Chuck Royce Reduces Stake in Lincoln Educational Services Corp

Overview of Chuck Royce (Trades, Portfolio)'s Recent Trade

On December 31, 2023, Chuck Royce (Trades, Portfolio)'s investment firm made a notable reduction in its holdings of Lincoln Educational Services Corp (NASDAQ:LINC), a provider of diversified career-oriented post-secondary education. The firm sold 270,588 shares, resulting in a 38.56% decrease in its position. This transaction had a minor impact of -0.03% on the portfolio, with the trade executed at a price of $10.04 per share. Following the sale, the firm retained 431,118 shares of LINC, which now comprises 0.04% of its portfolio and represents a 1.37% ownership in the company.

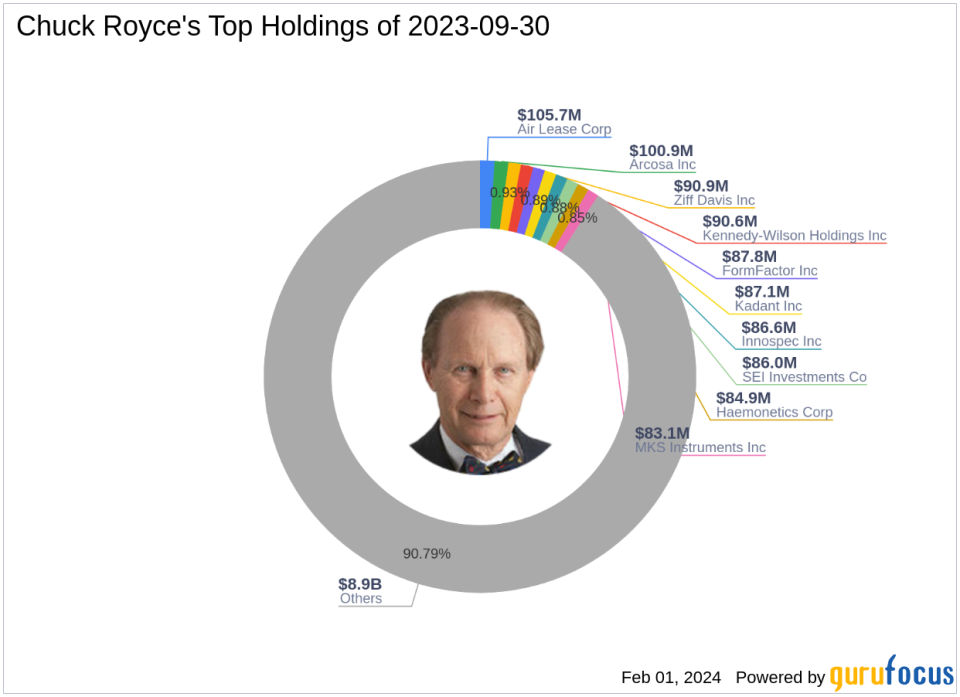

Chuck Royce (Trades, Portfolio)'s Investment Profile

Charles M. Royce, a venerated figure in the investment community, has been at the helm of Royce Pennsylvania Mutual Fund since 1972. With a focus on small-cap investing, the firm seeks out companies with market capitalizations up to $5 billion, occasionally extending to $10 billion. The investment philosophy is grounded in identifying undervalued stocks with strong balance sheets, a history of success, and promising futures. Royce's top holdings include FormFactor Inc (NASDAQ:FORM), Ziff Davis Inc (NASDAQ:ZD), and Air Lease Corp (NYSE:AL), with a portfolio equity of $9.82 billion predominantly in the Industrials and Technology sectors.

Lincoln Educational Services Corp at a Glance

Lincoln Educational Services Corp, trading under the symbol LINC, has been offering post-secondary education since its IPO on June 23, 2005. The company's programs span automotive technology, skilled trades, healthcare, hospitality services, and IT. With most revenue generated from the Transportation and Skilled Trades segment, LINC operates through Campus Operations and Transitional segments. As of the latest data, the company's market capitalization stands at $280.978 million, with a stock price of $8.96 and a PE ratio of 9.90, indicating profitability. However, the stock is currently deemed Significantly Overvalued with a GF Value of $6.43.

