Chuck Royce's Recent Reduction in Century Casinos Inc

Overview of Chuck Royce (Trades, Portfolio)'s Recent Stock Transaction

On December 31, 2023, the investment firm managed by Chuck Royce (Trades, Portfolio) executed a notable transaction involving Century Casinos Inc (NASDAQ:CNTY). The firm reduced its holdings in the company by 61,487 shares, which resulted in a -2.37% change in their position. Despite this reduction, the firm still holds a significant 2,527,441 shares in Century Casinos Inc. The trade was executed at a price of $4.88 per share, and as of the latest update, the position represents 0.13% of the firm's portfolio and 8.32% of the company's outstanding shares.

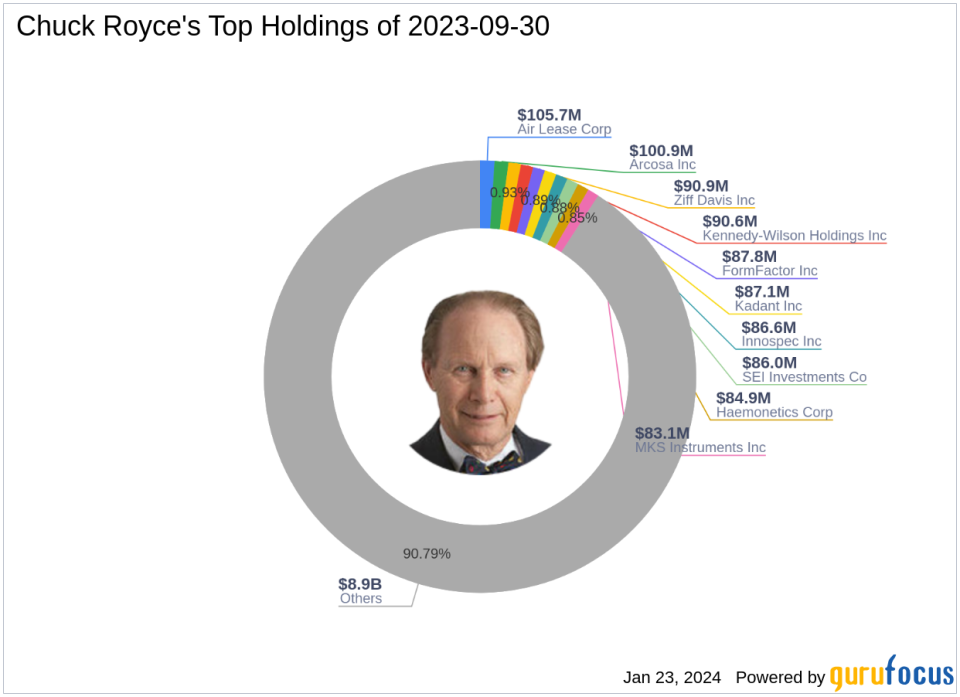

Profile of Chuck Royce (Trades, Portfolio)

Charles M. Royce, a renowned figure in the investment world, is celebrated for pioneering small-cap investing. Since 1972, Royce has been at the helm of the Royce Pennsylvania Mutual Fund, showcasing a remarkable tenure in portfolio management. The firm's investment philosophy is centered on identifying undervalued smaller companies, with a focus on strong balance sheets, a history of business success, and potential for future profitability. With a bachelor's degree from Brown University and an MBA from Columbia University, Royce's expertise is well-founded. The firm's top holdings include FormFactor Inc (NASDAQ:FORM), Ziff Davis Inc (NASDAQ:ZD), Air Lease Corp (NYSE:AL), Kennedy-Wilson Holdings Inc (NYSE:KW), and Arcosa Inc (NYSE:ACA), with an equity portfolio valued at $9.82 billion, predominantly in the Industrials and Technology sectors.

Century Casinos Inc Company Overview

Century Casinos Inc, with its stock symbol CNTY, is a casino entertainment company that has been operating since its IPO on October 11, 1977. The company is engaged in the development and operation of gaming establishments, along with related lodging, restaurant, horse racing, and entertainment facilities across North America and Poland. With a market capitalization of $113.85 million, Century Casinos Inc has a diverse portfolio of assets in the United States, Canada, and Poland. The company's segments include Food and Beverage, Gaming, Hotel, Other, Pari-mutuel, sports betting, and iGaming.

Analysis of the Trade Impact

The recent trade by Chuck Royce (Trades, Portfolio)'s firm had a reported impact of 0 on the portfolio, indicating that the transaction did not significantly alter the firm's investment stance in Century Casinos Inc. This could suggest a strategic adjustment rather than a shift in conviction about the company's prospects. The trade's price of $4.88 contrasts with the current stock price of $3.75, reflecting a -23.16% change since the transaction date.

