Chuck Royce Increases Stake in Silvercrest Asset Management Group Inc

Introduction to the Transaction

On December 31, 2023, Chuck Royce (Trades, Portfolio)'s investment firm made a notable addition to its portfolio by acquiring 87,201 shares of Silvercrest Asset Management Group Inc (NASDAQ:SAMG). This transaction marked an increase of 15.70% in the firm's holdings in SAMG, bringing the total share count to 642,691. The trade was executed at a price of $17 per share, impacting the portfolio by 0.02%. Following the acquisition, the firm's position in SAMG now represents 0.11% of the portfolio, with a 6.88% ownership of the traded company.

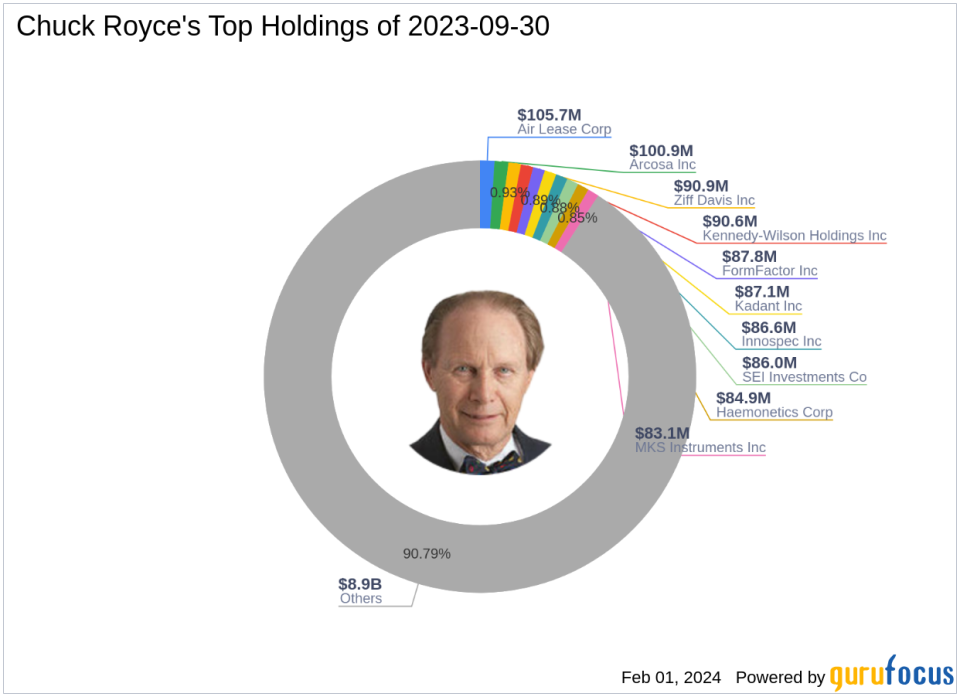

Chuck Royce (Trades, Portfolio)'s Profile

Charles M. Royce, a renowned figure in the investment world, has been at the helm of Royce Pennsylvania Mutual Fund since 1972. With a focus on small-cap investing, the firm seeks out companies with market capitalizations up to $5 billion, occasionally extending to $10 billion. Royce's investment philosophy centers on finding undervalued stocks with strong balance sheets, a history of business success, and promising future profitability. The firm's portfolio currently comprises 907 stocks, with top holdings in FormFactor Inc (NASDAQ:FORM), Ziff Davis Inc (NASDAQ:ZD), Air Lease Corp (NYSE:AL), Kennedy-Wilson Holdings Inc (NYSE:KW), and Arcosa Inc (NYSE:ACA), emphasizing a preference for the Industrials and Technology sectors. The firm's equity stands at $9.82 billion.

Silvercrest Asset Management Group Inc's Overview

Silvercrest Asset Management Group Inc, operating under the ticker SAMG, is a wealth management firm based in the USA. Since its IPO on June 27, 2013, SAMG has been dedicated to providing financial advisory and family office services to ultra-high net-worth individuals and institutional investors. The company specializes in both traditional and non-traditional investment strategies, including hedge funds, private equity, real estate, and commodities. SAMG's revenue is primarily derived from management and advisory fees associated with its assets under management.

Financial Snapshot of Silvercrest Asset Management Group Inc

As of the latest data, Silvercrest Asset Management Group Inc boasts a market capitalization of $155.829 million, with a stock price of $16.68. The company's price-to-earnings (P/E) ratio stands at 14.32. According to GuruFocus's exclusive method, SAMG is considered "Fairly Valued" with a GF Value of $17.30. The stock's price to GF Value ratio is 0.96, indicating that the stock is trading close to its intrinsic value.

