Church & Dwight (NYSE:CHD) Q4 Sales Beat Estimates

Household products company Church & Dwight (NYSE:CHD) announced better-than-expected results in Q4 FY2023, with revenue up 6.4% year on year to $1.53 billion. It made a non-GAAP profit of $0.65 per share, improving from its profit of $0.62 per share in the same quarter last year.

Is now the time to buy Church & Dwight? Find out by accessing our full research report, it's free.

Church & Dwight (CHD) Q4 FY2023 Highlights:

Revenue: $1.53 billion vs analyst estimates of $1.51 billion (1.1% beat)

EPS (non-GAAP): $0.65 vs analyst estimates of $0.65 (small beat)

EPS (non-GAAP) Guidance for Q1 2024 is $0.85 at the midpoint, below analyst estimates of $0.93, below analyst estimates of $0.93; full year 2024 guidance of $3.42, slightly above expectations of $3.41

Organic revenue growth guidance for 2024 of 4-5% year on year growth, above expectations of up 3.4%

Free Cash Flow of $133.5 million, down 41.3% from the previous quarter

Gross Margin (GAAP): 44.6%, up from 42% in the same quarter last year

Organic Revenue was up 5.3% year on year

Market Capitalization: $25.08 billion

Matthew Farrell, Chief Executive Officer, commented, “Our full year 2023 results illustrate the strength of our brands, innovative new products, and our focus on execution. We are exiting the year with strong momentum after posting two consecutive quarters of year-over-year volume growth. We expect volume to continue to drive growth into 2024. Our domestic brands grew consumption in 10 of 17 categories in 2023. We grew share on brands representing 60% of our sales. Global online sales accounted for 20% of total consumer sales in 2023, an increase of 26% compared to 2022.

Best known for its Arm & Hammer baking soda, Church & Dwight (NYSE:CHD) is a household and personal care products company with a vast portfolio that spans laundry detergent to toothbrushes to hair removal creams.

Household Products

Household products companies engage in the manufacturing, distribution, and sale of goods that maintain and enhance the home environment. This includes cleaning supplies, home improvement tools, kitchenware, small appliances, and home decor items. Companies within this sector must focus on product quality, innovation, and cost efficiency to remain competitive. Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options.

Sales Growth

Church & Dwight is larger than most consumer staples companies and benefits from economies of scale, giving it an edge over its smaller competitors.

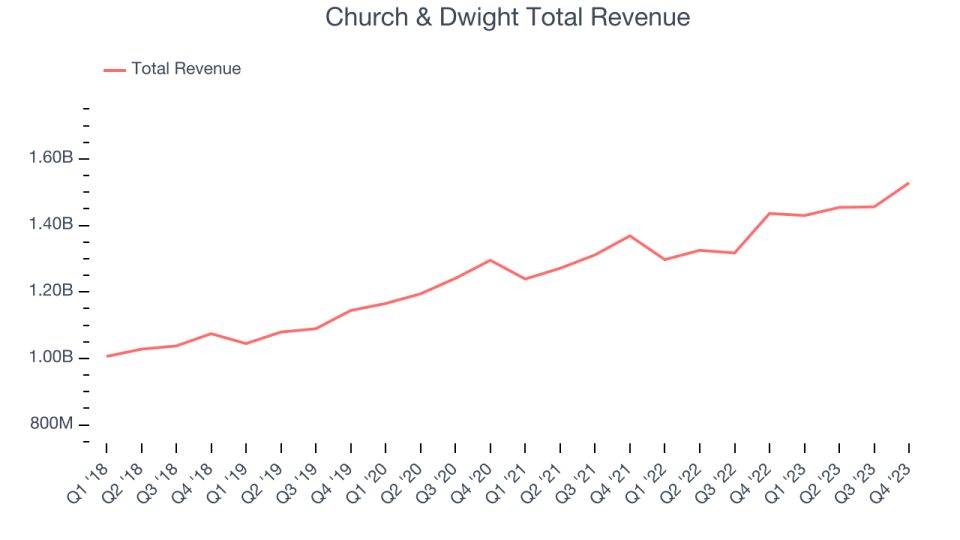

As you can see below, the company's annualized revenue growth rate of 6.2% over the last three years was mediocre for a consumer staples business.

This quarter, Church & Dwight reported solid year-on-year revenue growth of 6.4%, and its $1.53 billion in revenue outperformed Wall Street's estimates by 1.1%. Looking ahead, Wall Street expects sales to grow 3.3% over the next 12 months, a deceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Key Takeaways from Church & Dwight's Q4 Results

We were impressed by how nicely Church & Dwight beat analysts' organic revenue growth expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street's estimates. Organic revenue growth guidance for the full year 2024 was solid at 4-5%, above expectations of 3.4% year on year growth. On the other hand, operating margin missed. Also, its earnings forecast for next quarter was underwhelming, although full year EPS guidance was in line. Zooming out, we think this was still a decent, albeit mixed, quarter, showing that the company is staying on track. The stock is flat after reporting and currently trades at $100.78 per share.

So should you invest in Church & Dwight right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.