Chuck Royce Adjusts Position in Universal Stainless & Alloy Products Inc

Transaction Overview

On December 31, 2023, Chuck Royce (Trades, Portfolio)'s firm made a notable adjustment to its investment portfolio by reducing its stake in Universal Stainless & Alloy Products Inc (NASDAQ:USAP). The firm sold 112,540 shares at a price of $20.08 each, resulting in a -26.22% change in the firm's holdings. Following the transaction, the firm retained 316,660 shares of USAP, which now represents a 0.06% impact on the portfolio and a 3.48% ownership of the traded company.

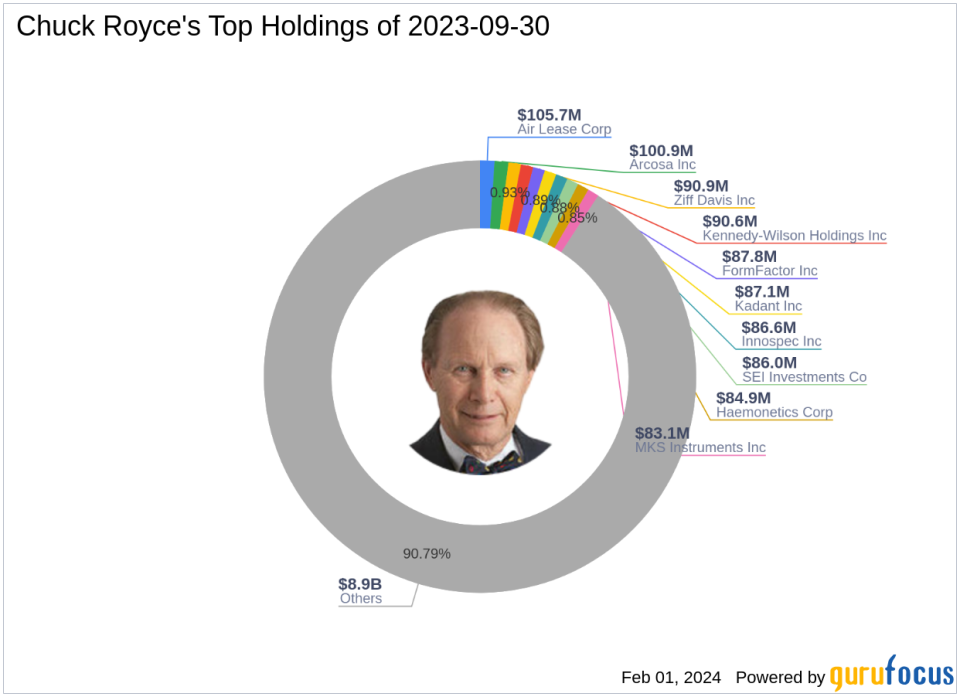

Guru Profile: Chuck Royce (Trades, Portfolio)

Charles M. Royce, a venerated figure in the investment community, is renowned for his expertise in small-cap investing. Since 1972, Royce has managed the Royce Pennsylvania Mutual Fund, demonstrating a consistent and disciplined approach to value investing. The firm's investment philosophy is centered on identifying undervalued companies with strong balance sheets, a history of success, and promising futures. With a focus on smaller companies, typically those with market capitalizations up to $5 billion, the firm seeks to invest in stocks trading below their estimated enterprise value. Chuck Royce (Trades, Portfolio)'s firm currently manages an equity portfolio valued at $9.82 billion, with top holdings in diverse sectors such as Industrials and Technology.

Company Overview: Universal Stainless & Alloy Products Inc

Universal Stainless & Alloy Products Inc, with its stock symbol USAP, operates in the steel industry in the United States. Since its IPO on December 14, 1994, the company has specialized in manufacturing and marketing semi-finished and finished specialty steel products. Its product range includes stainless steel, nickel alloys, tool steel, and other alloyed steels. USAP's business segments cater to a variety of clients, including conversion services, forgers, original equipment manufacturers, rerollers, and service centers. With a market capitalization of $171.404 million, USAP's financial performance and stock market presence are of keen interest to investors.

