Chuck Royce Increases Stake in NVE Corp

Overview of Chuck Royce (Trades, Portfolio)'s Recent Portfolio Addition

On January 31, 2024, the investment firm managed by Chuck Royce (Trades, Portfolio) made a notable addition to its investment portfolio by acquiring 2,500 shares of NVE Corp (NASDAQ:NVEC), a company specializing in spintronics and nanotechnology. This transaction reflects the firm's continued interest in small-cap companies with strong balance sheets and potential for profitable futures.

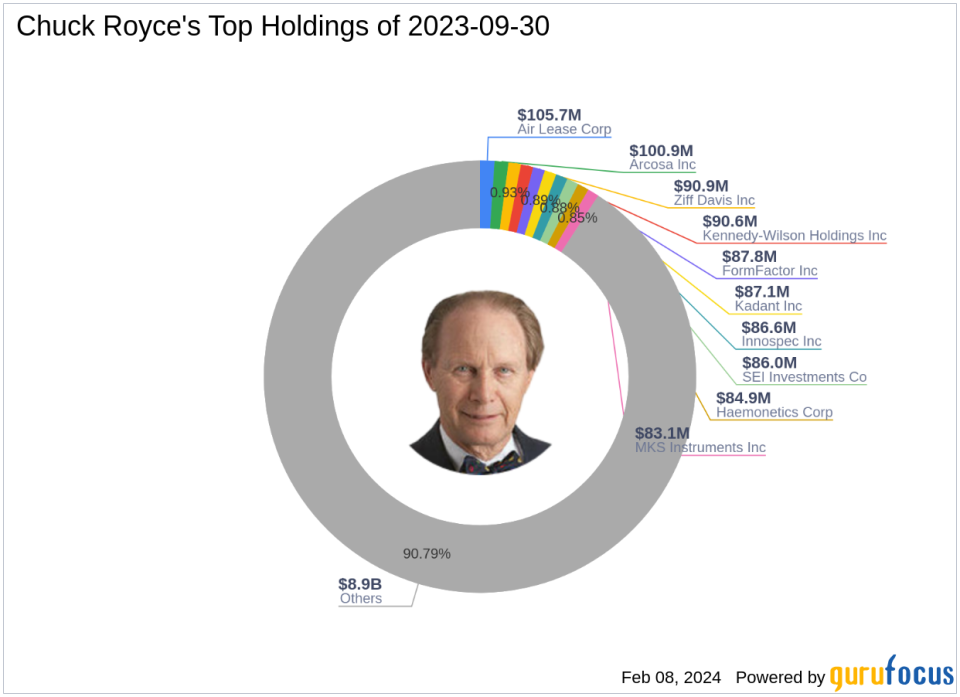

Investment Guru: Chuck Royce (Trades, Portfolio)

Charles M. Royce, a venerated figure in small-cap investing, has been at the helm of the Royce Pennsylvania Mutual Fund since 1972. With a focus on companies with market capitalizations up to $10 billion, the firm's investment philosophy is grounded in identifying undervalued stocks with robust financials and promising growth prospects. Chuck Royce (Trades, Portfolio)'s approach is encapsulated in the search for companies that exhibit a strong balance sheet, a successful business track record, and the potential for a profitable future.

NVE Corp: A Spintronics Innovator

NVE Corp operates within the cutting-edge field of spintronics, utilizing electron spin to create high-performance sensors and couplers for data acquisition and transmission. The company's diverse product range includes Digital sensors, Medical sensors, Rotation Sensors, and various other spintronic devices. NVE Corp's innovative designs are founded on giant magnetoresistance (GMR) and tunneling magnetoresistance (TMR) technologies, integrated with sophisticated circuitry.

Transaction Specifics

The recent transaction saw Chuck Royce (Trades, Portfolio)'s firm adding 2,500 shares of NVE Corp at a price of $79.99 per share, bringing the total holdings to 485,023 shares. This addition represents a 0.4% position in the portfolio, with the firm's stake in NVE Corp now standing at 10.03%.

