Chuck Royce's Firm Reduces Stake in American Superconductor Corp

Overview of Chuck Royce (Trades, Portfolio)'s Recent Trade

On December 31, 2023, the investment firm managed by Chuck Royce (Trades, Portfolio) executed a notable transaction involving American Superconductor Corp (NASDAQ:AMSC). The firm decided to reduce its holding in AMSC, a decision that aligns with its investment strategy and portfolio management practices. This move by one of the pioneers in small-cap investing is of particular interest to value investors who closely monitor guru trades for insights and trends.

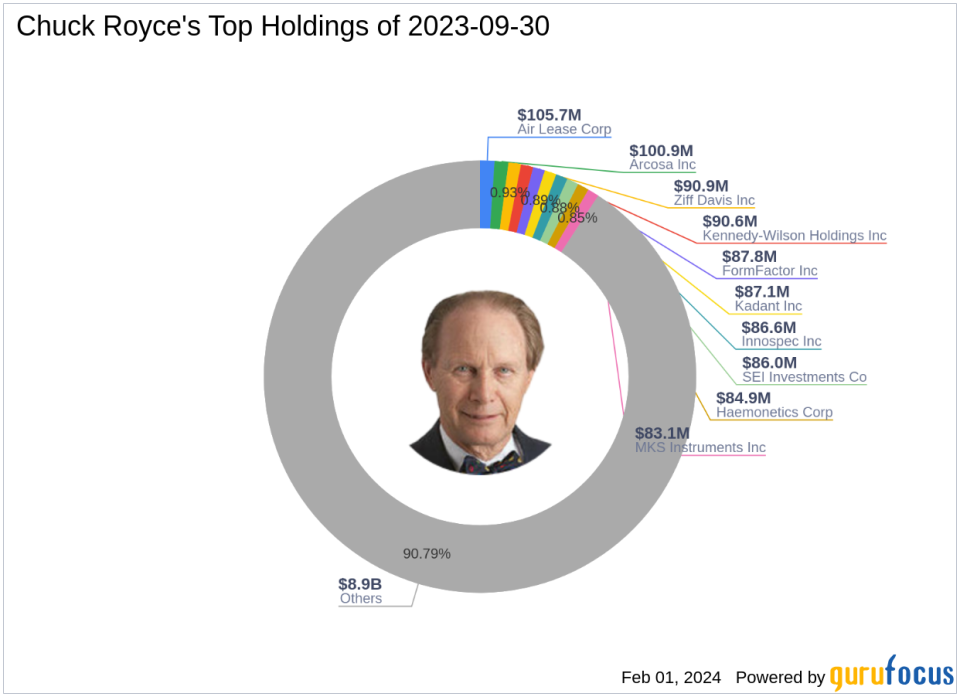

Investment Guru: Charles M. Royce

Charles M. Royce, a respected figure in the investment community, has been at the helm of the Royce Pennsylvania Mutual Fund since 1972. With a bachelor's degree from Brown University and an MBA from Columbia University, Royce's firm specializes in investing in smaller companies, with a keen eye for stocks trading below their estimated enterprise value. The firm's investment philosophy is grounded in identifying companies with strong balance sheets, a history of success, and promising futures.

Details of the Trade Action

The trade, which took place on the last day of 2023, saw the firm reduce its position in American Superconductor Corp by 400 shares. This adjustment represents a -0.03% change in the holding, reflecting a strategic portfolio decision rather than a significant shift in investment stance. The shares were sold at a price of $11.14, and following the transaction, the firm holds 1,245,860 shares of AMSC, accounting for 0.14% of the portfolio and 4.11% of the company's outstanding shares.

Impact and Position of the Trade

Despite the reduction, American Superconductor Corp remains a part of the firm's diverse portfolio, albeit with a slightly diminished presence. The trade did not have a measurable impact on the portfolio, indicating a minor adjustment rather than a major divestment. The current position of AMSC in the firm's holdings continues to reflect confidence in the company's potential, albeit with a more conservative exposure.

