Chuck Royce's Strategic Reduction in Resources Connection Inc

Chuck Royce (Trades, Portfolio), through Royce Pennsylvania Mutual Fund, has recently adjusted the firm's holdings in Resources Connection Inc (NASDAQ:RGP), signaling a strategic move in the portfolio. On December 31, 2023, the firm reduced its position in RGP by 386,922 shares, resulting in a 17.36% decrease in the held shares. This trade has had a minor impact of -0.06% on the overall portfolio, with the firm still holding 1,842,179 shares, which represents a 5.47% stake in the company. The transaction was executed at a price of $14.17 per share.

Chuck Royce (Trades, Portfolio)'s Investment Expertise

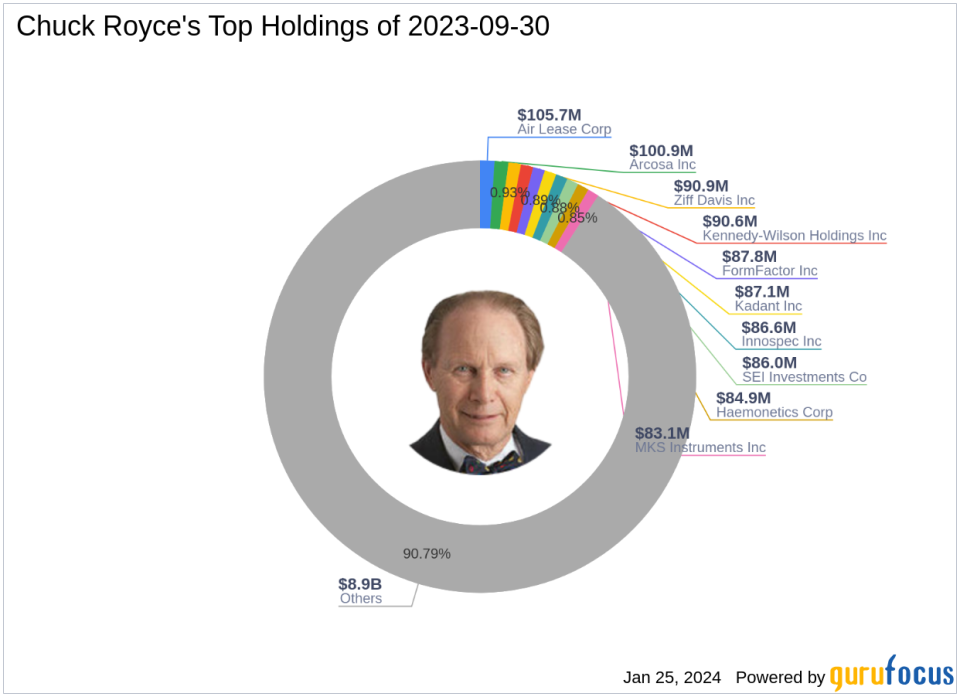

Charles M. Royce, a venerated figure in small-cap investing, has been at the helm of Royce Pennsylvania Mutual Fund since 1972. With a focus on companies with market capitalizations up to $5 billion, the firm's investment philosophy is grounded in identifying undervalued stocks with strong balance sheets, a history of success, and promising futures. Royce's portfolio, with 907 stocks, is heavily weighted in the Industrials and Technology sectors, with top holdings including FormFactor Inc (NASDAQ:FORM), Ziff Davis Inc (NASDAQ:ZD), and Air Lease Corp (NYSE:AL). The firm manages an equity portfolio valued at $9.82 billion, reflecting its significant influence in the market.

Resources Connection Inc at a Glance

Resources Connection Inc, operating primarily through its subsidiary Resources Global Professionals, offers a range of consulting and support services in various business sectors. With a market capitalization of $463.351 million and a PE ratio of 17.50, the company is positioned as a notable player in the business services industry. Despite a modest undervaluation with a GF Value of $15.35 and a price to GF Value ratio of 0.90, RGP's stock price has seen a slight decline of 2.41% since the trade, currently standing at $13.828.

