Chuck Royce's Strategic Reduction in Luna Innovations Inc Holdings

Overview of Chuck Royce (Trades, Portfolio)'s Recent Stock Transaction

On December 31, 2023, the investment firm managed by Chuck Royce (Trades, Portfolio) executed a notable transaction involving the shares of Luna Innovations Inc (NASDAQ:LUNA). The firm reduced its stake in the company by 316,807 shares, which represented a 17.22% change in its holdings. This adjustment brought the firm's total share count in Luna Innovations to 1,522,745, accounting for a 0.1% impact on the portfolio and leaving the firm with a 4.48% ownership in the traded stock. The shares were traded at a price of $6.65 each.

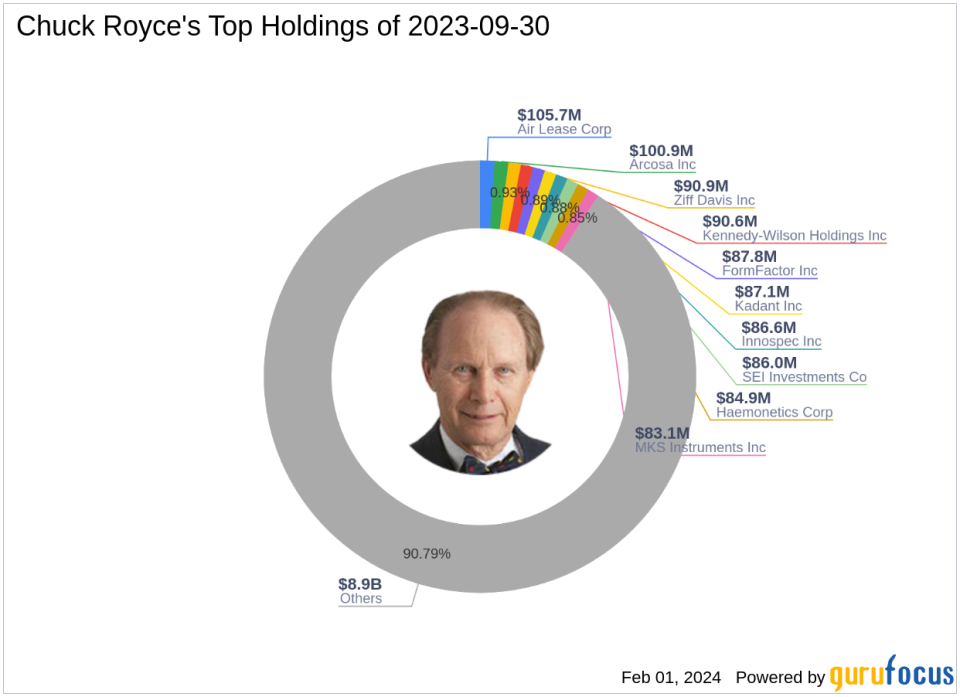

Profile of Chuck Royce (Trades, Portfolio)

Charles M. Royce, a renowned figure in the investment world, is celebrated for his pioneering work in small-cap investing. Since 1972, Royce has been at the helm of the Royce Pennsylvania Mutual Fund, showcasing his expertise and dedication to the field. A graduate of Brown University with an MBA from Columbia University, Royce's investment philosophy is deeply rooted in value investing. The firm's strategy focuses on identifying undervalued small-cap companies with strong balance sheets, a history of success, and promising futures. With a portfolio of 907 stocks and top holdings in sectors like Industrials and Technology, the firm manages an equity of $9.82 billion.

Details of Luna Innovations Inc

Luna Innovations Inc, based in the USA, has been a player in the optical technology industry since its IPO on June 2, 2006. The company specializes in fiber optic test, measurement, and control products for various industries, including telecommunications and photonics. Luna Innovations is also known for its distributed fiber optic sensing solutions, which are utilized in sectors such as aerospace, automotive, and infrastructure. With a market capitalization of $248.778 million and a stock price of $7.17, Luna Innovations is positioned within the Hardware industry. Despite a PE Ratio of 0.00 indicating a lack of profitability, the company is considered modestly undervalued with a GF Value of $9.95.