American Superconductor Corp's Business Overview

American Superconductor Corp, founded in 1991, operates within the energy sector, providing innovative technologies and solutions for cleaner and more efficient energy production and distribution. The company's business is divided into two main segments: Grid and Wind. The Grid segment, which generates the majority of the company's revenue, offers engineering services and grid systems that enhance network reliability and performance. The Wind segment enables manufacturers to launch wind turbines effectively.

Financial and Market Analysis of AMSC

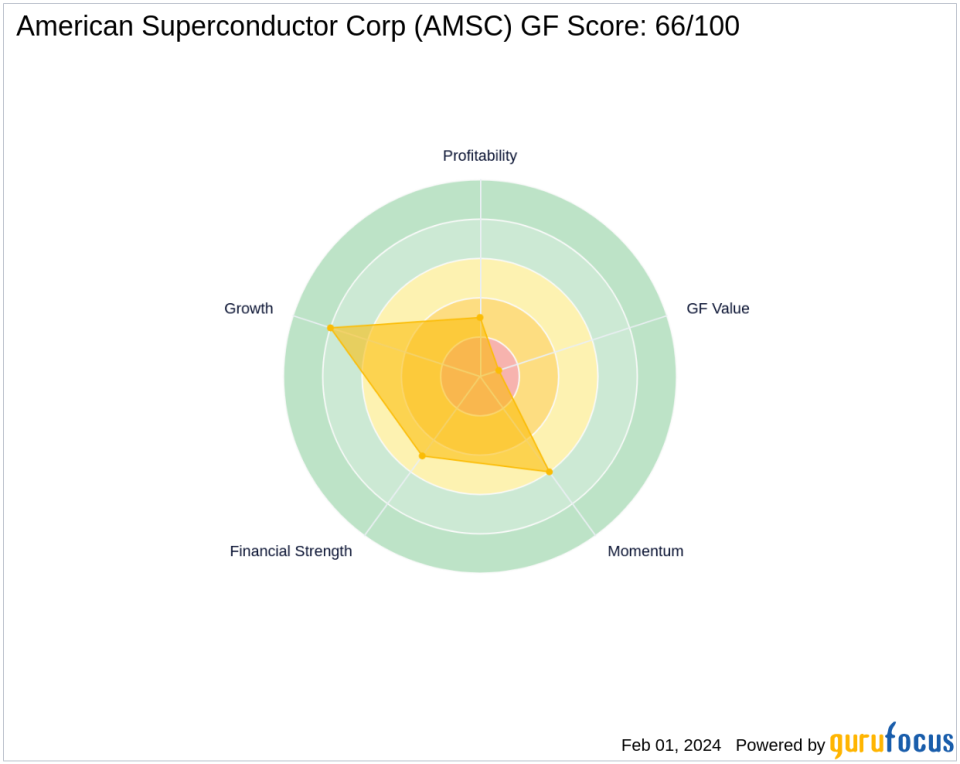

With a market capitalization of $338.407 million and a current stock price of $11.01, American Superconductor Corp is categorized as modestly overvalued according to the GF Value, which stands at $9.69. The stock's price-to-GF Value ratio is 1.14, and it has experienced a -1.17% price change since the transaction date. The company's GF Score is 66/100, indicating a potential for average performance in the future.

Comparative Metrics and Ranks

AMSC's performance metrics reveal a mixed picture. The company has a PE Ratio of 0.00, indicating it is currently not profitable. Its GF Score of 66 suggests average future performance potential. The company's Financial Strength and Profitability Ranks are 5/10 and 3/10, respectively, while its Growth Rank is a more robust 8/10. However, the GF Value Rank is low at 1/10, and the Momentum Rank stands at 6/10, reflecting moderate market momentum.

Industry and Market Trends

Within the Industrial Products industry, American Superconductor Corp is positioned to benefit from the growing demand for renewable energy solutions and efficient power grid technologies. Recent market trends towards sustainability and energy independence could positively influence the company's value and growth prospects.

Conclusion

The recent trade by Chuck Royce (Trades, Portfolio)'s firm, reducing its stake in American Superconductor Corp, aligns with its investment philosophy and portfolio management strategy. While the transaction was minor, it reflects the firm's ongoing assessment of AMSC's valuation and future potential. Value investors will continue to watch the firm's moves for insights into the evolving energy sector and the opportunities it presents.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.