Chuck Royce Increases Stake in SecureWorks Corp

Introduction to the Transaction

On December 31, 2023, Chuck Royce (Trades, Portfolio)'s investment firm made a notable addition to its holdings by acquiring 116,5775 shares of SecureWorks Corp (NASDAQ:SCWX), a leading cybersecurity provider. This transaction, which saw the firm add 130,746 shares, had a modest trade impact of 0.01% on the portfolio. The shares were purchased at a price of $7.38 each, reflecting a belief in the company's value at a total position of 0.09% in the portfolio and 7.14% of the company's outstanding shares.

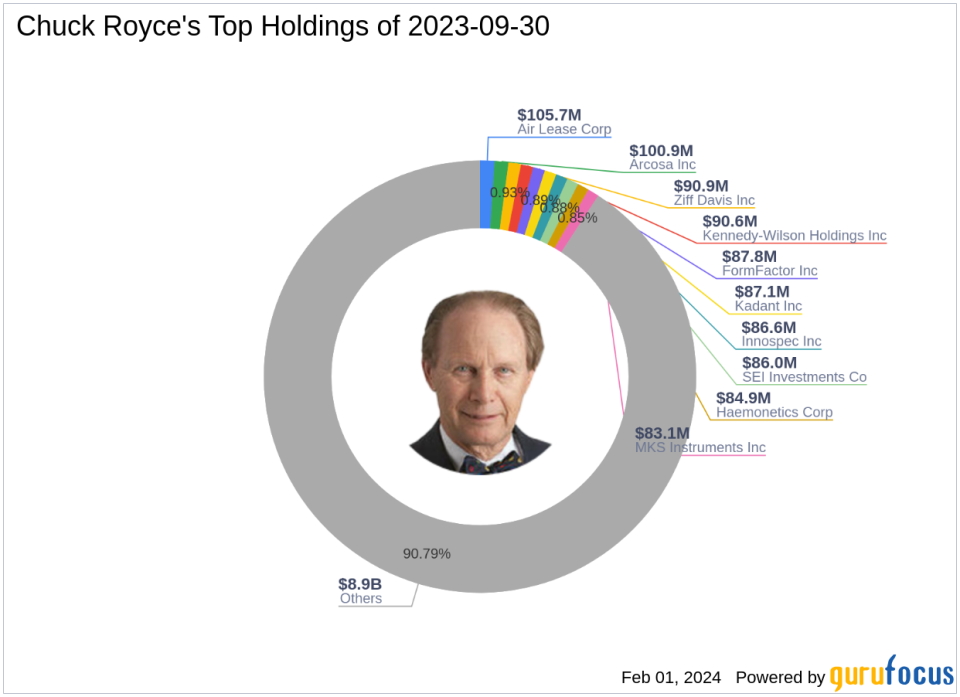

Profile of Chuck Royce (Trades, Portfolio)

Charles M. Royce, a venerated figure in small-cap investing, has been at the helm of Royce Pennsylvania Mutual Fund since 1972. With a bachelor's degree from Brown University and an MBA from Columbia University, Royce's investment philosophy centers on identifying undervalued smaller companies with strong balance sheets and potential for profitable futures. The firm's approach is to invest in companies with market capitalizations up to $5 billion, and occasionally up to $10 billion. Royce's top holdings include FormFactor Inc (NASDAQ:FORM), Ziff Davis Inc (NASDAQ:ZD), and Air Lease Corp (NYSE:AL), with a significant presence in the industrials and technology sectors, and an equity portfolio valued at $9.82 billion.

SecureWorks Corp Company Overview

SecureWorks Corp, trading under the symbol SCWX in the USA since its IPO on April 22, 2016, specializes in technology-driven cybersecurity solutions. The company's services span SaaS solutions, managed security services, and professional services, including incident response. SecureWorks aims to protect its customers by staying ahead of cyber threats and prioritizing real-time security incident responses.

