Chuck Royce's Strategic Reduction in Graham Corp Holdings

Transaction Overview

On December 31, 2023, the investment firm managed by Chuck Royce (Trades, Portfolio) executed a notable transaction involving the shares of Graham Corporation (NYSE:GHM). The firm reduced its stake in the company by 62,170 shares, which resulted in a 10.30% decrease in their holdings, leaving them with a total of 541,341 shares. This trade had a minor impact of -0.01% on the portfolio, with the shares being traded at a price of $18.97. The current position of Graham Corp in the firm's portfolio stands at 0.1%, with a significant ownership of 5.06% in the company.

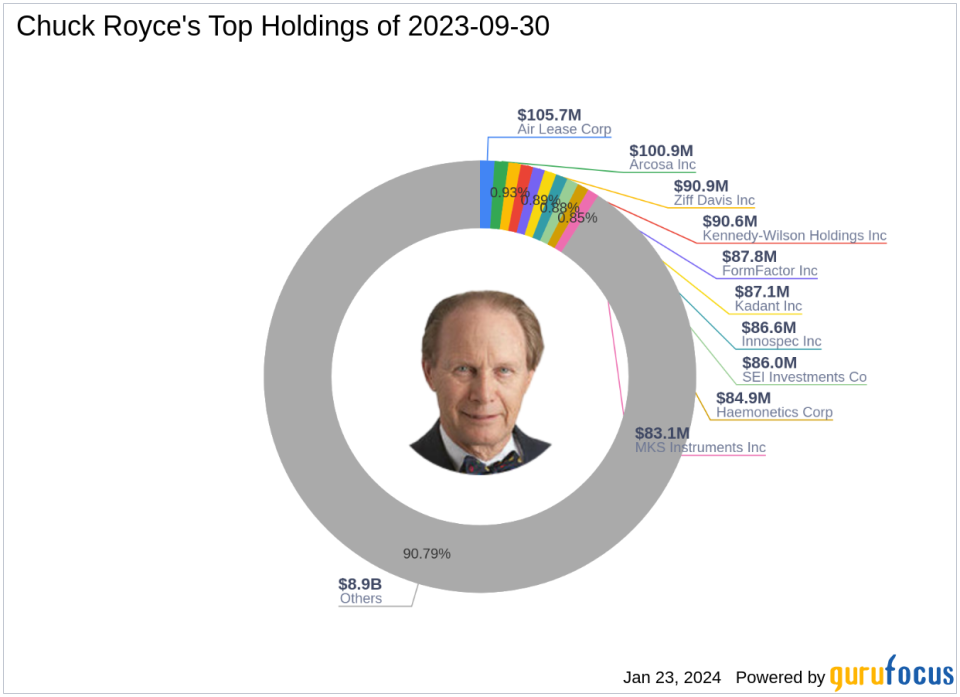

Chuck Royce (Trades, Portfolio)'s Investment Firm Profile

Charles M. Royce, a distinguished figure in the investment community, has been at the helm of Royce Pennsylvania Mutual Fund since 1972. The firm's investment philosophy is centered on small-cap companies, with a focus on those with market capitalizations up to $5 billion. The firm's approach is to identify undervalued stocks that have a strong balance sheet, a successful business track record, and potential for a profitable future. With an equity portfolio valued at $9.82 billion, the firm's top sectors include Industrials and Technology, with leading holdings in FormFactor Inc (NASDAQ:FORM), Ziff Davis Inc (NASDAQ:ZD), and others.

Graham Corporation at a Glance

Graham Corporation, with its stock symbol GHM, operates within the industrial products sector in the USA. Since its IPO on March 17, 1992, the company has specialized in manufacturing critical equipment for various industries, including energy, defense, and chemical/petrochemical. Graham Corp's market capitalization stands at $214.162 million, with a PE ratio of 74.11, indicating profitability concerns. The stock is currently priced at $20.01, modestly overvalued with a GF Value of $16.13 and a price to GF Value ratio of 1.24. The company's stock has seen a gain of 5.48% since the trade date and a year-to-date increase of 3.84%.

