Chuck Royce Bolsters Position in Ingles Markets Inc

Recent Portfolio Addition by Chuck Royce (Trades, Portfolio)

On December 31, 2023, the investment firm managed by Chuck Royce (Trades, Portfolio) made a notable addition to its portfolio by acquiring 7,00219 shares of Ingles Markets Inc (NASDAQ:IMKTA). This transaction reflects a 0.43% change in the firm's holdings, with a trade price of $86.37 per share. Despite the trade's minimal impact on the overall portfolio, holding a 4.82% stake in the company signifies a strategic move by the firm.

Chuck Royce (Trades, Portfolio)'s Investment Expertise

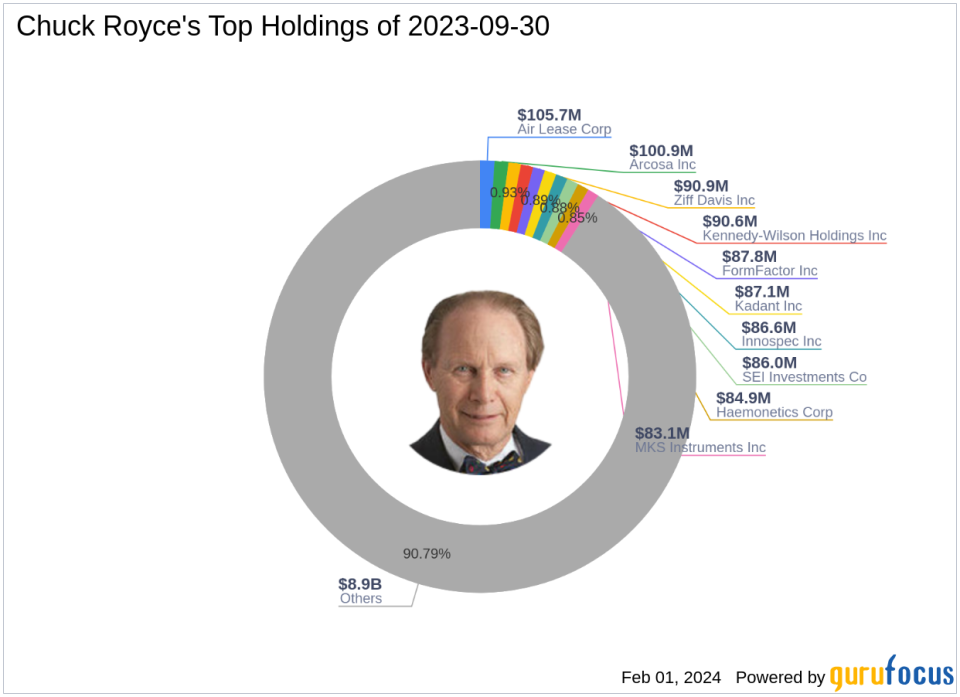

Charles M. Royce, a seasoned investor with a focus on small-cap companies, has been at the helm of Royce Pennsylvania Mutual Fund since 1972. With a bachelor's degree from Brown University and an MBA from Columbia University, Royce's investment philosophy centers on identifying undervalued companies with strong balance sheets, a history of success, and promising futures. The firm's portfolio, with 907 stocks and an equity of $9.82 billion, leans heavily towards the Industrials and Technology sectors. Among its top holdings are FormFactor Inc (NASDAQ:FORM), Ziff Davis Inc (NASDAQ:ZD), and Air Lease Corp (NYSE:AL).

Ingles Markets Inc at a Glance

Ingles Markets Inc, established in the southeastern United States, has been serving customers since its IPO on September 22, 1987. The company's supermarkets offer a wide array of products, from food items to general merchandise, and its real estate investments contribute to its revenue stream. With a market capitalization of $1.6 billion, Ingles Markets Inc has demonstrated solid financial performance and a significant market presence.

Impact of the Trade on Royce's Portfolio

The acquisition of Ingles Markets Inc shares by Chuck Royce (Trades, Portfolio)'s firm represents a strategic enhancement to the portfolio, with the trade constituting a 0.62% position. The timing of the trade, at a price slightly above the current market value, suggests confidence in the stock's future performance despite its current "Fairly Valued" GF Valuation status.

Ingles Markets Inc's Stock Metrics

Currently trading at $84.25, Ingles Markets Inc's stock is slightly below the trade price, indicating a -2.45% change. The stock is deemed "Fairly Valued" with a GF Value of $90.43 and a price to GF Value ratio of 0.93. The company's PE Percentage stands at 7.61, and it boasts a high GF Score of 93/100, suggesting strong outperformance potential.

Market Insights and Royce's Strategy

Chuck Royce (Trades, Portfolio)'s firm typically invests in smaller companies, and Ingles Markets Inc aligns well with this preference. The firm's top sectors include Industrials and Technology, and while Ingles Markets Inc falls under the Retail - Defensive industry, its market capitalization fits within the firm's investment criteria.

Other Gurus' Stakes in Ingles Markets Inc

Notable investors like Mason Hawkins (Trades, Portfolio), Charles Brandes (Trades, Portfolio), and Joel Greenblatt (Trades, Portfolio) also hold positions in Ingles Markets Inc. While the largest guru shareholder information is not provided, Royce's stake is significant and indicative of the stock's attractiveness to value investors.

Prospects of Chuck Royce (Trades, Portfolio)'s Investment

Ingles Markets Inc's growth, profitability, and financial health are reflected in its strong Profitability Rank and Growth Rank. With a solid Operating Margin and consistent Revenue Growth, the company's financials appear robust. Chuck Royce (Trades, Portfolio)'s investment decision, backed by a thorough analysis of the company's potential, could yield favorable outcomes for the firm's portfolio.

Conclusion

In conclusion, Chuck Royce (Trades, Portfolio)'s recent investment in Ingles Markets Inc is a calculated move that aligns with the firm's value investing philosophy. The stock's solid financial metrics and the firm's strategic portfolio positioning suggest a positive outlook for this investment. As Ingles Markets Inc continues to navigate the competitive retail landscape, investors will be watching closely to see how this addition to Royce's portfolio performs in the long term.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.