. Royce, a renowned figure in small-cap investing, has been managing the Royce Pennsylvania Mutual Fund since 1972. With a focus on companies with market capitalizations up to $5 billion, the firm seeks stocks trading below their estimated enterprise value. Royce's investment philosophy centers on strong balance sheets, a successful business track record, and future profitability potential. The firm's equity stands at $9.82 billion, with top holdings in various sectors, including Industrials and Technology.

Preformed Line Products Co at a Glance

Preformed Line Products Co, with its stock symbol PLPC, operates within the USA and has been publicly traded since April 28, 1999. The company designs and manufactures products for the construction and maintenance of overhead and underground networks in various industries. With a market capitalization of $630.621 million, PLPC's revenue is primarily driven by its Energy products segment. The company's financial health is reflected in its strong balance sheet, profitability, and growth ranks, each scoring an 8 out of 10.

Impact of the Trade on Royce's Portfolio

The recent transaction by Chuck Royce (Trades, Portfolio)'s firm has led to a modest decrease in its stake in PLPC. Despite this reduction, the firm maintains a significant position in the company, indicating a continued belief in its value proposition. The trade's impact on the portfolio was minimal, but it reflects the firm's active management and strategic adjustments based on market conditions and company performance.

Market Performance and Valuation of PLPC

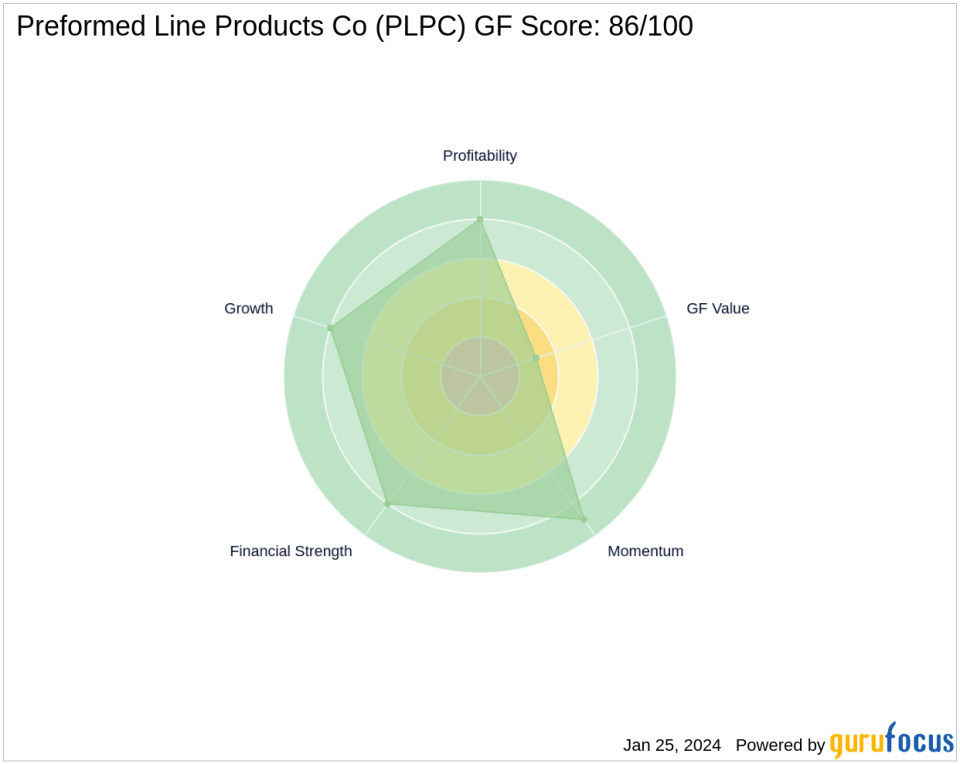

Currently, PLPC's stock price stands at $128.87, which is modestly overvalued according to the GF Value with an intrinsic value of $103.10. The stock has experienced a -3.73% price change since the transaction and a -3.06% change year-to-date. Despite these recent fluctuations, PLPC has seen a significant increase of 658.06% since its IPO. The company's GF Score of 86/100 suggests a strong potential for future performance.

Financial Health and Valuation Metrics

PLPC's financial health is robust, with a Financial Strength rank of 8/10 and an interest coverage ratio of 23.77. The company's Altman Z score of 5.09 indicates low bankruptcy risk. PLPC also boasts a high Profitability Rank and Piotroski F-Score, reflecting its operational efficiency and financial stability.

Industrial Products Sector and PLPC's Industry Standing

Within the industrial products sector, PLPC stands out for its specialized offerings in energy and communication infrastructure. The company's performance is competitive when compared to industry peers, and it continues to capitalize on market trends such as the expansion of renewable energy and telecommunications networks.

Hotchkis & Wiley Capital Management LLC's Position in PLPC

Hotchkis & Wiley Capital Management LLC is currently the largest shareholder in PLPC. The significance of their shareholding underscores the confidence major investors have in PLPC's business model and market position.

Conclusion: Analyzing the Transaction's Influence

The recent sale of shares by Chuck Royce (Trades, Portfolio)'s firm may signal a strategic reallocation of resources or a response to market dynamics. However, the firm's continued substantial holding in PLPC suggests a belief in the company's long-term value. Investors will be watching closely to see how this transaction influences PLPC's stock performance and Royce's investment strategy moving forward.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.