Chuy's Holdings Inc (CHUY) Reports Strong Earnings Growth and Margin Expansion in Q4 and Fiscal ...

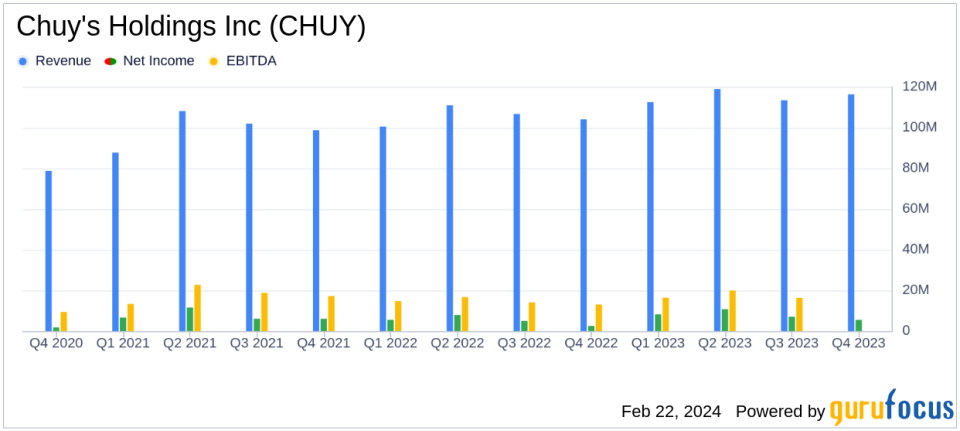

Revenue Growth: Q4 revenue increased by 11.8% to $116.3 million, and fiscal year revenue rose by 9.3% to $461.3 million.

Net Income: Q4 net income soared by 121.2% to $5.5 million, while fiscal year net income jumped by 51.1% to $31.5 million.

Earnings Per Share (EPS): Q4 EPS climbed to $0.31, up from $0.14 in the prior year; fiscal year EPS reached $1.76, up from $1.11.

Comparable Restaurant Sales: Q4 saw a modest increase of 0.3%, with the fiscal year showing a stronger 3.3% rise.

Operating Margin: Restaurant-level operating margin improved by 300 basis points to 20.0% in Q4 and by 200 basis points to 20.2% for the fiscal year.

Balance Sheet Strength: Chuy's ended the year with $67.8 million in cash and no debt, with an additional $25.0 million available under its credit facility.

Share Repurchase: The company repurchased approximately $28.9 million of its stock during the fiscal year.

On February 22, 2024, Chuy's Holdings Inc (NASDAQ:CHUY) released its 8-K filing, announcing financial results for the 14-week fourth quarter and the 53-week fiscal year ended December 31, 2023. The company, known for its authentic, freshly prepared Mexican and Tex-Mex inspired food, reported significant growth in revenue and net income, alongside a substantial increase in restaurant-level operating margins.

Financial Performance Highlights

Chuy's Holdings Inc (NASDAQ:CHUY) experienced robust growth in the fourth quarter, with revenue rising to $116.3 million, an 11.8% increase from the previous year. This growth was partly attributed to an extra operating week, which contributed approximately $8.7 million in revenue. For the full fiscal year, revenue increased by 9.3% to $461.3 million. The company's net income saw an impressive leap, with a 121.2% increase to $5.5 million in Q4 and a 51.1% increase to $31.5 million for the fiscal year. Earnings per share followed suit, with Q4 EPS at $0.31, up from $0.14, and fiscal year EPS at $1.76, up from $1.11.

Operational Efficiency and Margin Expansion

Chuy's reported a modest 0.3% increase in comparable restaurant sales for the fourth quarter, while the fiscal year saw a more substantial 3.3% rise. The company's restaurant-level operating margin, a key profitability metric, expanded by 300 basis points to 20.0% in Q4 and by 200 basis points to 20.2% for the fiscal year, marking the best result in over a decade.

President and CEO Steve Hislop expressed pride in the team's accomplishments, highlighting the effective execution that led to margin expansion and the company's commitment to providing value to customers. Hislop also noted the successful opening of a new restaurant in the fourth quarter and the company's plans to open 6 to 8 new restaurants in 2024, focusing on core markets with high average unit volumes (AUVs) and brand awareness.

We have a long runway ahead of us and are excited by the opportunity to grow the Chuys brand and maximizing shareholder value in 2024 and beyond," said Hislop.

Balance Sheet and Share Repurchase Program

Chuy's ended the year in a strong financial position, with $67.8 million in cash and no debt, and an additional $25.0 million available under its revolving credit facility. The company also returned significant capital to shareholders, repurchasing approximately $28.9 million of its common stock during the fiscal year.

Looking Forward

The company provided an outlook for 2024, expecting adjusted net income per diluted share of $1.82 to $1.87. This guidance is based on assumptions including general and administrative expenses of $30.0 to $31.0 million, six to eight new restaurant openings, net capital expenditures of approximately $41 to $46 million, and an effective annual tax rate of 13% to 14%.

Chuy's Holdings Inc (NASDAQ:CHUY) continues to demonstrate strong financial health and operational efficiency, positioning itself for sustained growth and shareholder value creation in the upcoming year.

For more detailed information on Chuy's Holdings Inc's financial results, please refer to the full 8-K filing.

Investors interested in the latest financial trends and insights are encouraged to visit GuruFocus.com for comprehensive analysis and expert commentary.

Explore the complete 8-K earnings release (here) from Chuy's Holdings Inc for further details.

This article first appeared on GuruFocus.