Impact of the Trade on Chuck Royce (Trades, Portfolio)'s Portfolio

The recent reduction in GHM shares by Chuck Royce (Trades, Portfolio)'s firm reflects a strategic move within the portfolio. The trade price of $18.97 is now below the current stock price of $20.01, suggesting a positive performance post-transaction. However, with the stock being assessed as modestly overvalued against the GF Value, the firm's decision to reduce its stake may align with its value investing principles.

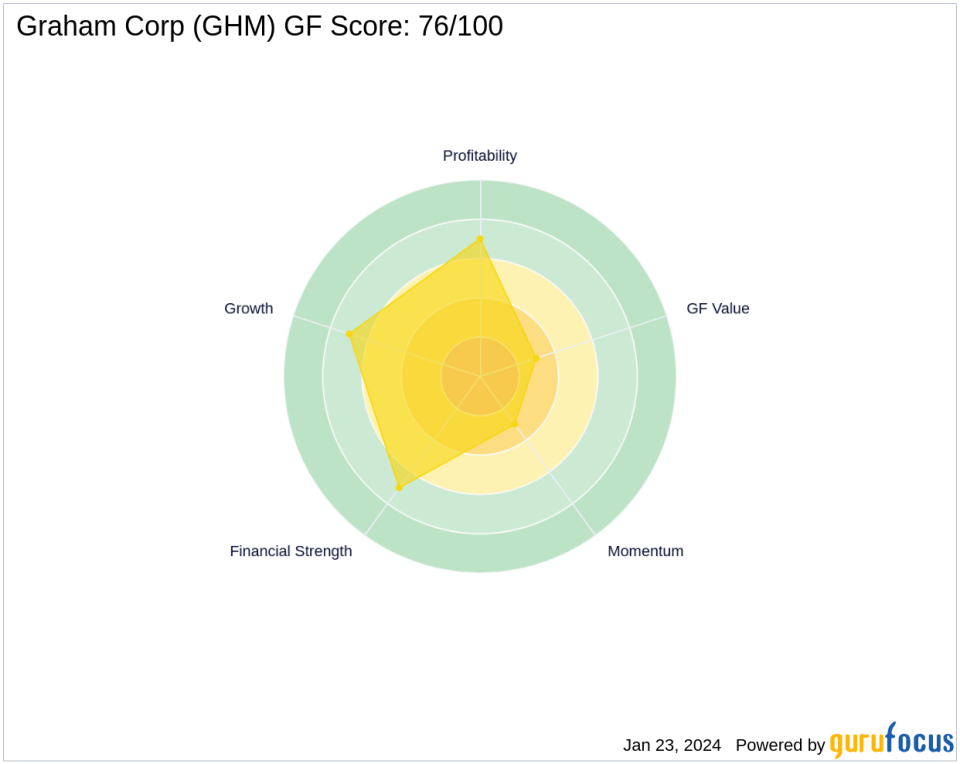

Financial Health and Market Position of Graham Corp

Graham Corp's financial health is solid, with a Financial Strength rank of 7/10 and a Profitability Rank of 7/10. The company's Growth Rank is also at 7/10, indicating a stable growth trajectory. However, the GF Value Rank and Momentum Rank are lower at 3/10, suggesting that the stock may not be as attractive from a valuation and momentum perspective.

Industrial Sector and Market Trends

The industrial products sector, where Graham Corp operates, is highly competitive and cyclical. The company's performance must be evaluated in the context of sector trends and overall market movements. Graham Corp's specific focus on critical equipment for energy, defense, and chemical/petrochemical industries positions it in a niche market with specialized demand.

Other Notable Investors in Graham Corp

Chuck Royce (Trades, Portfolio)'s firm is not the only notable investor in Graham Corp. Other gurus such as Mario Gabelli (Trades, Portfolio), First Eagle Investment (Trades, Portfolio), and Robert Olstein (Trades, Portfolio) also hold shares in the company. Brandes Investment is currently the largest guru shareholder, although the exact share percentage is not disclosed.

Conclusion

The recent trade action by Chuck Royce (Trades, Portfolio)'s firm in Graham Corp reflects a careful portfolio adjustment. While the firm has reduced its stake, the company's solid financial health and stable growth prospects may still make it an attractive investment for other value investors. The current valuation and future outlook of Graham Corp will continue to be closely monitored by market participants.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.