Trade Impact Analysis

The recent trade by Chuck Royce (Trades, Portfolio)'s firm has slightly decreased its exposure to USAP, with the trade having a minimal impact of -0.02% on the portfolio. The firm's remaining stake of 316,660 shares indicates a continued, albeit reduced, confidence in the company's prospects. This adjustment reflects the firm's strategic portfolio management and its ongoing assessment of USAP's performance and potential value.

Market Performance of USAP

Since the trade date, USAP's stock price has experienced a decline of -6.08%, moving from the trade price of $20.08 to the current price of $18.86. This year-to-date change of -2.03% suggests a challenging market environment for the company. Despite this, the stock has seen a significant increase of 128.61% since its IPO, indicating long-term growth.

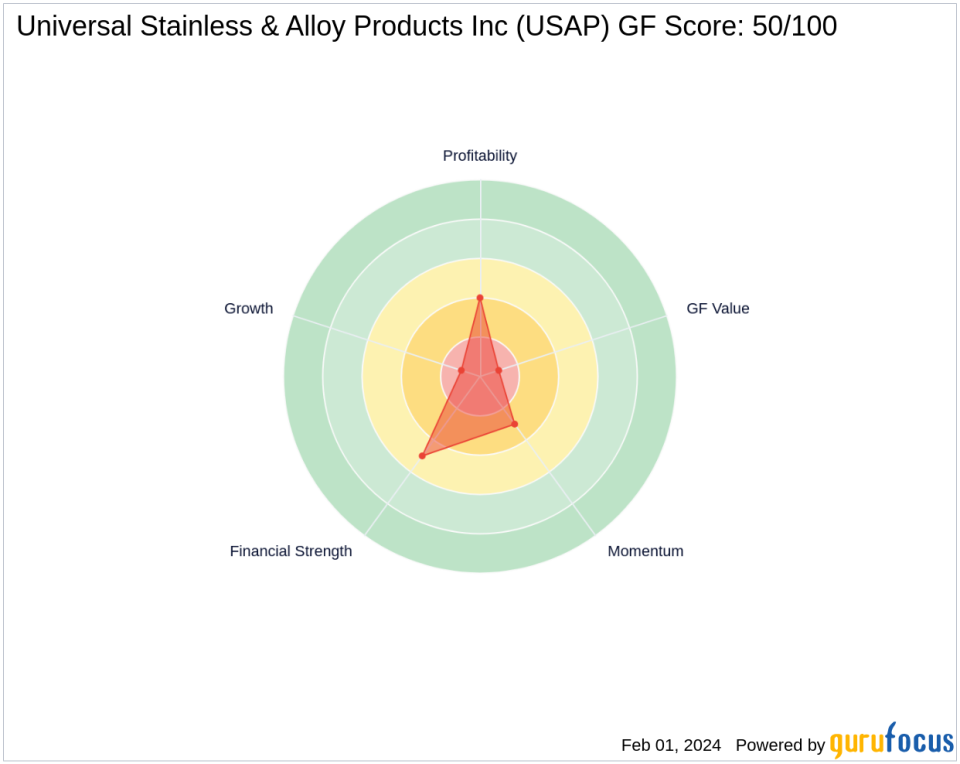

Valuation and Financial Health

USAP's current valuation status, as indicated by the GF Value, is "Significantly Overvalued" with a GF Value of $13.18 and a price to GF Value ratio of 1.43. The company's financial health, as reflected by its Financial Strength rank of 5/10 and a Altman Z score of 2.57, suggests moderate stability. However, its Profitability Rank of 4/10 and Piotroski F-Score of 6 indicate challenges in maintaining consistent profitability.

Comparative Metrics and Ranks

When compared to industry standards, USAP's performance metrics present a mixed picture. The company's Growth Rank of 1/10 and GF Value Rank of 1/10 are concerning, reflecting poor growth prospects and valuation. Additionally, its Momentum Rank of 3/10 suggests a lack of positive market sentiment. These factors may have influenced Chuck Royce (Trades, Portfolio)'s decision to reduce the firm's position in USAP.

Conclusion

In summary, Chuck Royce (Trades, Portfolio)'s firm's recent transaction involving Universal Stainless & Alloy Products Inc represents a strategic portfolio adjustment. While the firm maintains a stake in USAP, the reduction in shares held reflects a cautious approach in light of the company's overvaluation and mixed financial health indicators. Investors will continue to monitor USAP's market performance and the firm's investment decisions for insights into the steel industry's investment landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.