Church & Dwight (CHD) Ups View on Q2 Earnings & Sales Beat

Church & Dwight Co., Inc. CHD posted strong second-quarter 2023 results, as both the top and bottom lines increased year over year and cruised past the Zacks Consensus Estimate. Strength in the company’s brands, robust consumption and pricing remained upsides. Church & Dwight also benefited from buyout gains.

Quarter in Detail

Church & Dwight posted adjusted earnings of 92 cents per share, beating the Zacks Consensus Estimate of 79 cents. The top line surged 21.1% year over year due to increased sales, a better-than-expected gross margin and a reduced tax rate.

Net sales of $1,454.2 million advanced 9.7% year over year and beat the Zacks Consensus Estimate of $1,424 million. Results continued to be driven by robust consumer demand for the company’s brands as well as enhanced case fill. Church & Dwight’s recent buyouts — THERABREATH mouthwash and the HERO brand — performed particularly well and witnessed robust consumption and market share gains.

Organic sales increased 5.4% compared with our estimate of 3.3% growth. Organic sales growth was backed by a favorable product mix and pricing to the tune of 5.8%, partly negated by lower volumes. The company’s U.S. portfolio saw consumption growth in 11 of 17 categories. Global online sales, as a percentage of total sales, increased to 18% in the second quarter compared with 16.3% in the preceding quarter.

The gross margin expanded 270 basis points (bps) to 43.9% on better pricing, productivity and gains from the Hero acquisition, which more than offset manufacturing cost inflation.

Marketing expenses increased by $29.3 million year over year to $132.2 million. As a percentage of sales, the figure rose 130 bps to 9.1%. Adjusted SG&A expenses, as a percentage of sales, increased 60 bps to 14.2% due to increased incentive compensations.

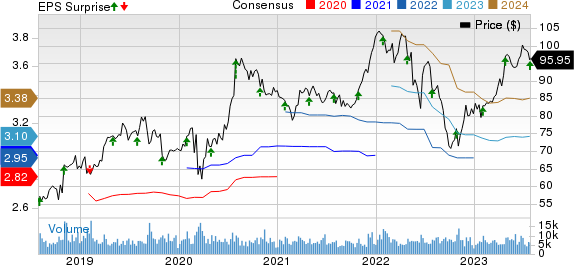

Church & Dwight Co., Inc. Price, Consensus and EPS Surprise

Church & Dwight Co., Inc. price-consensus-eps-surprise-chart | Church & Dwight Co., Inc. Quote

Segmental Details

Consumer Domestic: Net sales in the segment increased 12.3% to $1,128.2 million due to both household and personal care sales growth. Our estimate for segment sales for the second quarter stood at $1,079 million.

Organic sales increased 6.3% due to favorable pricing and product mix to the tune of 6.5%, partly hurt by a 0.2% decline in volumes. Organic sales growth was backed by strength in the THERABREATH mouthwash, ARM & HAMMER Liquid Detergent, ARM & HAMMER unit dose laundry detergent and ARM & HAMMER Cat Litter.

Consumer International: Net sales in the segment increased 4.9% to $241.9 million compared with our estimate of $241.7 million. Net sales were hurt by currency headwinds to the tune of 1.2%. Organic sales were up 6.1%, driven by favorable pricing and product mix of 5.5% and higher volumes to the tune of 0.6%. Organic sales growth was fueled by BATISTE, OXICLEAN, STERIMAR and WATERPIK.

Specialty Products: Sales in the segment dropped 6.5% to $84.1 million. Organic sales fell 6.5% due to soft volumes (down 4.2%) and a reduced price/mix (down 2.3%), mainly due to the dairy business as low-priced imports were back to the U.S. market.

Other Updates

CHD ended the quarter with cash on hand of $396.9 million and total debt of $2.4 billion. For the six months ended Jun 30, 2023, cash from operating activities was $509.2 million. Capital expenditures were $24.4 million in the same time frame.

The company expects about $250 million in capital expenditures for 2023. It still anticipates annual capital expenditures to return to nearly 2% of sales in 2025.

For 2023, Church & Dwight raised its expectation of cash flow from operations from $950 million to around $1 billion.

Guidance

Church & Dwight expects sales and gross margin strength to sustain in the second half of 2023. Constant brand investments, product innovation and successful execution are likely to drive results. Accordingly, the company has raised its full-year outlook for sales, gross margin, earnings per share (EPS) and cash flow. CHD expects to make considerable increases in marketing and SG&A investments.

For 2023, management expects reported sales growth of nearly 8%, up from the previous guidance of 6-7%. The company anticipates organic sales growth of roughly 5%, up from the previously guided range of 3-4%. Reported sales growth is likely to be about 6% in the second half of 2023.

Church & Dwight expects the 2023 reported gross margin to expand about 200 bps compared with the previous view of 120 bps. Management envisions favorable commodity costs, better productivity and solid growth from recent buyouts. The gross margin is also expected to benefit from pricing, pack size changes and laundry concentration. The gross profit is expected to grow at a double-digit rate in 2023.

The adjusted operating profit is expected to increase nearly 8% in 2023 compared with the previous guidance of 6-8%.

CHD anticipates a year-over-year adjusted EPS of $3.15, which implies growth of 6% from the year-ago period quarter. Earlier, management expected 2-4% growth in adjusted EPS. Management now expects adjusted EPS growth to be flat in the second half of 2023. Reported EPS is likely to be $3.03 in 2023.

Management expects to raise marketing as a percentage of sales to about 11% in 2023 (from 10.5% projected before). It also expects SG&A to increase from 2022 due to incentive compensations and growth-oriented investments. Other expenses for 2023 are expected to be approximately $100 million, and the tax rate is likely to be roughly 22%.

Q3 View

For the third quarter of 2023, Church & Dwight expects a roughly 8% increase in reported sales. Organic sales are estimated to rise nearly 4%. Management expects to witness gross margin expansion in the quarter, alongside expecting a significant rise in marketing and SG&A spending. It also expects a higher tax rate in the third quarter.

Consequently, management expects adjusted EPS of 66 cents, indicating a 13% drop from the year-ago quarter’s adjusted EPS. This is because investment spending is more skewed toward the third quarter. Reported EPS is likely to be 63 cents in the third quarter.

Shares of this Zacks Rank #2 (Buy) company have rallied 19.1% in the past six months compared with the industry’s 9.1% growth.

Other Solid Staple Stocks

Some other top-ranked consumer staple stocks are Energizer Holdings, Inc. ENR, TreeHouse Foods THS and Celsius Holdings CELH.

Energizer Holdings, which manufactures, markets and distributes household batteries, specialty batteries and lighting products, currently sports a Zacks Rank #1 (Strong Buy). ENR has a trailing four-quarter earnings surprise of 7.7%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Energizer Holdings’ current fiscal-year earnings suggests growth of about 2% from the year-ago reported numbers.

TreeHouse Foods, a food and beverage product company, currently sports a Zacks Rank #1. THS has a trailing four-quarter earnings surprise of 49.3%, on average.

The Zacks Consensus Estimate for TreeHouse Foods’ current fiscal-year earnings suggests growth of 120.1% from the year-ago reported figures.

Celsius Holdings, which offers functional drinks and liquid supplements, currently carries a Zacks Rank #2. CELH delivered an earnings surprise of 81.8% in the last reported quarter.

The Zacks Consensus Estimate for Celsius Holdings’ current fiscal-year sales and earnings suggests growth of 69.6% and 154.4%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Energizer Holdings, Inc. (ENR) : Free Stock Analysis Report

Church & Dwight Co., Inc. (CHD) : Free Stock Analysis Report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report