Chuck Royce Reduces Stake in NVE Corp

Overview of Chuck Royce (Trades, Portfolio)'s Recent Stock Transaction

Chuck Royce (Trades, Portfolio), a notable figure in the investment community, has recently adjusted the firm's position in NVE Corp (NASDAQ:NVEC), a company specializing in spintronics nanotechnology. On December 31, 2023, the firm executed a reduction in its holdings, signaling a strategic move within its investment portfolio. This transaction involved the sale of 600 shares at a price of $78.43 each, leaving the firm with a total of 482,523 shares in NVEC.

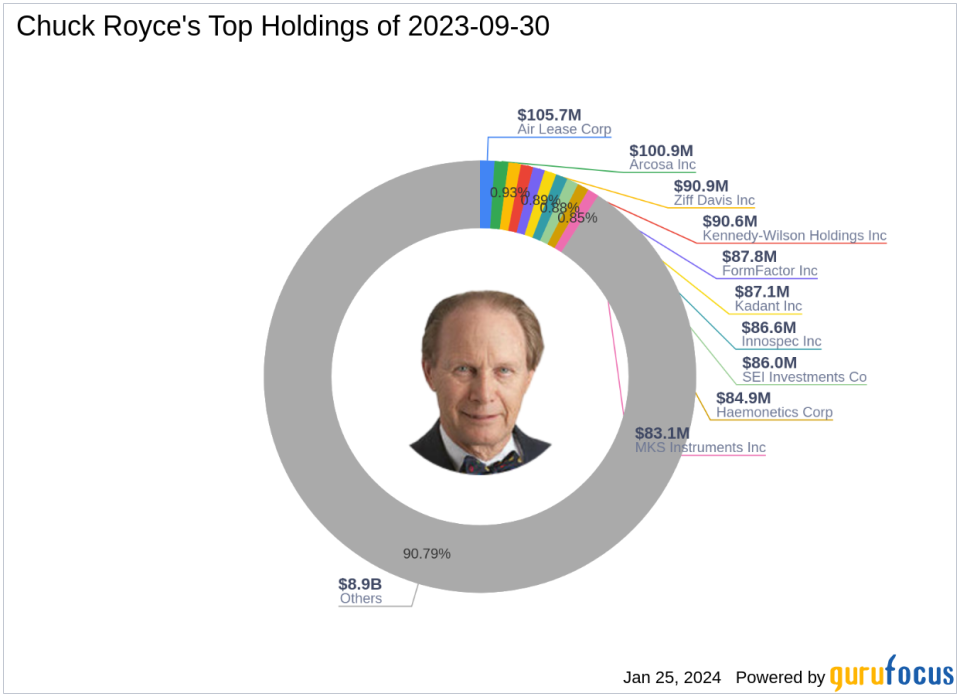

Profile of Chuck Royce (Trades, Portfolio)

Charles M. Royce, a seasoned investor and a pioneer in small-cap investing, has been managing the Royce Pennsylvania Mutual Fund since 1972. With a bachelor's degree from Brown University and an MBA from Columbia University, Royce's firm focuses on investing in smaller companies, typically with market capitalizations up to $5 billion. The firm's investment philosophy is centered on finding undervalued stocks with strong balance sheets, a history of success, and promising futures. The firm's top holdings include FormFactor Inc (NASDAQ:FORM), Ziff Davis Inc (NASDAQ:ZD), and Air Lease Corp (NYSE:AL), among others, with a significant presence in the Industrials and Technology sectors and an equity portfolio valued at $9.82 billion.

Details of the Trade Action

The recent transaction by Chuck Royce (Trades, Portfolio)'s firm on December 31, 2023, was a reduction in the firm's stake in NVE Corp. The trade resulted in a 0.12% decrease in the firm's holdings, with a negligible impact on the overall portfolio, given the trade impact of 0%. The firm's position in NVEC now stands at 0.39% of the portfolio, with a holding percentage of 9.98% in the company.

NVE Corp Company Overview

NVE Corp, operating in the USA since its IPO on September 11, 1996, is a leader in the development and sale of spintronic devices, which are integral in data acquisition and transmission. The company's product line includes various sensors and couplers, with a focus on giant magnetoresistance (GMR) and tunneling magnetoresistance (TMR) technologies. NVE Corp's financial metrics reveal a market capitalization of $385.462 million, a stock price of $79.75, and a PE ratio of 17.88, indicating profitability. The stock is currently deemed "Fairly Valued" with a GF Value of $82.90 and a price to GF Value ratio of 0.96.

