Chuck Royce Bolsters Stake in Vishay Precision Group Inc

Introduction to the Transaction

On the last day of 2023, Chuck Royce (Trades, Portfolio)'s firm made a notable addition to its investment portfolio by increasing its stake in Vishay Precision Group Inc (NYSE:VPG). The transaction involved the acquisition of 128,974 shares at a price of $34.07 each, marking a 17.10% change in the firm's holdings. This move had a 0.04% impact on the portfolio, bringing the total share count in VPG to 883,141 and representing a 0.31% position in the portfolio. Notably, the firm now holds a 7.06% equity stake in VPG.

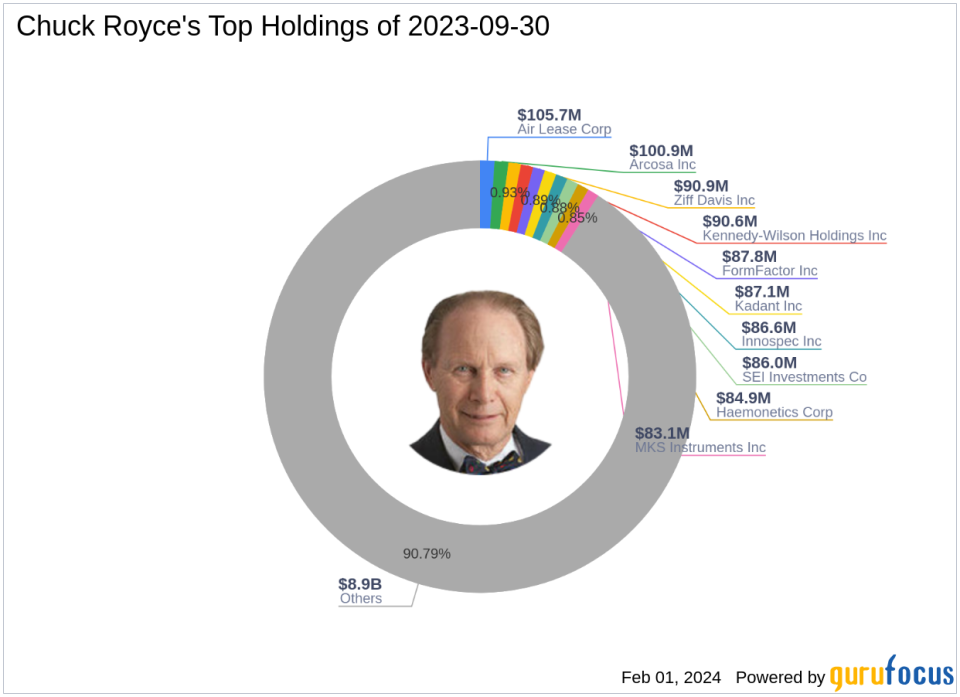

Profile of Chuck Royce (Trades, Portfolio)

Charles M. Royce, a renowned figure in the investment world, has carved out a niche in small-cap investing. Since 1972, Royce has managed the Royce Pennsylvania Mutual Fund, leveraging his extensive experience and education from Brown University and Columbia University. The firm's investment philosophy is centered on identifying undervalued small-cap companies with strong balance sheets, a history of business success, and promising future profitability. With a focus on companies with market capitalizations up to $5 billion, the firm's approach is to invest in stocks trading below their estimated enterprise value. Currently, the firm manages an equity portfolio worth $9.82 billion, with top holdings in sectors such as Industrials and Technology.

Vishay Precision Group Inc Company Overview

Vishay Precision Group Inc, with its specialization in sensors and measurement systems, caters to a diverse clientele requiring precision products. The company operates through three segments: Measurement Systems, Sensors, and Weighing Solutions. Since its IPO on June 23, 2010, VPG has established a strong business presence in the United States and internationally. With a market capitalization of $431.438 million and a PE percentage of 14.58, VPG is currently considered modestly undervalued, with a GF Value of $40.95 and a stock price to GF Value ratio of 0.78.

Analysis of the Trade's Significance

The recent acquisition by Chuck Royce (Trades, Portfolio)'s firm is a strategic move, reflecting confidence in VPG's market position and growth potential. The addition of VPG shares has bolstered the firm's portfolio, with the stock now accounting for a significant 0.31% of the total investments. The firm's 7.06% ownership in VPG underscores a substantial commitment to the company's future.

