Chuck Royce's Firm Adjusts Position in Orion Group Holdings Inc

Overview of Recent Stock Transaction by Chuck Royce (Trades, Portfolio)'s Firm

On December 31, 2023, the investment firm led by Chuck Royce (Trades, Portfolio) executed a notable transaction involving Orion Group Holdings Inc (NYSE:ORN), a specialty construction company. The firm reduced its stake in ORN by 109,500 shares, resulting in a -5.66% change in its holdings. This adjustment left the firm with a total of 1,825,535 shares, valued at a trade price of $4.94 per share. Despite the reduction, ORN still represents 0.09% of the firm's portfolio and 5.62% of the company's outstanding shares, indicating a continued interest in the stock's potential.

Profile of the Guru: Chuck Royce (Trades, Portfolio)

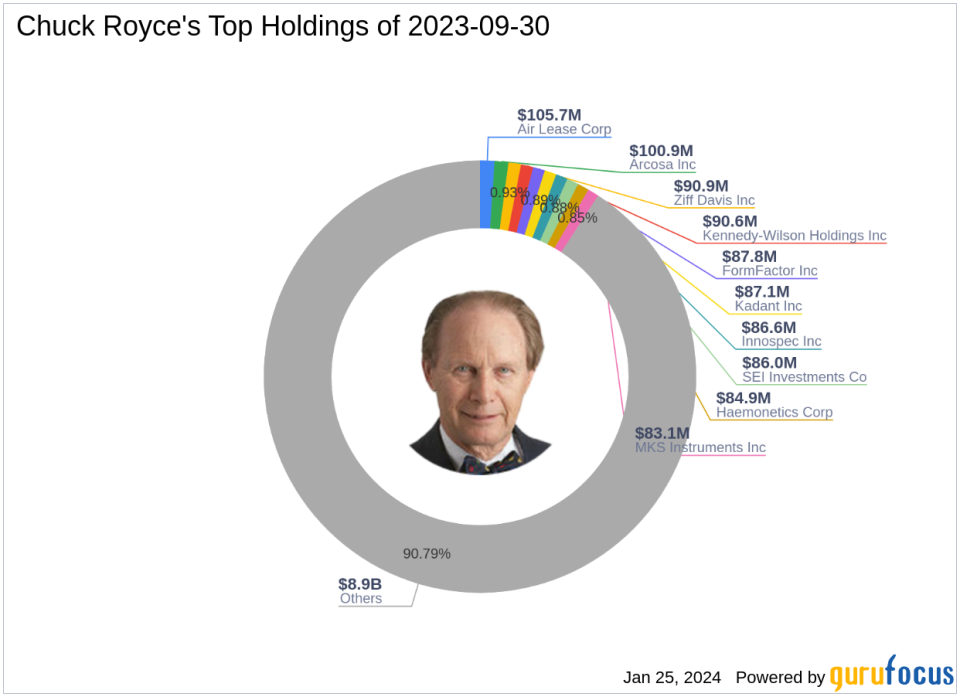

Charles M. Royce, a renowned figure in the investment world, has been at the helm of Royce Pennsylvania Mutual Fund since 1972. With a bachelor's degree from Brown University and an MBA from Columbia University, Royce has established a reputation as a pioneer in small-cap investing. The firm's investment philosophy centers on identifying undervalued smaller companies with strong balance sheets, a history of success, and promising futures. With a focus on enterprises with market capitalizations up to $5 billion, the firm's approach is grounded in seeking stocks trading below their estimated enterprise value. As of the latest data, the firm manages an equity portfolio worth $9.82 billion, with top holdings in various sectors, including Industrials and Technology.

Orion Group Holdings Inc: Company Overview

Orion Group Holdings Inc operates within the infrastructure, industrial, and building sectors, offering specialty construction services. The company's business is divided into two main segments: Concrete and Marine. ORN provides a range of services, including marine transportation facility construction, dredging, and concrete construction services. Established in 1995, Orion Group Holdings has expanded its operations across the United States, Canada, and the Caribbean Basin, catering to both onshore and offshore projects.

Financial Snapshot of Orion Group Holdings Inc

With a market capitalization of approximately $188.448 million and a current stock price of $5.8, Orion Group Holdings Inc's financial standing is a mix of challenges and opportunities. The stock is currently deemed Significantly Overvalued by GuruFocus, with a GF Value of $3.53 and a Price to GF Value ratio of 1.64. Despite this, the stock has experienced a 17.41% gain since the reported transaction and a 20.08% increase year-to-date. However, the company's long-term performance has been less favorable, with a -63.75% change since its IPO. The GF Score for ORN stands at 54/100, indicating a potential for poor future performance.

Impact of the Trade on Chuck Royce (Trades, Portfolio)'s Portfolio

The recent transaction by Chuck Royce (Trades, Portfolio)'s firm has slightly decreased its exposure to Orion Group Holdings Inc, but the stock remains a part of its diverse portfolio. The firm's strategy of investing in undervalued small-cap stocks with strong fundamentals suggests that ORN still aligns with its investment criteria, despite the reduction in shareholding.

Sector and Market Analysis

Royce's firm has shown a preference for the Industrials and Technology sectors, with Orion Group Holdings fitting within the former category. The current market trends, including the emphasis on infrastructure development, could influence the stock's future performance and justify the firm's continued interest in ORN.

Comparative Analysis with Other Gurus

While Chuck Royce (Trades, Portfolio)'s firm has adjusted its position in ORN, other notable investors such as Brandes Investment and First Eagle Investment (Trades, Portfolio) maintain holdings in the company. The comparative analysis of positions reveals that Royce's firm is among the significant investors in Orion Group Holdings, with a strategic stake that reflects its investment philosophy.

Conclusion

The recent transaction by Chuck Royce (Trades, Portfolio)'s firm in Orion Group Holdings Inc is a strategic move that aligns with its investment approach. Value investors may find the firm's decision to adjust its position in ORN noteworthy, as it reflects a careful assessment of the stock's valuation and potential within the portfolio. As the market continues to evolve, the implications for ORN's stock performance will be closely monitored by investors and industry analysts alike.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.