Chuck Royce Bolsters Position in Healthcare Services Group Inc

Chuck Royce (Trades, Portfolio)'s investment firm has recently increased its stake in Healthcare Services Group Inc (NASDAQ:HCSG), a notable move in the healthcare sector. On December 31, 2023, the firm added 534,791 shares to its holdings, impacting the portfolio by 0.06%. This transaction brought the firm's total share count in HCSG to 3,914,207, representing a 0.41% position in the portfolio and a 5.30% ownership of the company's stock.

Investment Guru Chuck Royce (Trades, Portfolio)'s Profile

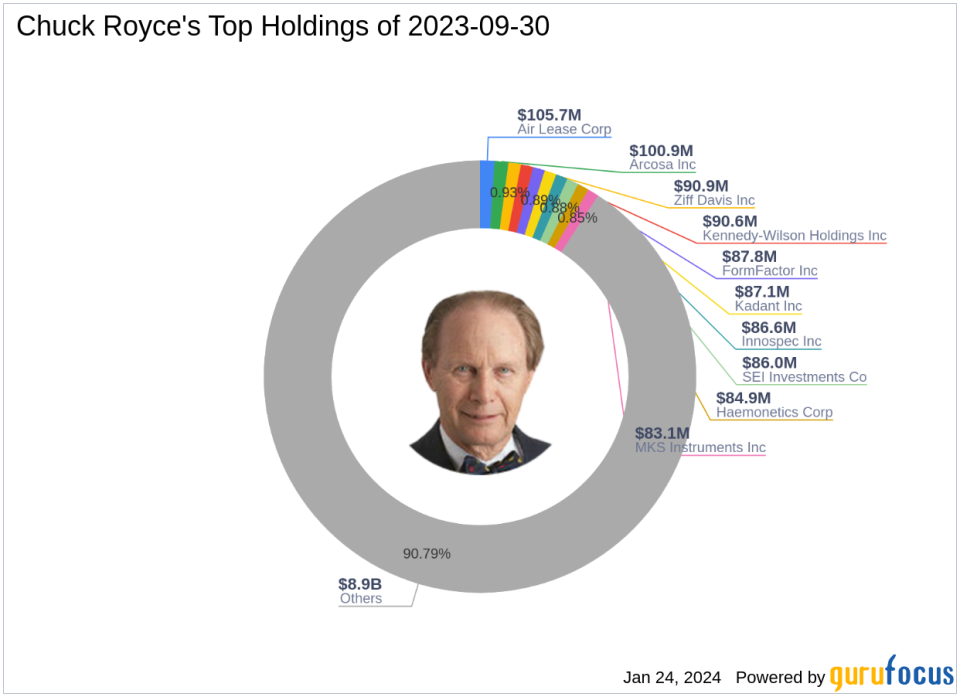

Charles M. Royce, a venerated figure in small-cap investing, has been at the helm of Royce Pennsylvania Mutual Fund since 1972. With a bachelor's degree from Brown University and an MBA from Columbia University, Royce's investment philosophy is centered on identifying undervalued companies with strong balance sheets, a successful business track record, and the potential for future profitability. The firm's approach is to invest in smaller companies, with a focus on those with market capitalizations up to $5 billion. Royce's top holdings include FormFactor Inc (NASDAQ:FORM), Ziff Davis Inc (NASDAQ:ZD), Air Lease Corp (NYSE:AL), Kennedy-Wilson Holdings Inc (NYSE:KW), and Arcosa Inc (NYSE:ACA), with a significant presence in the Industrials and Technology sectors.

Healthcare Services Group Inc: A Company Overview

Healthcare Services Group Inc provides essential housekeeping and facility management services to the healthcare industry. With operations spanning two main segments, Dietary and Housekeeping, HCSG offers a range of services including cleaning, laundry, and dietary department services to nursing homes, retirement complexes, and hospitals across the United States. The company's commitment to quality service has been a cornerstone of its business model since its IPO on November 22, 1983.