VPG's Market Performance and Valuation

Despite being modestly undervalued, VPG's stock price has experienced a 6.43% decline since the transaction, currently trading at $31.88. The year-to-date performance also shows a slight dip of 3.42%. However, the stock has seen a substantial gain of 155.04% since its IPO, indicating long-term growth potential.

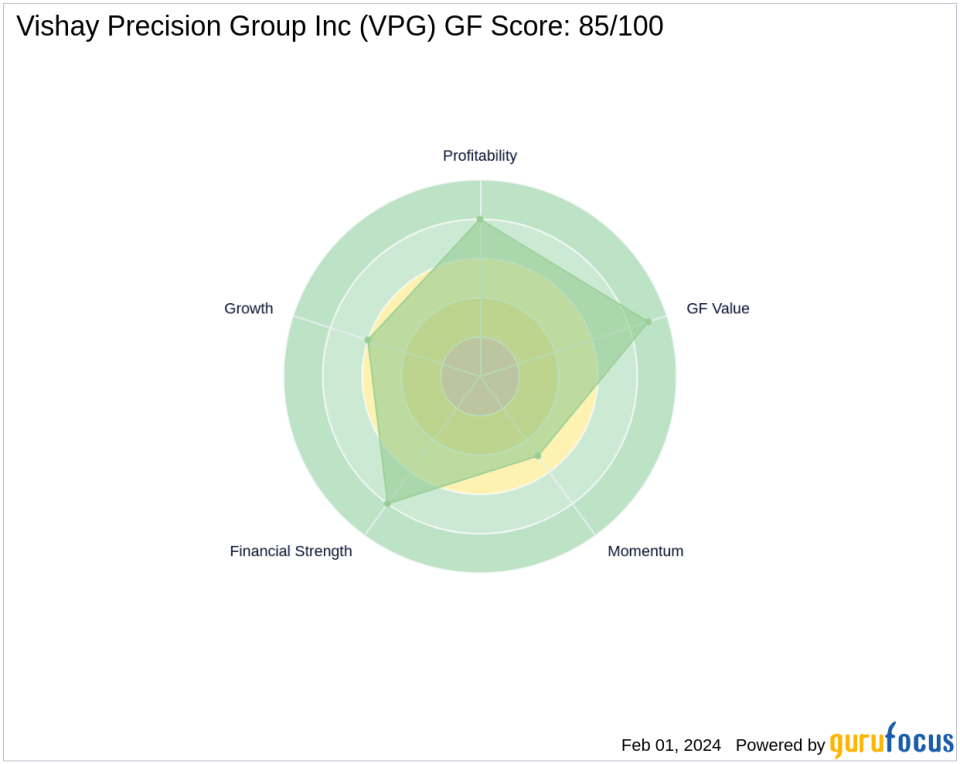

Financial and Growth Metrics of VPG

Vishay Precision Group's financial health is reflected in its Financial Strength rank of 8/10 and Profitability Rank of 8/10. The company's Growth Rank stands at 6/10, with a GF Value Rank of 9/10. VPG's Piotroski F-Score is a strong 8, and its Altman Z-Score of 3.68 indicates low bankruptcy risk. The company's cash to debt ratio of 1.19 and interest coverage of 10.99 further demonstrate its solid financial footing.

VPG's Position in the Industry and Among Gurus

In the hardware industry, VPG maintains a competitive stance with its specialized product offerings. Among the investment gurus, Chuck Royce (Trades, Portfolio)'s firm is not alone in recognizing VPG's potential. Other notable investors, such as Mario Gabelli (Trades, Portfolio), also hold shares in the company. The largest shareholder among the gurus is Barrow, Hanley, Mewhinney & Strauss, although their exact share percentage is not disclosed.

Conclusion

The recent investment by Chuck Royce (Trades, Portfolio)'s firm in Vishay Precision Group Inc is a significant development for value investors to consider. The firm's increased stake in VPG reflects a belief in the company's strong financials and growth prospects. As VPG continues to navigate the competitive hardware industry, the backing of seasoned investors like Royce could signal a positive trajectory for the company's stock performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.