Churchill Downs's (NASDAQ:CHDN) Q4 Sales Beat Estimates, Stock Soars

Racing, gaming, and entertainment company Churchill Downs (NASDAQ:CHDN) announced better-than-expected results in Q4 FY2023, with revenue up 16.9% year on year to $561.2 million. It made a non-GAAP profit of $0.86 per share, improving from its profit of $0.73 per share in the same quarter last year.

Is now the time to buy Churchill Downs? Find out by accessing our full research report, it's free.

Churchill Downs (CHDN) Q4 FY2023 Highlights:

Revenue: $561.2 million vs analyst estimates of $553 million (1.5% beat)

EPS (non-GAAP): $0.86 vs analyst estimates of $0.78 (10.1% beat)

Free Cash Flow was -$124.3 million compared to -$48.63 million in the previous quarter

Gross Margin (GAAP): 28.7%, up from 27.3% in the same quarter last year

Market Capitalization: $8.67 billion

Famous for hosting the Kentucky Derby, Churchill Downs (NASDAQ:CHDN) operates a horse racing, online wagering, and gaming entertainment business in the United States.

Casinos and Gaming

Casino and gaming companies that offer slot machines, Texas Hold ‘Em, Blackjack and the like can enjoy limited competition because gambling is a highly regulated industry. These companies can also enjoy healthy margins and profits-have you ever heard the phrase ‘the house always wins’? Regulation cuts both ways, however, and casino and gaming companies may face stroke-of-the-pen risk that suddenly limits what they do or where they can do it. Furthermore, digitization is changing the game, pun intended. Whether it’s online poker or sports betting on your smartphone, innovation is forcing casino and gaming companies to adapt to keep up with changing consumer preferences such as being able to wager anywhere on demand.

Sales Growth

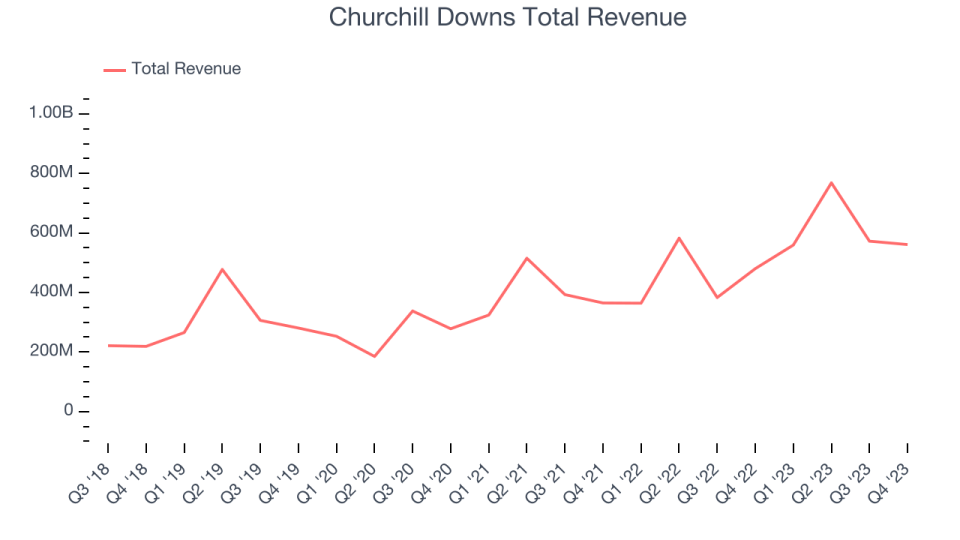

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. Churchill Downs's annualized revenue growth rate of 19.5% over the last five years was impressive for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Churchill Downs's healthy annualized revenue growth of 24.1% over the last two years is above its five-year trend, suggesting its brand resonates with consumers.

We can dig even further into the company's revenue dynamics by analyzing its most important segments, Racing and Gaming, which are 41.9% and 41% of revenue. Over the last two years, Churchill Downs's Racing revenue (live and historical) averaged 70.4% year-on-year growth while its Gaming revenue (casino games) averaged 19.3% growth.

This quarter, Churchill Downs reported robust year-on-year revenue growth of 16.9%, and its $561.2 million of revenue exceeded Wall Street's estimates by 1.5%. Looking ahead, Wall Street expects sales to grow 11.3% over the next 12 months, a deceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

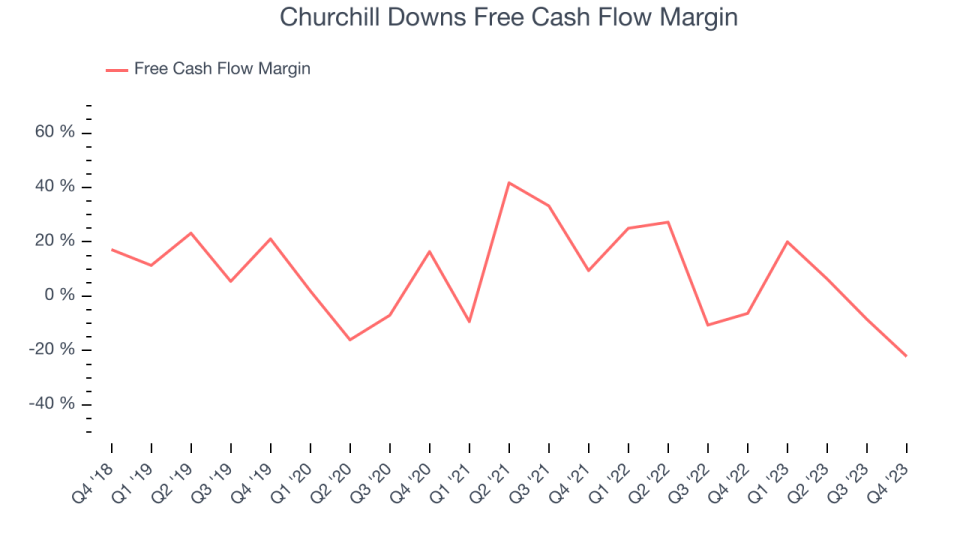

Over the last two years, Churchill Downs has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 3.9%, subpar for a consumer discretionary business.

Churchill Downs burned through $124.3 million of cash in Q4, equivalent to a negative 22.1% margin, reducing its cash burn by 310% year on year. Over the next year, analysts predict Churchill Downs will reach cash profitability. Their consensus estimates imply its LTM free cash flow margin of negative 0.5% will increase to positive 6.5%.

Key Takeaways from Churchill Downs's Q4 Results

It was good to see Churchill Downs beat analysts' revenue and EPS expectations this quarter. The 'Live and Historical Racing' and 'Gaming' segments showed solid performance that individually beat Wall Street's Consensus estimates. No guidance was given in the earnings release. Overall, this was a healthy quarter for the company. The stock is up 5.3% after reporting and currently trades at $123.57 per share.

So should you invest in Churchill Downs right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.