Detailed Transaction Insights

The trade on December 31, 2023, saw Chuck Royce (Trades, Portfolio)'s firm reduce its stake in LINC at a trade price of $10.04. The firm's current holding of 431,118 shares reflects a modest 0.04% of its portfolio, with a significant 1.37% stake in the company. This move aligns with the firm's strategy of investing in undervalued companies with strong financials and growth potential.

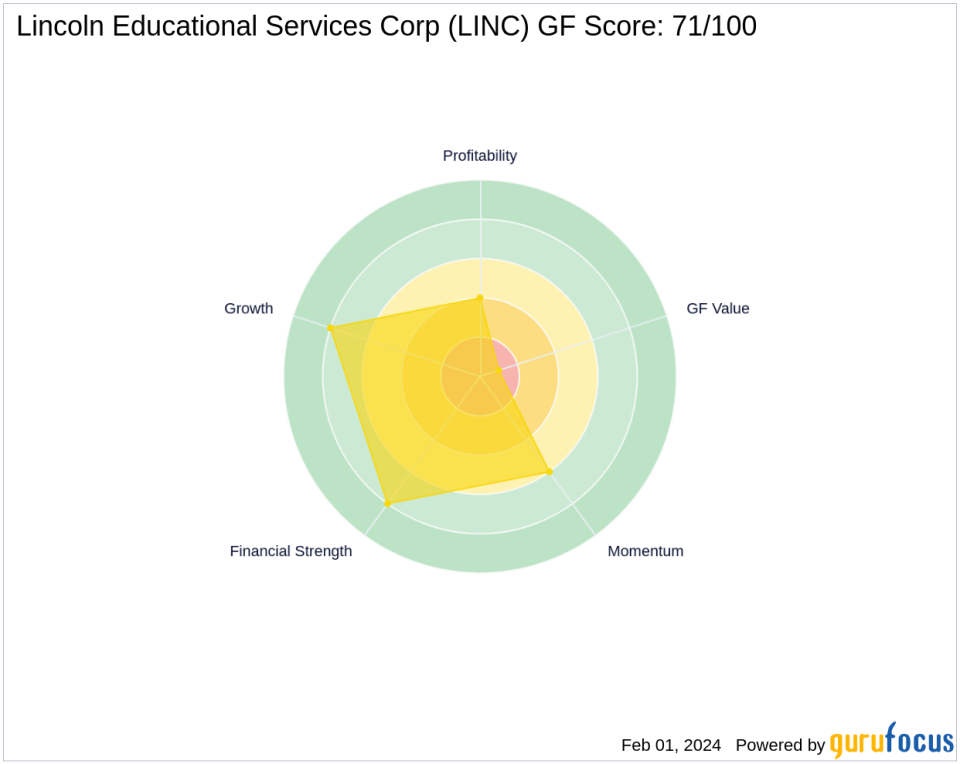

Financial Health and Stock Performance

LINC's financial health is robust, with a Financial Strength rank of 8/10 and an interest coverage ratio of 83.89. The stock's GF Score of 71/100 suggests average performance potential. Despite a Profitability Rank of 4/10, the company boasts a high ROE of 19.02% and an ROA of 9.31%. However, the stock's GF Value Rank of 1/10 indicates that it is significantly overvalued at the current price.

Comparative Stock Metrics

LINC's Growth Rank stands at 8/10, supported by a three-year revenue growth rate of 6.50% and EBITDA growth of 17.70%. The stock's Momentum Rank is 6/10, reflecting a mix of recent price performance and longer-term trends. Despite these positive indicators, the stock's valuation remains a concern, with a price to GF Value ratio of 1.39.

Market Context and Guru Holdings

Chuck Royce (Trades, Portfolio)'s firm is not the only notable investor in LINC. First Eagle Investment (Trades, Portfolio) Management, LLC holds a significant stake in the company, although the exact share percentage is not disclosed. Royce's top holdings and sector preferences provide context for this transaction, indicating a strategic adjustment rather than a shift in overall investment philosophy.

Conclusion

The recent reduction in LINC by Chuck Royce (Trades, Portfolio)'s firm is a strategic move that aligns with the firm's investment philosophy of seeking value in small-cap companies. While the transaction's impact on the portfolio is minimal, it reflects the firm's ongoing assessment of LINC's valuation and future prospects. Investors and market watchers will be keen to see how this trade influences LINC's performance and Royce's investment outcomes in the coming quarters.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.