Chuck Royce Trims Position in Manitex International Inc

Transaction Overview

On December 31, 2023, Chuck Royce (Trades, Portfolio)'s firm made a notable adjustment to its investment portfolio by reducing its stake in Manitex International Inc (NASDAQ:MNTX). The firm sold 97,400 shares of the company, which resulted in a 6.63% decrease in their holdings. This transaction had a minor impact of -0.01% on the portfolio, with the shares being traded at a price of $8.74 each. Following the sale, the firm retained 1,372,734 shares of Manitex International, which now represents 0.12% of the portfolio and 6.78% of the company's outstanding shares.

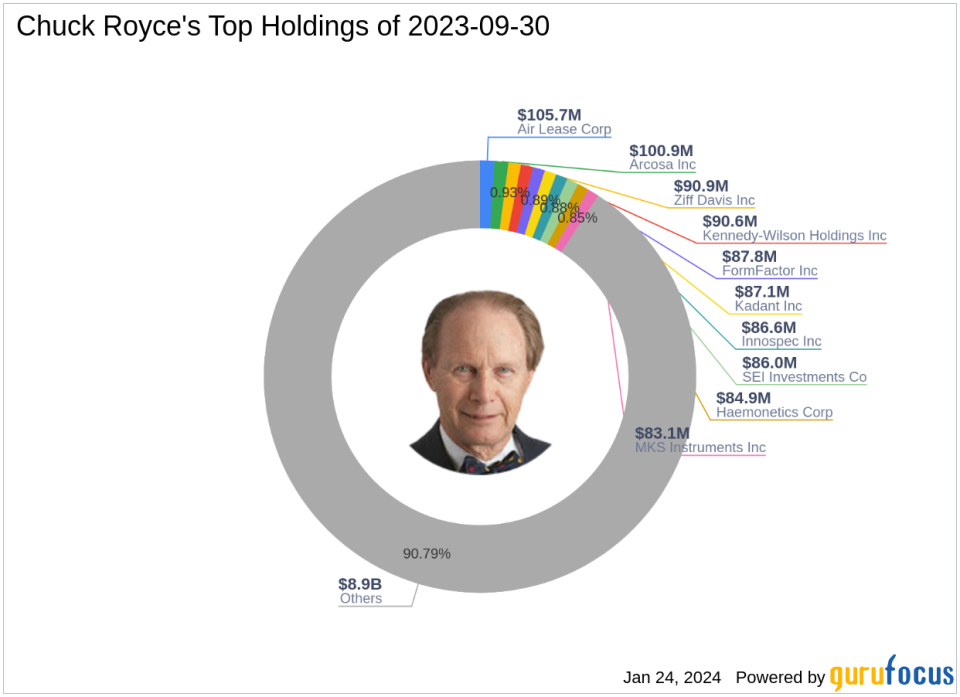

Chuck Royce (Trades, Portfolio)'s Investment Profile

Charles M. Royce, a seasoned investor with a focus on small-cap companies, has been at the helm of Royce Pennsylvania Mutual Fund since 1972. The firm's investment philosophy is grounded in value investing, seeking out companies with strong balance sheets, a successful business track record, and promising future profitability. With a preference for companies with market capitalizations up to $5 billion, the firm's approach is to invest in undervalued stocks that have a lower enterprise value than their intrinsic worth. Chuck Royce (Trades, Portfolio)'s firm currently manages an equity portfolio valued at $9.82 billion, with top holdings in various sectors, including Industrials and Technology.

Manitex International Inc at a Glance

Manitex International Inc, with its headquarters in the USA, specializes in the design, manufacture, and distribution of engineered lifting solutions. The company operates primarily through two segments: Lifting Equipment and Rental Equipment. Since its IPO on February 15, 2005, Manitex has focused on delivering products such as boom trucks, truck cranes, and sign cranes, primarily to the United States market. With a market capitalization of $165.46 million and a stock price of $8.17, the company is currently deemed as Fairly Valued according to GF Valuation, with a GF Value of $8.20. The stock's PE ratio stands at 57.13, indicating a valuation that reflects its earnings.

Impact of the Trade on Royce's Portfolio

The recent transaction by Chuck Royce (Trades, Portfolio)'s firm has slightly altered its investment landscape. The reduction in Manitex International shares has decreased the stock's presence in the portfolio to a modest 0.12%. Despite this change, the firm still maintains a significant 6.78% holding in the company, showcasing a continued belief in its potential.