Analysis of the Trade's Significance

The reduction in NVEC shares by Chuck Royce (Trades, Portfolio)'s firm represents a minor adjustment in the portfolio, with the position size remaining substantial. The firm's holding percentage in NVE Corp remains significant, indicating continued confidence in the company's prospects despite the reduction.

Market Context and Stock Valuation

NVE Corp's current market capitalization stands at $385.462 million, with a stock price of $79.75. The stock is considered "Fairly Valued" according to the GF Value, with a GF Value of $82.90. The stock's valuation metrics suggest that it is trading close to its intrinsic value.

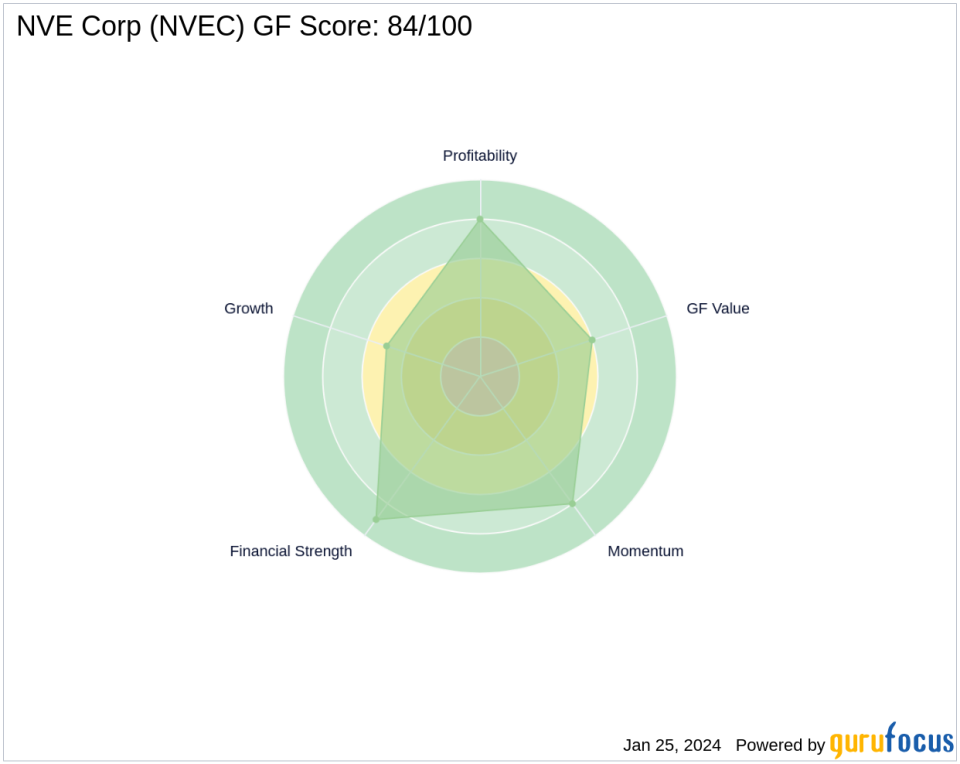

Performance and Rankings

NVE Corp boasts a strong Financial Strength with a rank of 9/10 and a Profitability Rank of 8/10. The company's GF Score of 84/100 indicates good outperformance potential. The Piotroski F-Score of 7 and an impressive Altman Z score of 227.01 further underscore the company's robust financial health.

Sector and Industry Perspective

Within the Semiconductors industry, NVE Corp maintains a competitive stance. The stock's performance is analyzed in the context of its sector, with a focus on its Growth Rank of 5/10, GF Value Rank of 6/10, and Momentum Rank of 8/10, reflecting its potential for future performance.

In conclusion, Chuck Royce (Trades, Portfolio)'s firm's recent reduction in NVE Corp shares is a strategic portfolio adjustment that aligns with the firm's value investing philosophy. While the transaction size was modest, it reflects the firm's ongoing assessment of NVE Corp's valuation and future growth prospects within the dynamic semiconductors industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.