Chuck Royce Increases Stake in Intevac Inc

Transaction Overview

On December 31, 2023, Chuck Royce (Trades, Portfolio)'s investment firm made a notable addition to its portfolio by acquiring 113,900 additional shares of Intevac Inc (NASDAQ:IVAC), a company specializing in high-productivity, thin-film processing systems. The transaction was executed at a trade price of $4.32 per share, increasing the firm's total holdings in IVAC to 3,400,706 shares. This move reflects a 0.01% trade impact on the portfolio, with the position in IVAC now representing 0.15% of the firm's holdings and 12.89% of IVAC's outstanding shares.

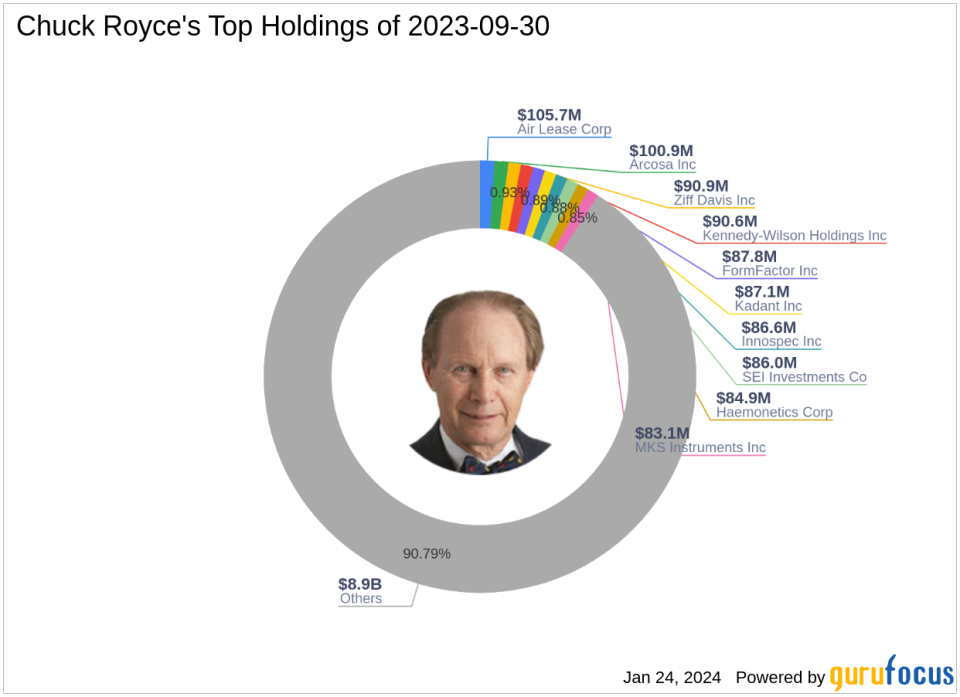

Profile of Investment Firm: Chuck Royce (Trades, Portfolio)

Charles M. Royce, a renowned figure in the investment world, has been at the helm of Royce Pennsylvania Mutual Fund since 1972. With a bachelor's degree from Brown University and an MBA from Columbia University, Royce's firm is a pioneer in small-cap investing, focusing on companies with market capitalizations up to $5 billion. The firm's investment philosophy centers on identifying undervalued stocks with strong balance sheets, a history of success, and promising futures. Currently, the firm manages an equity portfolio worth $9.82 billion, with top holdings in various sectors, including Industrials and Technology.