Financial and Market Data of HCSG

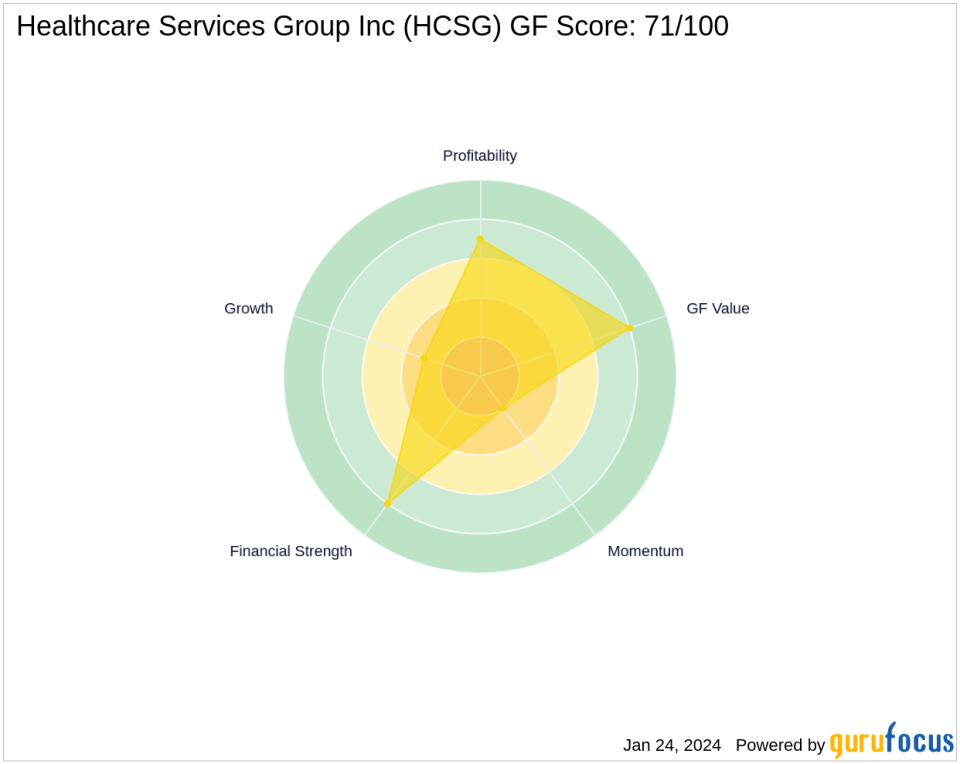

As of the date of this article, Healthcare Services Group Inc boasts a market capitalization of $722.243 million, with a current stock price of $9.78. The stock's PE Ratio stands at 22.23, indicating profitability, but the GF Value suggests caution, labeling it a Possible Value Trap with a price to GF Value ratio of 0.57. Since the recent transaction, the stock has seen a price decrease of 5.69%, and year-to-date, it has declined by 8.08%. Despite these challenges, the stock has experienced a significant increase of 3,054.84% since its IPO.

Chuck Royce (Trades, Portfolio)'s Investment in HCSG

The addition of HCSG shares has further solidified Chuck Royce (Trades, Portfolio)'s investment in the healthcare sector. The firm's total holding of 3,914,207 shares in HCSG is a testament to its belief in the company's value proposition. Despite the stock's current price being lower than the trade price of $10.37, the firm maintains a significant position, indicating confidence in the stock's future performance.

Sector and Portfolio Context

Chuck Royce (Trades, Portfolio)'s portfolio is heavily weighted towards Industrials and Technology, with HCSG fitting into a broader strategy that values financial strength and growth potential. With an equity value of $9.82 billion, the firm's investment in HCSG represents a strategic move within the Healthcare Providers & Services industry, complementing its top holdings and sector focus.

Performance Metrics of HCSG

Healthcare Services Group Inc's financial health is reflected in its Financial Strength rank of 8/10 and Profitability Rank of 7/10. However, the company's Growth Rank is lower at 3/10. The GF Score of 71/100 suggests average performance potential, supported by a Piotroski F-Score of 6 and an Altman Z score of 4.73. The company's cash to debt ratio is healthy at 2.14, and its interest coverage stands at 6.15.

Market Sentiment and Other Investors

Brandes Investment currently holds the largest guru share percentage in HCSG, while other notable investors like HOTCHKIS & WILEY also maintain positions in the company. This collective interest from respected investors may signal a positive market sentiment towards HCSG's future prospects.

Transaction Analysis

The recent acquisition by Chuck Royce (Trades, Portfolio)'s firm has a modest yet strategic impact on the portfolio, reinforcing the firm's commitment to Healthcare Services Group Inc. While the stock's current market performance shows a slight downturn, the firm's increased stake could be indicative of a long-term investment horizon, banking on the company's solid financials and market position to yield future gains.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.