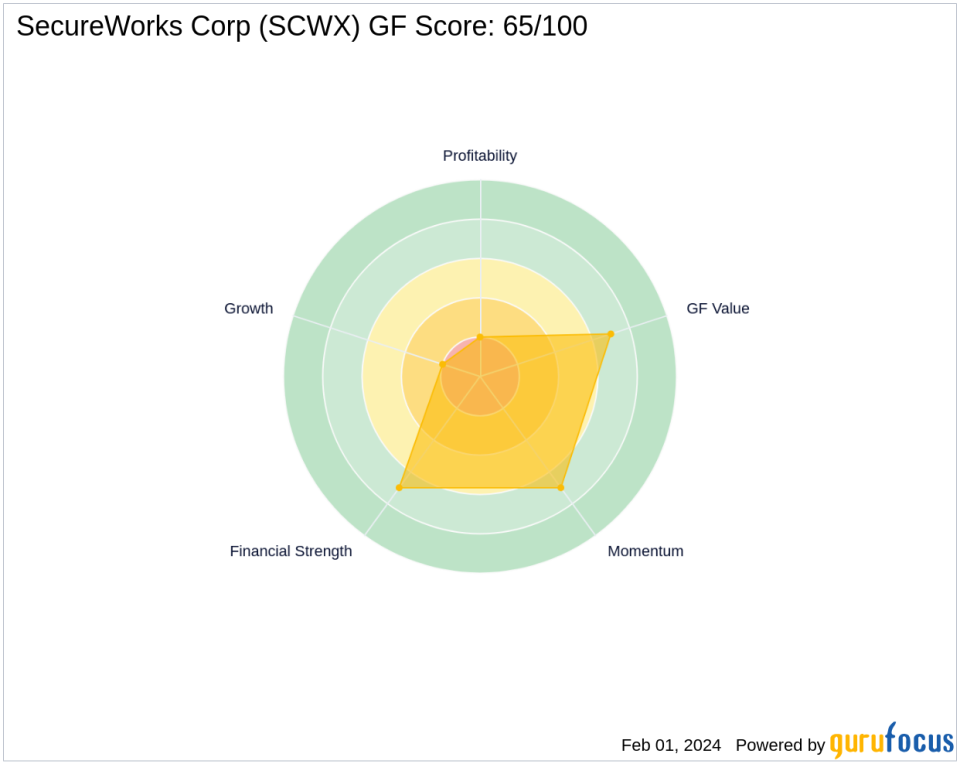

Financial and Market Analysis of SecureWorks Corp

As of the date of this article, SecureWorks Corp has a market capitalization of $593.084 million, with a current stock price of $6.87. The stock is deemed "Modestly Undervalued" with a GF Value of $7.69 and a Price to GF Value ratio of 0.89. However, the stock has experienced a decline of -6.91% since the transaction and a year-to-date change of -3.78%. The company's GF Score stands at 65/100, indicating potential challenges in future performance.

SecureWorks Corp's Position in Chuck Royce (Trades, Portfolio)'s Portfolio

SecureWorks Corp holds a position ratio of 0.09% in Royce's portfolio, with a total of 1,165,775 shares. This position, while not among the firm's top holdings, represents a significant stake in the company, indicating a strategic investment choice by Royce.

SecureWorks Corp's Financial Health and Performance Rankings

The financial health of SecureWorks Corp is reflected in its Financial Strength rank of 7/10, with a Cash to Debt ratio of 6.60. However, the company's Profitability Rank and Growth Rank are both low at 2/10. The GF Value Rank and Momentum Rank are more favorable at 7/10, and the Piotroski F-Score is at 2, indicating some concerns regarding financial stability. The Altman Z-Score of 0.53 suggests potential financial distress.

Industry Context and Other Gurus' Interest

In the competitive software industry, SecureWorks Corp stands out with its cybersecurity focus. Notable investors like Mario Gabelli (Trades, Portfolio) also hold shares in the company, while First Eagle Investment (Trades, Portfolio) Management, LLC is the largest guru shareholder, demonstrating the interest of seasoned investors in this sector.

Market Reaction and Future Outlook

The market's reaction to Chuck Royce (Trades, Portfolio)'s trade has been mixed, with SecureWorks Corp's stock showing a Relative Strength Index (RSI) of 32.17 over 5 days, indicating some overselling pressure. The future outlook for the company, based on financial growth metrics and the GF Score, suggests that while there are areas of concern, there may also be untapped potential for investors willing to take on the associated risks.

Transaction Analysis

The recent acquisition by Chuck Royce (Trades, Portfolio)'s firm has a relatively small impact on the overall portfolio but signifies a strategic investment in SecureWorks Corp. Despite the stock's current undervaluation and negative momentum, Royce's interest could be based on long-term growth prospects and the firm's solid financial strength. Investors will be watching closely to see how this position evolves in the context of the broader cybersecurity industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.