Chuck Royce Increases Stake in Haynes International Inc

Overview of Chuck Royce (Trades, Portfolio)'s Recent Trade

On December 31, 2023, Chuck Royce (Trades, Portfolio)'s investment firm made a notable addition to its holdings in Haynes International Inc (NASDAQ:HAYN), a company specializing in high-performance nickel and cobalt-based alloys. The firm added 52,916 shares to its position, representing an 8.58% increase and impacting the portfolio by 0.03%. The shares were acquired at a price of $57.05 each, bringing the total number of shares held to 669,330. This transaction has increased the firm's stake in Haynes International Inc to 5.25% of its portfolio, with a position ratio of 0.39%.

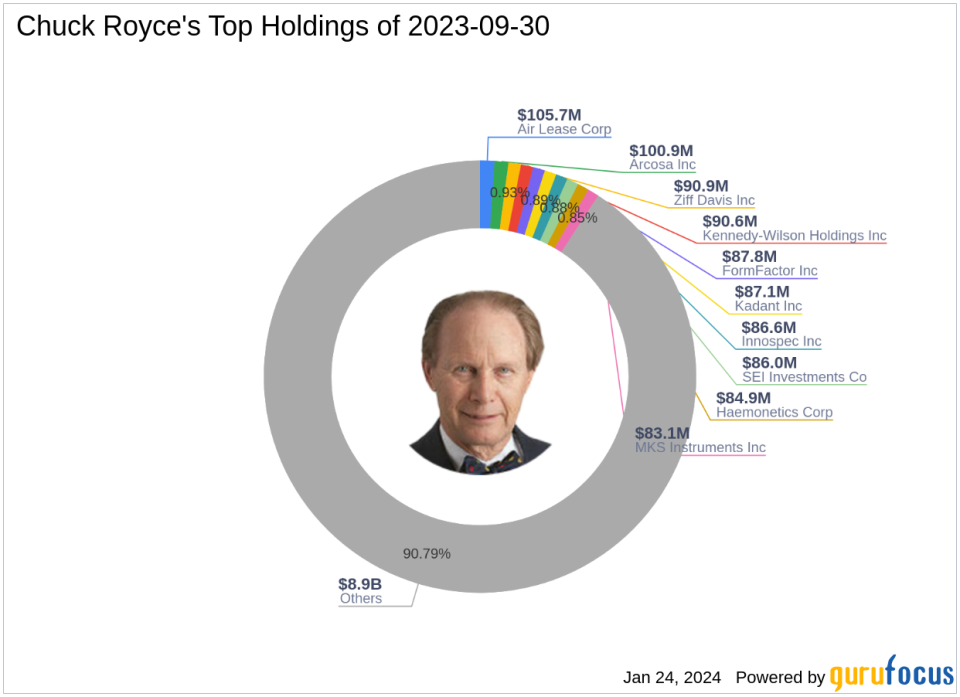

Chuck Royce (Trades, Portfolio)'s Investment Approach

Charles M. Royce, a renowned figure in small-cap investing, has been managing the Royce Pennsylvania Mutual Fund since 1972. With a bachelor's degree from Brown University and an MBA from Columbia University, Royce's firm focuses on investing in smaller companies, typically with market capitalizations up to $5 billion. The firm's value investing philosophy centers on identifying undervalued stocks with strong balance sheets, a history of business success, and promising future profitability. Among the firm's top holdings are FormFactor Inc (NASDAQ:FORM), Ziff Davis Inc (NASDAQ:ZD), and Air Lease Corp (NYSE:AL). With an equity portfolio valued at $9.82 billion, the firm's top sectors include Industrials and Technology.

Haynes International Inc at a Glance

Haynes International Inc, trading under the symbol HAYN, is a U.S.-based company that went public on March 23, 2007. The company's core business lies in the production and distribution of advanced, high-performance alloys, primarily serving the aerospace, industrial gas turbine, and chemical processing industries. With a market capitalization of $677.626 million and a stock price of $53.01, Haynes International Inc is currently deemed fairly valued by GuruFocus, with a GF Value of $56.68 and a price to GF Value ratio of 0.94.

