Chuck Royce's Firm Adds to Stake in Lakeland Industries Inc

Introduction to the Transaction

On December 31, 2023, Chuck Royce (Trades, Portfolio)'s investment firm made a notable addition to its holdings by acquiring 27,773 shares of Lakeland Industries Inc (NASDAQ:LAKE), a company specializing in industrial protective clothing. This transaction, executed at a trade price of $18.54 per share, increased the firm's total share count in LAKE to 691,951. Despite the trade's seemingly small impact on the portfolio at just 0.01%, it is significant as it represents 9.40% of the firm's holdings in the traded stock, indicating a strategic position in LAKE within the firm's investment strategy.

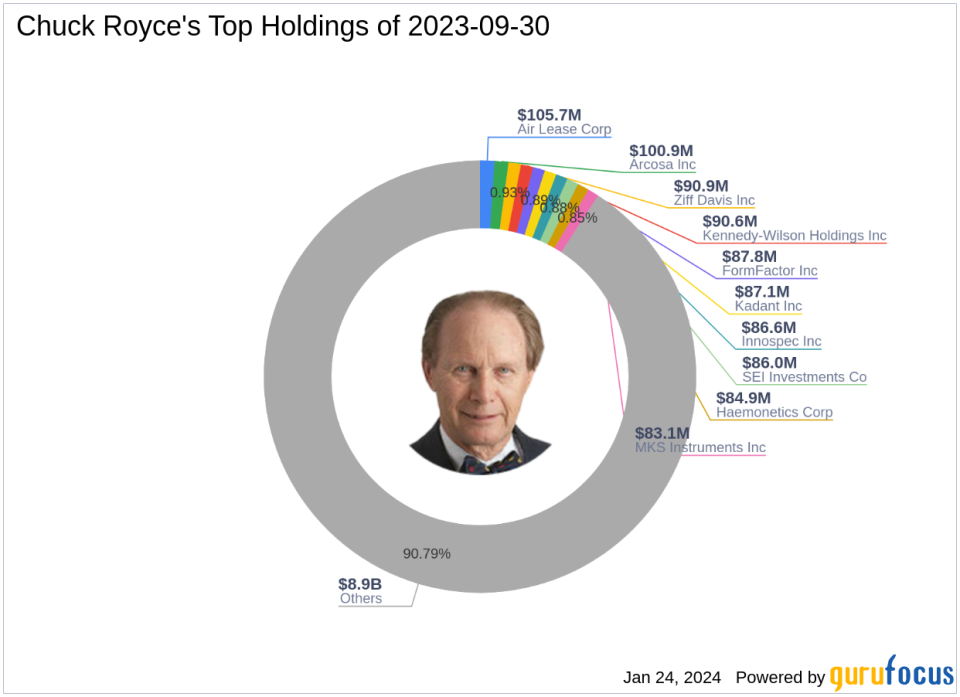

Profile of Guru Investor Chuck Royce (Trades, Portfolio)

Charles M. Royce, a venerated figure in the investment community, is renowned for his pioneering work in small-cap investing. Since 1972, Royce has been at the helm of the Royce Pennsylvania Mutual Fund, applying his extensive knowledge gained from a bachelor's degree from Brown University and an MBA from Columbia University. The firm's investment philosophy is centered on identifying undervalued small-cap companies with strong balance sheets, a history of success, and promising futures. With a portfolio of 907 stocks, the firm's top holdings include FormFactor Inc (NASDAQ:FORM), Ziff Davis Inc (NASDAQ:ZD), and Air Lease Corp (NYSE:AL), predominantly in the Industrials and Technology sectors, with an equity value of $9.82 billion.

Lakeland Industries Inc Company Overview

Lakeland Industries Inc, with its stock symbol LAKE, operates within the USA's Manufacturing - Apparel & Accessories industry. Since its IPO on September 9, 1986, the company has developed a diverse range of safety garments and accessories for various industrial sectors. With a market capitalization of $128.147 million and a PE ratio of 20.23, LAKE's stock is currently priced at $17.40, deemed "Fairly Valued" with a GF Value of $18.49. The company's business segments include Chemical, Disposables, Fire Service, Gloves, High Performance Wear, High Visibility, and Wovens, catering to a global customer base.