Intevac Inc at a Glance

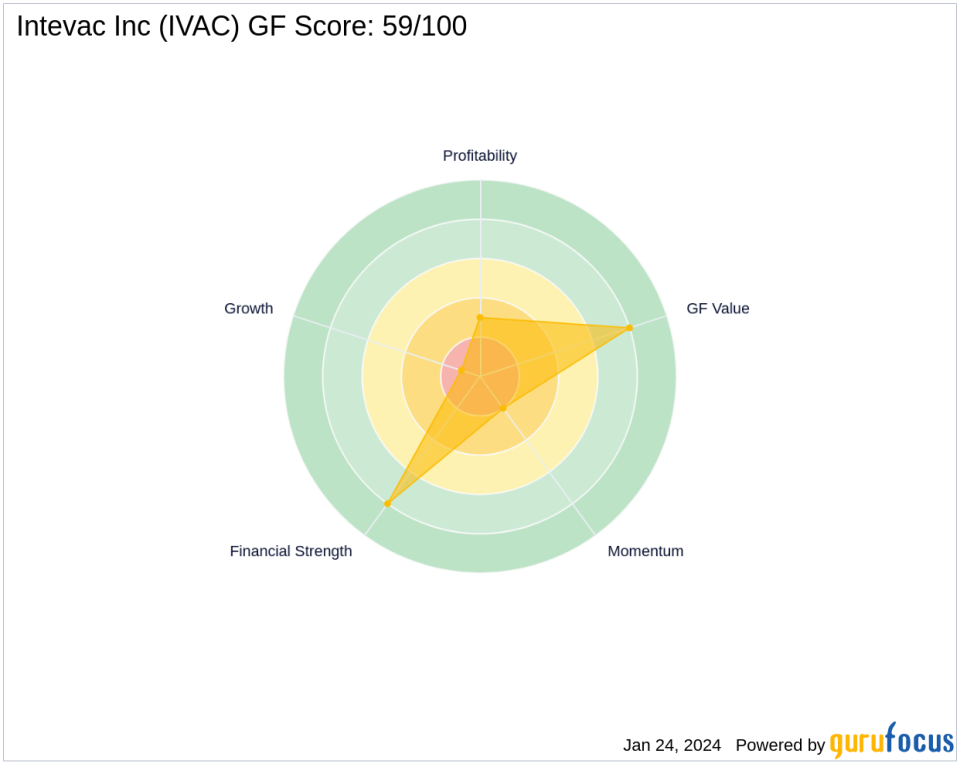

Intevac Inc, with its stock symbol IVAC, operates within the industrial products sector, primarily in Asia. Since its IPO on November 21, 1995, the company has been dedicated to the design and development of thin-film processing systems for various applications, including hard disk drives and display cover panels. Despite a market capitalization of $112.351 million and a current stock price of $4.26, Intevac's financial performance indicators suggest challenges, with a GF Score of 59/100, indicating poor future performance potential.

Impact of the Trade on Portfolio

The recent acquisition by Chuck Royce (Trades, Portfolio)'s firm has a modest yet strategic impact on the portfolio. The additional shares in IVAC slightly bolster the firm's position in the technology sector, aligning with its value investing approach. Despite the small trade impact, the firm's significant stake in IVAC demonstrates a conviction in the company's potential value.

Market Performance and Valuation of Intevac

Intevac's market performance has been less than stellar, with a stock price decline of 1.39% since the trade and a year-to-date drop of 3.18%. The stock's price-to-GF Value ratio stands at 0.51, indicating that it may be undervalued. However, the GF Value suggests caution, labeling it a possible value trap. Investors should think twice before following suit, considering the stock's historical performance and current valuation metrics.

Financial Health and Valuation Metrics

Intevac's financial health is a mixed bag, with a strong Financial Strength rank of 8/10 but a low Profitability Rank of 3/10. The company's GF Value Rank is favorable at 8/10, yet its Growth Rank is concerning at 1/10. These metrics, combined with a Piotroski F-Score of 3 and an Altman Z-Score of 2.18, suggest that while the company is financially stable, its profitability and growth prospects are questionable.

Comparative Analysis

When compared to the largest guru shareholder in Intevac Inc, GAMCO Investors, Chuck Royce (Trades, Portfolio)'s firm holds a substantial position, although specific share percentage data for GAMCO is not provided. This comparison highlights the firm's significant interest in IVAC relative to other major investors.

Conclusion

In summary, Chuck Royce (Trades, Portfolio)'s firm has increased its stake in Intevac Inc, a company facing financial and growth challenges. While the firm's investment aligns with its value-driven philosophy, the stock's current valuation and market performance suggest caution. Value investors should carefully consider the potential implications of this move and monitor Intevac's future financial health and growth prospects.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.