Financial Health of NVE Corp

As of the report date, NVE Corp boasts a market capitalization of $383.917 million and a stock price of $79.43. The company's financial health is reflected in its PE Ratio of 17.81, indicating profitability. NVE Corp is currently deemed "Fairly Valued" with a GF Value of $82.70 and a Price to GF Value ratio of 0.96.

Market Performance of NVE Corp

Since the trade date, NVE Corp's stock has experienced a slight decline of 0.7%. However, the year-to-date performance shows an increase of 4.73%. Historically, the stock has seen a decrease of 38.01% since its IPO in 1996.

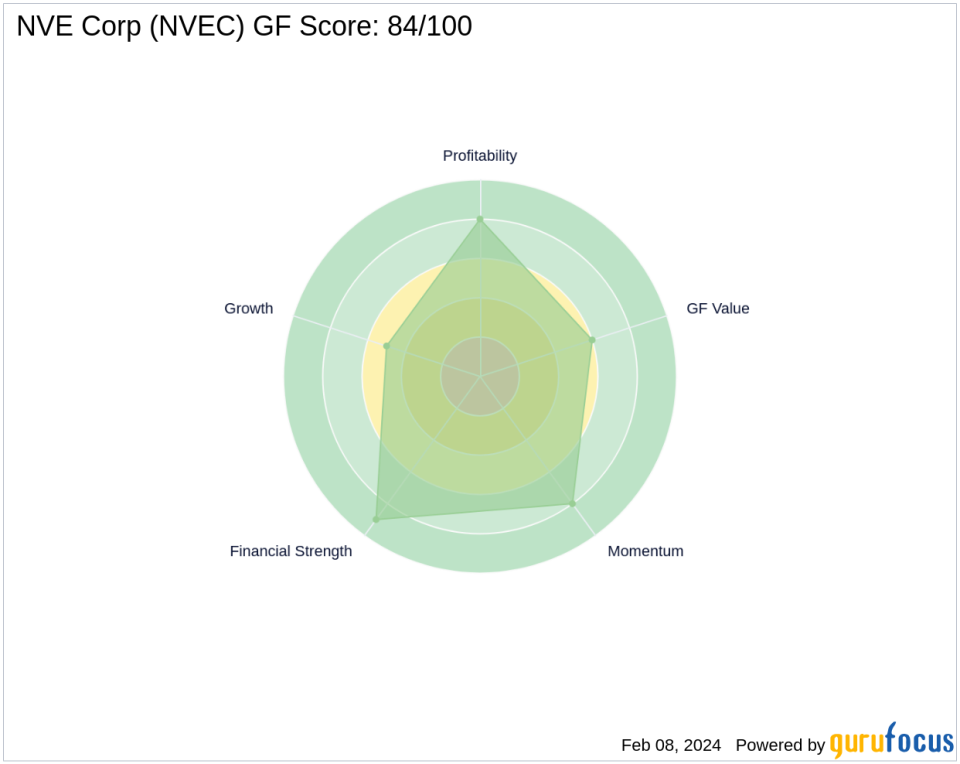

GuruFocus Rankings for NVE Corp

NVE Corp has achieved a GF Score of 84/100, indicating good potential for future performance. The company's financial strength is robust, with a Financial Strength Rank of 9/10 and a Profitability Rank of 8/10. Its Growth Rank and GF Value Rank stand at 5/10 and 6/10, respectively, while the Momentum Rank is a strong 8/10.

Industry Context and Competitive Positioning

Chuck Royce (Trades, Portfolio)'s top holdings predominantly lie in the Industrials and Technology sectors, with NVE Corp positioned within the competitive Semiconductors industry. The firm's strategic investments reflect a keen eye for companies that are leaders in their respective fields and have the potential to deliver long-term value to shareholders.

Transaction Analysis and Portfolio Impact

The recent acquisition of NVE Corp shares by Chuck Royce (Trades, Portfolio)'s firm is a strategic move that aligns with the firm's investment philosophy. While the trade impact on the portfolio is currently minimal, the increased stake in NVE Corp signifies confidence in the company's financial health and growth prospects. As NVE Corp continues to innovate within the semiconductors space, this investment may well contribute to the firm's portfolio performance in the future.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.