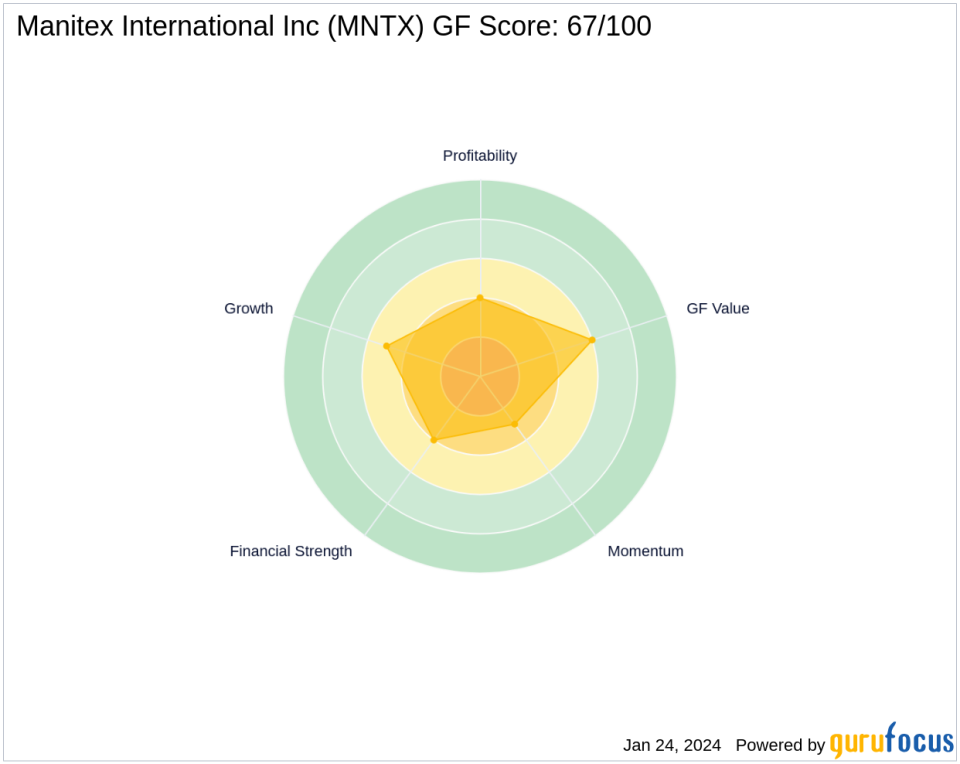

Manitex International's Stock Performance and Valuation

Since the transaction, Manitex International's stock has experienced a -6.52% decline in price, currently trading below the transaction price at $8.17. The stock's GF Score of 67/100 suggests a moderate future performance potential. The company's financial health is reflected in its Financial Strength rank of 4/10 and Profitability Rank of 4/10. Additionally, Manitex holds a Piotroski F-Score of 7, indicating a healthy financial situation.

Chuck Royce (Trades, Portfolio)'s Sector Focus and Top Holdings

The firm's investment strategy is heavily weighted towards the Industrials and Technology sectors. Within this framework, Manitex International plays a role that aligns with the firm's preference for industrial companies with a strong market presence and potential for growth.

Manitex International's Market Position

Since its IPO, Manitex International's stock has seen a price change of 31.77%, with a year-to-date change of 0.74%. The company holds a competitive position within the Farm & Heavy Construction Machinery industry, reflecting its specialized focus on lifting equipment.

Comparative Analysis with Largest Guru Shareholder

First Eagle Investment (Trades, Portfolio) Management, LLC is currently the largest guru shareholder in Manitex International. While specific share percentage data is not provided, Chuck Royce (Trades, Portfolio)'s firm's position is significant and indicative of a strong conviction in the company's value and future prospects.

Transaction Analysis

The reduction in Manitex International shares by Chuck Royce (Trades, Portfolio)'s firm is a strategic move that slightly adjusts the portfolio's exposure to the company. While the firm maintains a substantial stake, the sale reflects a nuanced approach to portfolio management, balancing conviction with diversification. As the stock continues to navigate the market, the firm's seasoned investment philosophy will likely continue to guide its decisions regarding Manitex International.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.