Analysis of the Trade's Significance

The recent trade by Chuck Royce (Trades, Portfolio)'s firm, while having a minimal impact on the overall portfolio, is significant within the context of LAKE, accounting for a substantial 9.40% of the firm's holdings in the stock. This suggests a targeted investment approach, possibly indicating the firm's confidence in LAKE's future performance or an alignment with the firm's investment criteria for small-cap value opportunities.

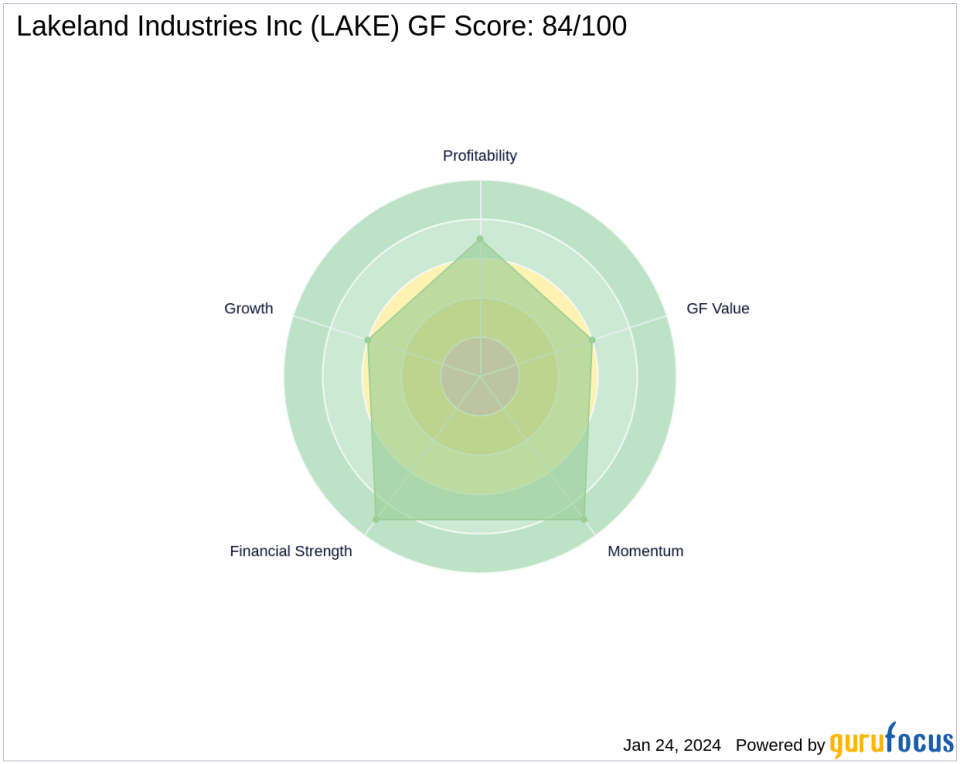

Performance and Valuation Metrics of LAKE

Since the transaction, LAKE's stock has experienced a price decline of 6.15%, with a year-to-date change of -5.23%. However, the stock has seen a substantial increase of 277.44% since its IPO. The GF Score of 84/100 indicates a strong potential for outperformance, supported by high ranks in Financial Strength (9/10), Profitability (7/10), and Momentum (9/10).

Financial Health and Growth Prospects of LAKE

Lakeland Industries Inc's financial health is robust, with a Piotroski F-Score of 7 and an Altman Z score of 5.63, indicating low bankruptcy risk. The company's cash to debt ratio of 2.46 further underscores its financial stability. However, growth metrics such as revenue, EBITDA, and earnings growth over the past three years have been mixed, with a revenue growth of 2.80%, an EBITDA decline of 1.00%, and a decrease in earnings growth of 16.30%.

Comparative Analysis with Other Gurus

Other notable investors, such as HOTCHKIS & WILEY, also hold positions in Lakeland Industries Inc. However, data on the largest guru shareholder and their share percentage is not available, making it challenging to compare the firm's stake relative to other prominent investors.

Market Context and Future Outlook

The current market conditions and industry trends will play a crucial role in shaping the future of Lakeland Industries Inc. Given the firm's recent investment and the company's solid GF Score, there is an indication of positive sentiment towards LAKE's market position and growth potential. Investors will be watching closely to see how these factors influence the stock's performance moving forward.

In conclusion, Chuck Royce (Trades, Portfolio)'s firm's recent investment in Lakeland Industries Inc reflects a strategic move that aligns with its small-cap value investing philosophy. With a strong financial foundation and a significant position in the stock, the firm appears poised to capitalize on LAKE's future growth and market performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.