Impact of Royce's Trade on Portfolio

The recent trade by Chuck Royce (Trades, Portfolio) reflects a calculated adjustment to the firm's investment in Resources Connection Inc. With a post-trade position of 0.27% in the portfolio, the firm maintains a significant interest in RGP, albeit slightly reduced. The timing of the trade, amidst RGP's current valuation and performance metrics, suggests a nuanced approach to portfolio management, balancing potential growth against market dynamics.

Resources Connection Inc's Market Dynamics

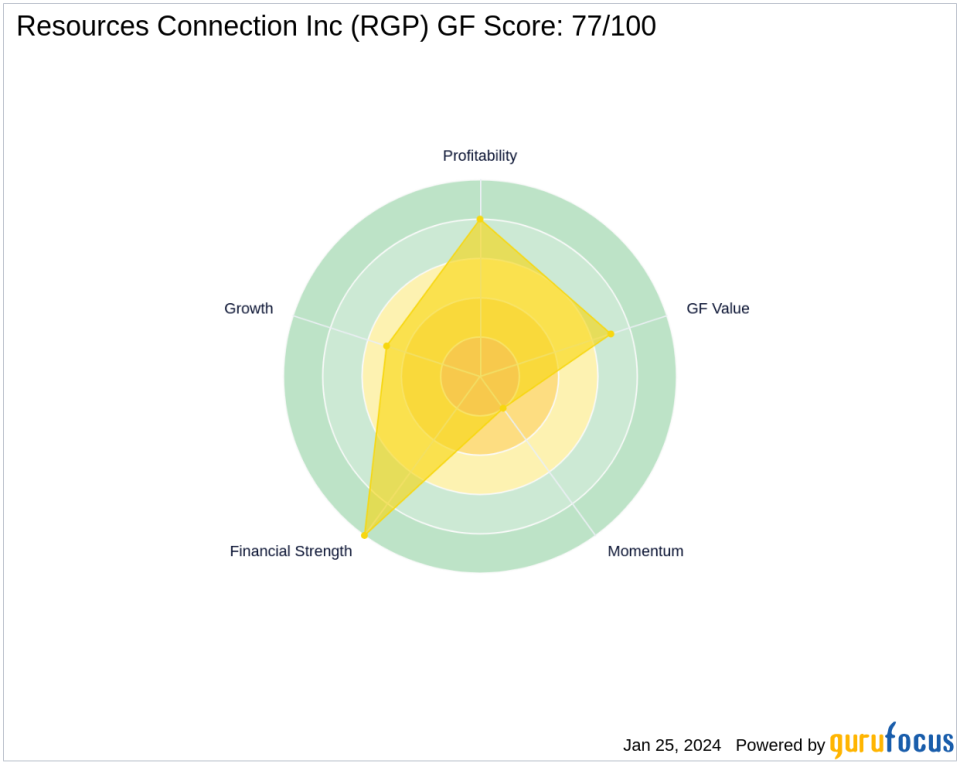

Resources Connection Inc's current market valuation is modestly undervalued according to the GF Score of 77/100, indicating a potential for outperformance. The company's financial strength is robust, with a Financial Strength rank of 10/10 and an interest coverage rank of 75. The Altman Z score of 4.63 further underscores the company's financial stability. However, the stock's Momentum Rank of 2/10 suggests a lack of short-term performance potential.

Industry Context and Other Investors

In the broader business services sector, Resources Connection Inc competes with a diverse range of firms. The industry is influenced by economic factors and evolving business needs, which can impact the performance of companies like RGP. Notably, other significant investors in RGP include Hotchkis & Wiley Capital Management LLC and Ken Fisher (Trades, Portfolio), each with their own investment strategies that may contrast with Chuck Royce (Trades, Portfolio)'s approach.

Concluding Insights

The recent reduction in Resources Connection Inc by Chuck Royce (Trades, Portfolio)'s firm is a strategic move that aligns with the firm's investment philosophy and market outlook. While the trade has had a minimal impact on the portfolio, it reflects the firm's ongoing assessment of RGP's valuation and performance within the business services industry. For value investors, this transaction underscores the importance of continuous portfolio evaluation and the potential benefits of a value-oriented investment approach.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.