Chuck Royce's Firm Reduces Stake in AstroNova Inc

Overview of Chuck Royce (Trades, Portfolio)'s Recent Stock Transaction

On December 31, 2023, the investment firm managed by Chuck Royce (Trades, Portfolio) executed a notable transaction involving AstroNova Inc (NASDAQ:ALOT), a company specializing in specialty printers and data acquisition systems. The firm reduced its stake in AstroNova by 6,370 shares, which adjusted its total holding to 477,097 shares. This trade, executed at a price of $16.26 per share, reflects a strategic portfolio adjustment by one of the prominent figures in small-cap investing.

Profile of the Guru: Chuck Royce (Trades, Portfolio)

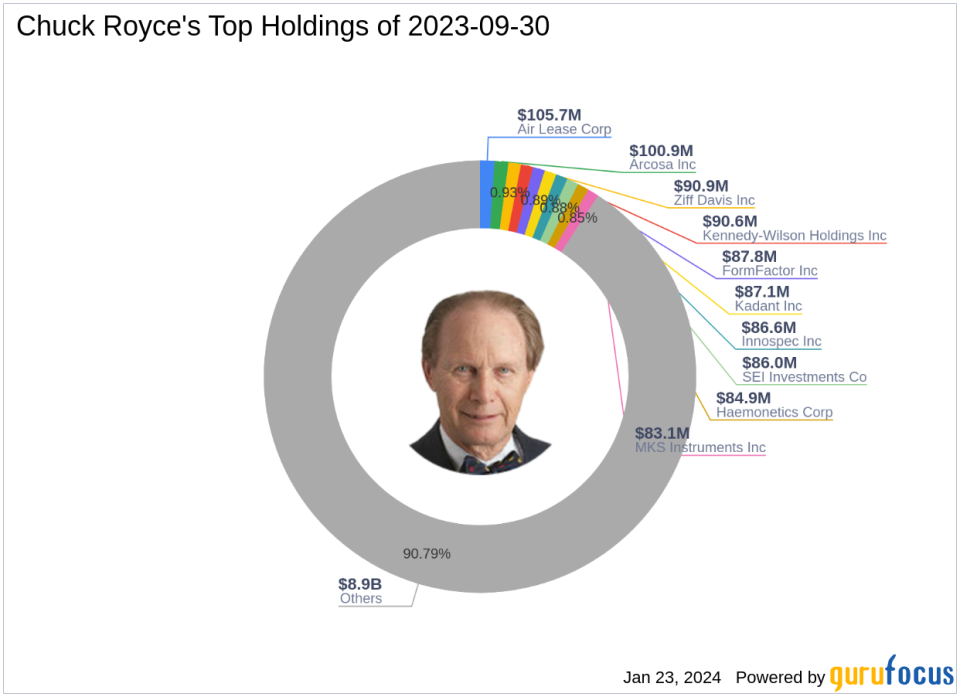

Charles M. Royce, a venerated name in the investment community, is renowned for his expertise in small-cap investing. With a career spanning over five decades, Royce has been at the helm of the Royce Pennsylvania Mutual Fund since 1972. His academic credentials include a bachelor's degree from Brown University and an MBA from Columbia University. The firm's investment philosophy is centered on identifying undervalued small to mid-sized companies with strong balance sheets, a history of success, and promising futures. Chuck Royce (Trades, Portfolio)'s firm currently manages an equity portfolio worth $9.82 billion, with top holdings in various sectors, including Industrials and Technology.

AstroNova Inc Company Overview

AstroNova Inc, trading under the symbol ALOT, operates within the hardware industry in the United States. Since its IPO on September 7, 1984, the company has developed a diverse range of specialty printing systems and data acquisition and analysis systems. AstroNova's business is segmented into Product Identification and Test & Measurement, catering to sectors such as aerospace, automotive, and packaging. The company's commitment to innovation has positioned it as a key player in its target markets.

Transaction Specifics

The recent transaction by Chuck Royce (Trades, Portfolio)'s firm saw a reduction in AstroNova shares, resulting in a 1.32% decrease in the firm's stake. This move has altered the firm's position in AstroNova to 0.08% of its portfolio, while still maintaining a 6.42% ownership in the company. Despite the reduction, AstroNova remains a part of the firm's diverse investment portfolio.

