Chuck Royce's Q2 2023 13F Filing Update: Top Trades and Portfolio Overview

Charles M. Royce, a pioneer of small-cap investing, recently filed his firm's 13F report for the second quarter of 2023. Royce, who has been the portfolio manager for Royce Pennsylvania Mutual Fund since 1972, is renowned for his investment philosophy that emphasizes long-term value. He holds a bachelor's degree from Brown University and a Master of Business Administration from Columbia University. His firm's portfolio for Q2 2023 contained 912 stocks with a total value of $10.30 billion.

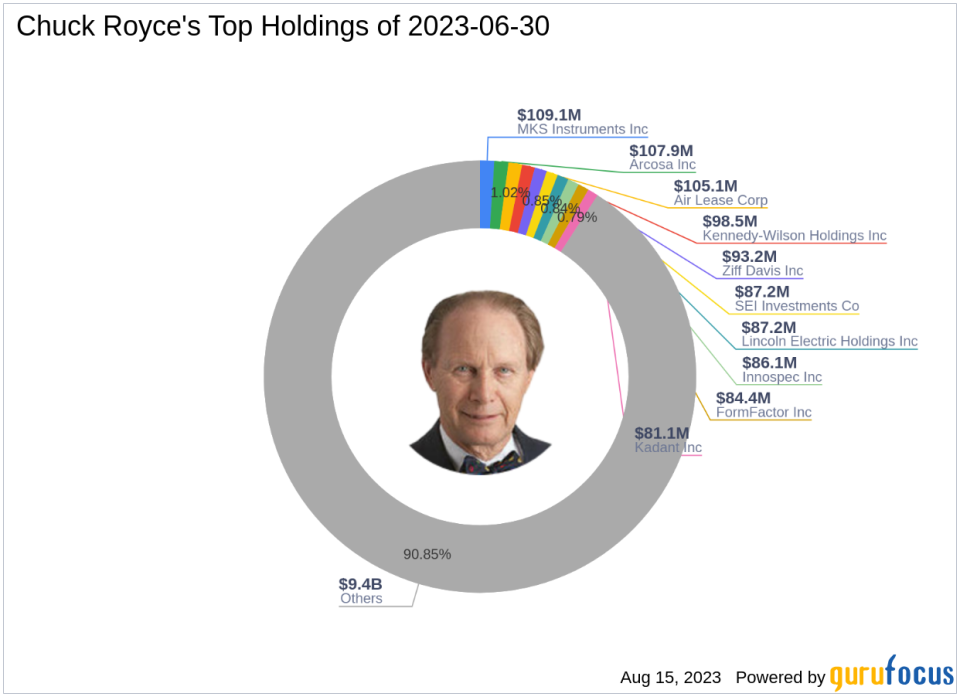

Top Holdings

The top holdings in Royce's portfolio were MKSI (1.06%), ACA (1.05%), and AL (1.02%).

Top Three Trades of the Quarter

The following were the firm's top three trades of the quarter:

Circor International Inc (NYSE:CIR)

Royce's firm sold out of their 1,361,240-share investment in Circor International Inc (NYSE:CIR), which previously held a weight of 0.42% in the portfolio. The shares traded for an average price of $34.98 during the quarter. As of August 15, 2023, CIR's price was $55.72 with a market cap of $1.14 billion. The stock has returned 181.98% over the past year. GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rating of 6 out of 10. In terms of valuation, CIR has a price-earnings ratio of 40.67, a price-book ratio of 7.42, a EV-to-Ebitda ratio of 10.67, and a price-sales ratio of 1.39.

First Citizens BancShares Inc (NASDAQ:FCNCA)

The firm reduced their investment in First Citizens BancShares Inc (NASDAQ:FCNCA) by 33,952 shares, impacting the equity portfolio by 0.33%. The stock traded for an average price of $1,153.86 during the quarter. As of August 15, 2023, FCNCA's price was $1,430.995 with a market cap of $20.62 billion. The stock has returned 66.98% over the past year. GuruFocus gives the company a financial strength rating of 3 out of 10 and a profitability rating of 6 out of 10. In terms of valuation, FCNCA has a price-earnings ratio of 1.95, a price-book ratio of 1.10, a price-earnings-to-growth (PEG) ratio of 0.12, and a price-sales ratio of 3.43.

Franchise Group Inc (NASDAQ:FRG)

Royce's firm reduced their investment in Franchise Group Inc (NASDAQ:FRG) by 1,084,831 shares, impacting the equity portfolio by 0.29%. The stock traded for an average price of $28.63 during the quarter. As of August 15, 2023, FRG's price was $29.865 with a market cap of $1.05 billion. The stock has returned -10.20% over the past year. GuruFocus gives the company a financial strength rating of 4 out of 10 and a profitability rating of 6 out of 10. In terms of valuation, FRG has a price-book ratio of 4.66, a EV-to-Ebitda ratio of 42.59, and a price-sales ratio of 0.25.

In conclusion, the Q2 2023 13F filing reveals significant moves by Chuck Royce (Trades, Portfolio)'s firm, reflecting their strategic investment decisions based on market conditions and company performance. These insights can provide valuable information for investors looking to understand market trends and investment strategies.

This article first appeared on GuruFocus.