Analysis of the Trade Impact

The recent reduction in Luna Innovations shares by Chuck Royce (Trades, Portfolio)'s firm has a minimal direct impact on the portfolio, given the -0.02% trade impact. However, the decision to decrease the position could signal a strategic move by the firm, reflecting its assessment of the stock's future performance or a rebalancing of the portfolio. The trade was executed at a price point below the GF Value, suggesting a potential valuation consideration in the decision-making process.

Market Performance of Luna Innovations Inc

Since its IPO, Luna Innovations has seen a price change of 19.5%, with a year-to-date increase of 5.44%. Post-transaction, the stock has gained 7.82%, indicating positive market reception. The stock's current price to GF Value ratio stands at 0.72, further underscoring its modest undervaluation status.

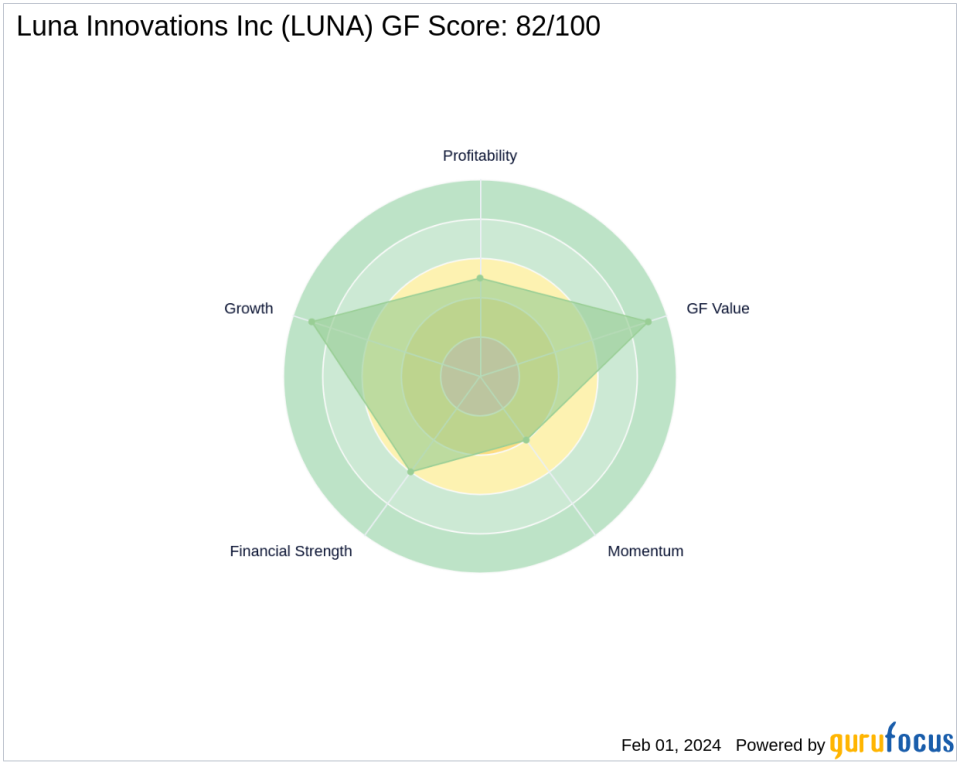

Financial Health and Growth Prospects of Luna Innovations Inc

Luna Innovations' financial health is reflected in its Financial Strength rank of 6/10 and a Profitability Rank of 5/10. The company's GF Score of 82/100 indicates good outperformance potential, supported by a high Growth Rank of 9/10 and a GF Value Rank of 9/10. However, the Momentum Rank of 4/10 suggests that the stock may not have strong short-term performance momentum.

Sector and Industry Context

Industrials and Technology sectors are prominent in Chuck Royce (Trades, Portfolio)'s portfolio, reflecting a strategic focus on these areas. Within the competitive landscape of the Hardware industry, Luna Innovations' unique offerings in fiber optic technology set it apart, potentially offering growth opportunities as industries increasingly rely on advanced sensing and measurement solutions.

Conclusion

In summary, Chuck Royce (Trades, Portfolio)'s recent reduction in Luna Innovations shares is a strategic move that aligns with the firm's value investing philosophy. While the transaction has a minor impact on the portfolio, it reflects a careful consideration of the company's valuation and growth prospects. Luna Innovations' financial health, growth potential, and positioning within the Hardware industry suggest that the firm's decision was made with a long-term perspective in mind, offering valuable insights for value investors monitoring Chuck Royce (Trades, Portfolio)'s investment moves.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.