Chuck Royce Increases Stake in Repay Holdings Corp

On December 31, 2023, Chuck Royce (Trades, Portfolio)'s investment firm made a notable addition to its portfolio by acquiring 971,812 shares of Repay Holdings Corp (NASDAQ:RPAY), a leading provider of integrated payment processing solutions. This transaction increased the firm's total holdings in RPAY to 4,964,487 shares, marking a significant vote of confidence in the company's future prospects. The trade had a 0.08% impact on the portfolio, with the shares purchased at an average price of $8.54, and it now represents a 0.43% portfolio position with a 5.24% ownership of the traded stock.

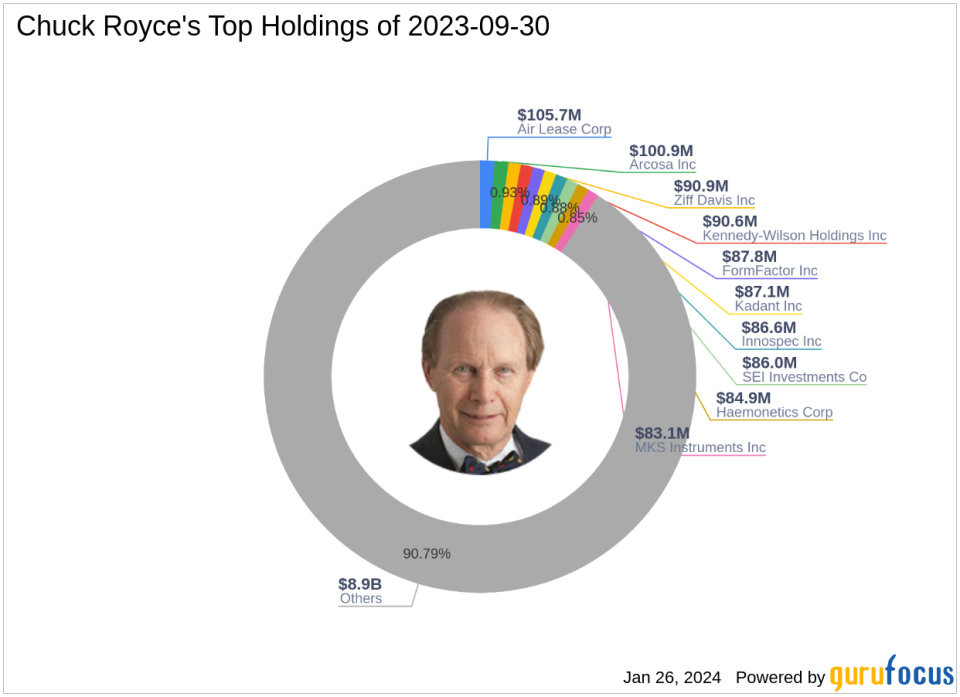

Investment Expertise of Chuck Royce (Trades, Portfolio)

Charles M. Royce, a renowned figure in the investment world, has been at the helm of Royce Pennsylvania Mutual Fund since 1972. With a focus on small-cap investing, the firm seeks out companies with strong balance sheets and the potential for profitable futures. The investment philosophy is grounded in finding undervalued stocks that trade below their enterprise value. Royce's approach has consistently emphasized the importance of financial stability and business success as indicators of a company's long-term value.

About Repay Holdings Corp

Repay Holdings Corp, trading under the symbol RPAY in the USA, went public on July 17, 2018. The company operates primarily in the payment processing industry, offering a range of solutions including mobile apps, text payments, and virtual terminals. RPAY's business is divided into Consumer Payments and Business Payments, with a focus on eliminating intersegment revenues. The company's innovative approach to payment solutions has positioned it as a key player in the financial technology sector.

Financial and Market Position of RPAY

As of the date of this article, Repay Holdings Corp has a market capitalization of $716.734 million, with a current stock price of $7.875. The company's GF Value is set at $16.49, indicating a Price to GF Value ratio of 0.48. However, RPAY is currently labeled as a "Possible Value Trap, Think Twice" according to GuruFocus' valuation methods. The stock has experienced a -7.79% decline since the trade date, a -18.39% drop from its IPO, and a -6.69% decrease year-to-date.

Chuck Royce (Trades, Portfolio)'s Strategic Investment in RPAY

Chuck Royce (Trades, Portfolio)'s firm has demonstrated a strategic interest in RPAY, with the stock now holding a 0.43% ratio in the portfolio. The current stock price is below the trade price of $8.54, and significantly under the GF Value, suggesting a potential undervaluation. This aligns with the firm's investment philosophy of targeting stocks trading for less than their estimated worth.

Assessing RPAY's Financial Health

Repay Holdings Corp's financial health is a mixed picture. The company has a Financial Strength rank of 4/10 and a Profitability Rank of 3/10. Its GF Score stands at 57/100, indicating poor future performance potential. The Piotroski F-Score is a solid 7, but the Altman Z-Score of 0.57 suggests financial distress. RPAY's Cash to Debt ratio is 0.27, which places it at rank 2312 in this category.

Industry Context and Other Notable Investors

Chuck Royce (Trades, Portfolio)'s firm has a preference for the Industrials and Technology sectors, with RPAY fitting into the latter as part of the Software industry. Within this competitive landscape, RPAY's performance is closely watched relative to industry standards. Baron Funds is currently the largest guru shareholder in RPAY, while other notable investors like Ken Fisher (Trades, Portfolio) also maintain stakes in the company.

Transaction Impact Analysis

The recent acquisition of RPAY shares by Chuck Royce (Trades, Portfolio)'s firm is a strategic move that reflects confidence in the company's value proposition despite its current financial metrics. The firm's history of investing in undervalued small-cap companies with strong balance sheets suggests that this addition to the portfolio is in line with its long-term investment philosophy. As RPAY continues to navigate the dynamic payment processing market, investors will be watching closely to see if the firm's investment thesis bears fruit.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.