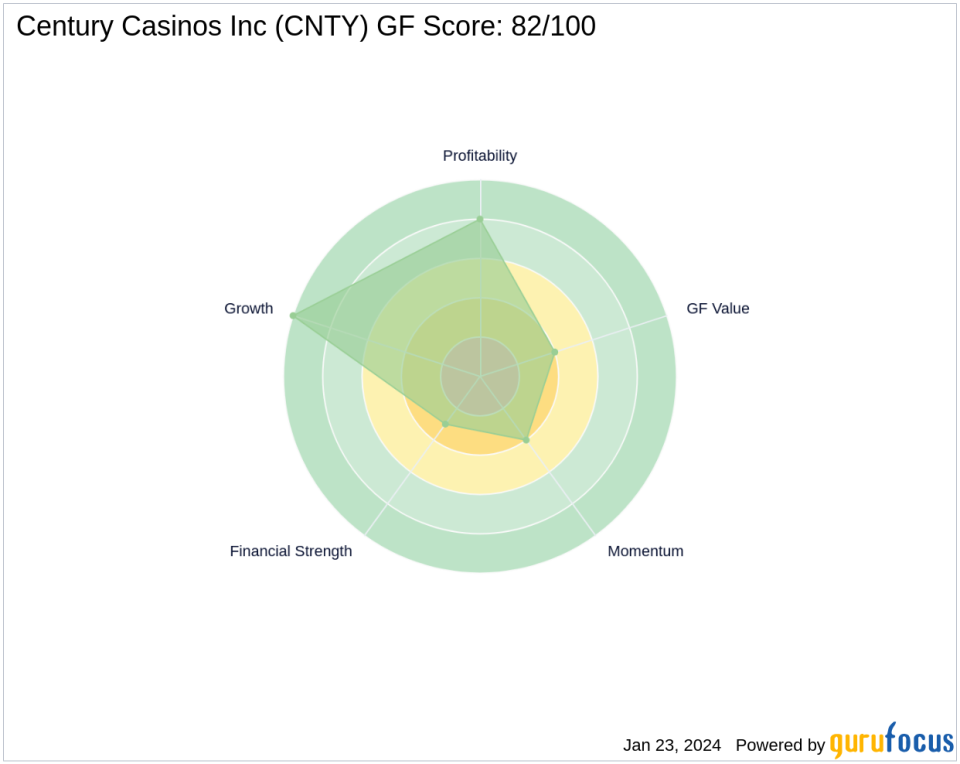

Financial Health and Stock Performance of Century Casinos Inc

Century Casinos Inc's financial health and stock performance present a mixed picture. The company's GF Score stands at 82/100, indicating good potential for outperformance. However, the stock's Financial Strength is rated 3/10, and its Profitability Rank is higher at 8/10. The Growth Rank is impressive at 10/10, but the GF Value Rank and Momentum Rank are both at 4/10. The Piotroski F-Score is low at 3, and the Altman Z-Score is at 0.75, which could raise concerns about financial stability. The stock's Cash to Debt ratio is 0.19, and the company's Operating Margin Growth is 20.40%. Despite these figures, the stock's performance since the trade and year-to-date has been negative, with a -23% YTD change.

GuruFocus Valuation and Rankings

The GF Value of Century Casinos Inc is $12.02, suggesting a possible value trap as the stock is currently trading at a price to GF Value ratio of 0.31. Investors are advised to think twice, given the stock's current valuation status. The company's financial rankings, such as the GF Score, Financial Strength, and Profitability Rank, provide a comprehensive view of its potential and areas of concern.

Sector and Market Considerations

Chuck Royce (Trades, Portfolio)'s firm has shown a preference for the Industrials and Technology sectors, and Century Casinos Inc, operating within the Travel & Leisure industry, represents a diversification into the entertainment and hospitality segment. The current state of the industry and market trends could influence the stock's performance, and investors should consider these factors when evaluating the company's prospects.

Conclusion and Summary of Key Points

In summary, Chuck Royce (Trades, Portfolio)'s recent reduction in Century Casinos Inc reflects a minor adjustment in the firm's portfolio. While the company's GF Score suggests good potential, the low GF Value Rank and challenging financial ratios warrant caution. The stock's performance since the trade and its year-to-date decline highlight the need for careful analysis before making investment decisions. Investors should consider the firm's investment philosophy, the company's financial health, and sector trends when assessing the outlook for Century Casinos Inc.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.