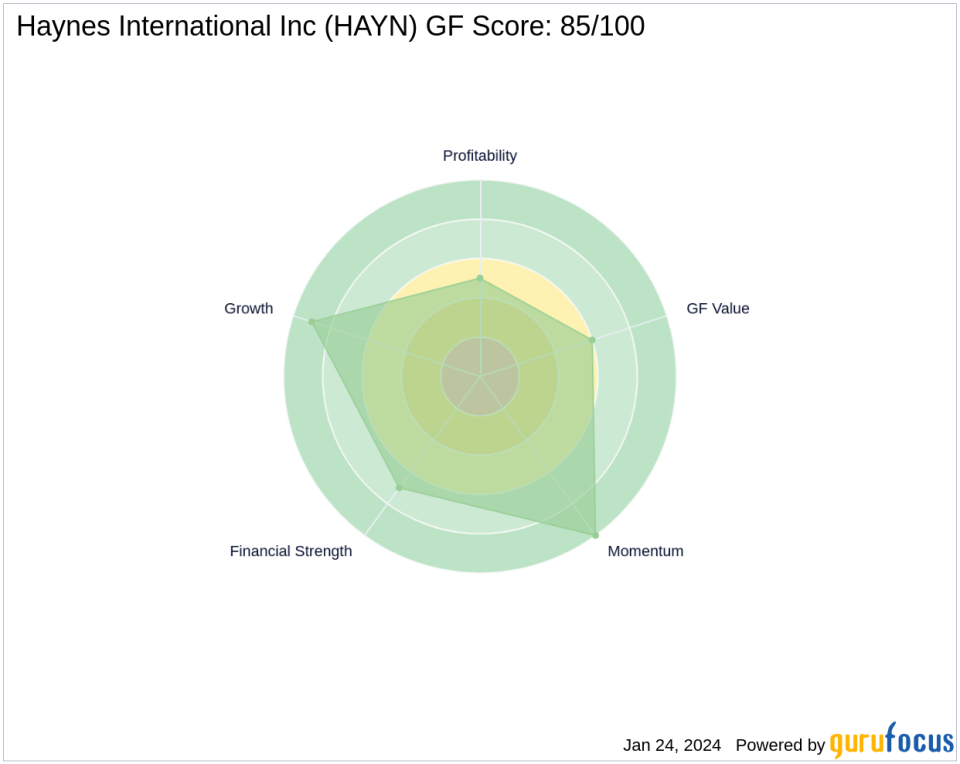

Financial Health and Market Performance of Haynes International Inc

Haynes International Inc boasts a GF Score of 85/100, indicating strong potential for outperformance. The company's financial strength is reflected in its balance sheet rank of 7/10, while its profitability rank stands at 5/10. The growth rank is impressive at 9/10, and the GF Value rank is 6/10. The stock's momentum rank is at the top with 10/10. Despite a year-to-date price decline of 7.5% and a recent drop of 7.08% since the transaction date, the stock has seen a substantial increase of 292.67% since its IPO.

Chuck Royce (Trades, Portfolio)'s Confidence in Haynes International Inc

Following the recent acquisition, Chuck Royce (Trades, Portfolio)'s firm now holds a significant 669,330 shares in Haynes International Inc. This investment represents a substantial portion of the firm's portfolio, highlighting the confidence in the company's future prospects and alignment with the firm's investment strategy.

Haynes International Inc in the Industrial Sector

Haynes International Inc operates within the industrial products industry, a sector where Chuck Royce (Trades, Portfolio)'s firm has shown considerable interest. The company's focus on specialized alloys positions it well within the industry, catering to high-demand sectors such as aerospace and industrial gas turbines.

Other Prominent Investors in Haynes International Inc

Chuck Royce (Trades, Portfolio)'s firm is not the only notable investor in Haynes International Inc. Other prominent investors include Ken Fisher (Trades, Portfolio) and Mario Gabelli (Trades, Portfolio). However, the largest guru shareholder is First Eagle Investment (Trades, Portfolio) Management, LLC, which holds a significant stake in the company.

Transaction Impact Analysis

The recent transaction by Chuck Royce (Trades, Portfolio)'s firm not only underscores a strong belief in Haynes International Inc's value proposition but also has the potential to influence the stock's performance positively. With the firm's history of successful small-cap investments and the company's solid financial and market metrics, this increased stake could be a strategic move that benefits both the firm and its clients in the long run.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.