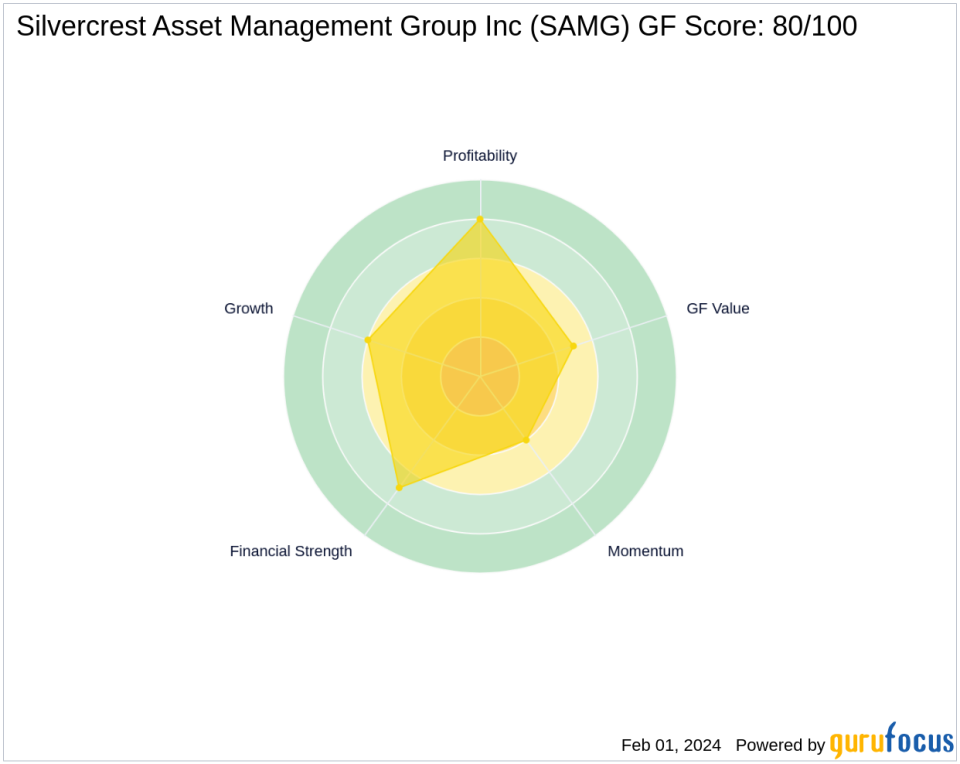

Performance Metrics of Silvercrest Asset Management Group Inc

Silvercrest Asset Management Group Inc exhibits a GF Score of 80/100, suggesting good potential for future performance. The company's Financial Strength is rated 7/10, while its Profitability Rank is a solid 8/10. SAMG's Growth Rank and GF Value Rank are 6/10 and 5/10, respectively, with a Momentum Rank of 4/10. The company's Piotroski F-Score is 5, and its Altman Z score is 3.19, indicating financial stability.

Chuck Royce (Trades, Portfolio)'s Investment in Context

Chuck Royce (Trades, Portfolio)'s recent investment in SAMG represents a strategic move within the firm's portfolio. Although SAMG is not among the firm's top holdings, its addition signifies confidence in the asset management industry and complements the firm's investment strategy. The firm's stake in SAMG is significant, with a 6.88% ownership, indicating a bullish outlook on the company's future performance.

Market Reaction and Future Outlook

Since the trade date, SAMG's stock price has experienced a slight decline of -1.88%, with a year-to-date change of -0.77%. Despite this, the company's long-term growth prospects and financial health indicators remain robust, suggesting potential for recovery and growth in the future.

Industry and Peer Comparison

In the asset management industry, SAMG holds a competitive position, offering a unique blend of services that cater to a niche market of ultra-high net-worth individuals. The largest guru shareholder in SAMG is Keeley-Teton Advisors, LLC (Trades, Portfolio), although the specific share percentage is not disclosed. This investment by Chuck Royce (Trades, Portfolio)'s firm further solidifies SAMG's standing among value investors.

In conclusion, Chuck Royce (Trades, Portfolio)'s firm's recent acquisition of additional shares in Silvercrest Asset Management Group Inc aligns with its investment philosophy and adds a promising asset to its diverse portfolio. The firm's significant stake in SAMG, coupled with the company's solid financial metrics and GF Score, suggests confidence in its future performance and potential for value appreciation.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.