Financial Snapshot of AstroNova Inc

AstroNova Inc currently boasts a market capitalization of $130.446 million, with a stock price of $17.55. The company's PE Percentage stands at 39.89%, indicating profitability, although it is considered modestly overvalued with a GF Value of $15.21 and a price to GF Value ratio of 1.15. The stock has experienced a gain of 7.93% since the transaction and an impressive 2,093.75% increase since its IPO. Year-to-date, the stock has risen by 9.01%.

Guru's Portfolio and AstroNova's Position Within It

Chuck Royce (Trades, Portfolio)'s firm's top holdings include FormFactor Inc (NASDAQ:FORM), Ziff Davis Inc (NASDAQ:ZD), Air Lease Corp (NYSE:AL), Kennedy-Wilson Holdings Inc (NYSE:KW), and Arcosa Inc (NYSE:ACA). Within this diverse portfolio, AstroNova Inc represents a smaller, yet strategic holding, reflecting the firm's confidence in the company's potential for growth and value creation.

AstroNova Inc's Market Performance and Valuation

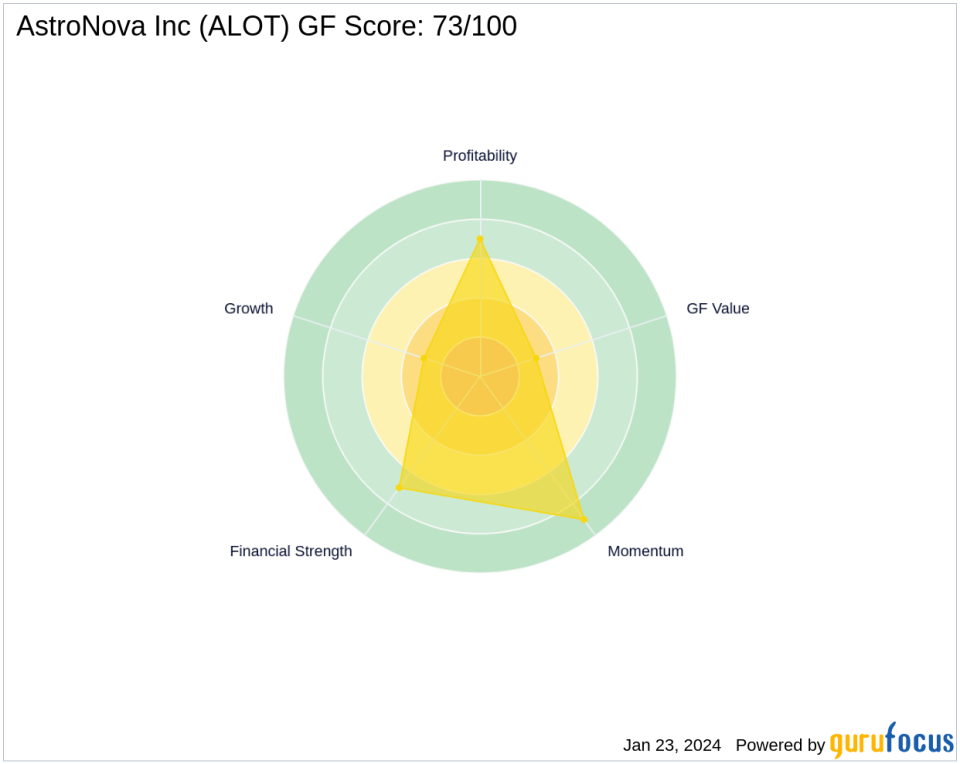

AstroNova's stock performance has been robust, with a GF Score of 73/100, indicating a likelihood of average performance. The company's Financial Strength and Profitability Rank are both at 7/10, while its Growth Rank and GF Value Rank are lower at 3/10. However, its Momentum Rank is high at 9/10, suggesting strong market movement. The Piotroski F-Score of 7 and Altman Z-Score of 4.00 further reinforce the company's financial stability.

Conclusion and Market Outlook

The reduction in AstroNova shares by Chuck Royce (Trades, Portfolio)'s firm is a strategic move that aligns with the firm's investment philosophy. Despite the reduction, AstroNova's current valuation and market momentum indicators, such as a strong GF Score and high Momentum Rank, suggest that the company remains a valuable component of the firm's portfolio. Investors will be watching closely to see how this transaction influences AstroNova's market performance in the coming months.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.