Ciena (CIEN) & Flex Partner for Pluggable OLT Manufacturing

Ciena CIEN announced that it had extended its agreement with Flex (FLEX) to begin producing cutting-edge pluggable optical line terminals (OLTs) and optical network units (ONUs) at a Flex factory in the United States by mid-2024.

The move aligns with Ciena's commitment to expand high-speed Internet access, generate jobs, and assist broadband providers in meeting national requirements. Flex will provide advanced manufacturing capabilities, allowing Ciena to produce these innovative devices efficiently and support the Broadband Equity Adoption and Deployment initiatives.

The partnership also enhances the capabilities of U.S. network providers to grow their local presence. Ciena's pluggable OLTs are an integral part of a comprehensive broadband portfolio that includes middle-mile networks, access infrastructure, and critical software and services.

Ciena Corporation Price and Consensus

Ciena Corporation price-consensus-chart | Ciena Corporation Quote

Furthermore, Ciena's host routing systems are developed per 25G, which will improve service provider network investments without requiring hardware change and enhance the sustainability of the solutions. Additionally, Ciena plans to develop its next-generation 25GS-PON pluggable OLTs and ONUs in the United States to create open, modular, and scalable broadband networks.

Ciena is a well-known provider of optical networking equipment, software and services. Increasing cloud adoption, rising demand for higher capacity and bandwidth, and proliferation of edge applications drive demand for Ciena’s diversified product portfolio.

Fiber Deep technology represents a significant opportunity for the company driven by the strong adoption of its products among all major cable operators in the global market. The company expects its total addressable market to grow from $13 billion in 2020 to more than $22 billion over the next several years.

In September, the company announced its collaboration with Virgin Media Ireland to facilitate a three-year transition toward a complete fiber network and a shift from traditional cable services to fully automated and high-speed fiber broadband services.

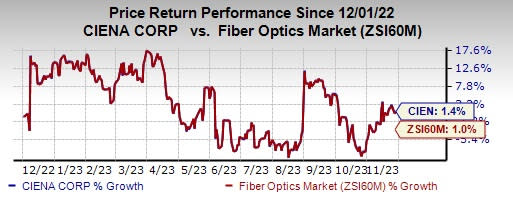

CIEN currently carries a Zacks Rank #3 (Hold). Shares of the company have gained 1.4% compared with the sub-industry’s growth of 1% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the broader technology space are Pegasystems PEGA, Flex FLEX and Watts Water Technologies WTS. Pegasystems and Flex presently sport a Zacks Rank #1 (Strong Buy), whereas Watts Water Technologies carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Pegasystems’ 2023 EPS has improved 21.2% in the past 60 days to $1.77. PEGA delivered an average earnings surprise of 1,250.2% in the trailing four quarters. Shares of PEGA have jumped 45% in the past year.

The Zacks Consensus Estimate for Flex’s fiscal 2024 EPS has increased 3.6% in the past 60 days to $2.56. Flex’s long-term earnings growth rate is 12.4%.

Flex’s earnings outpaced the Zacks Consensus Estimate in each of the last four quarters, the average earnings surprise being 11%. Shares of the company have risen 28.3% in the past year.

The Zacks Consensus Estimate for Watts Water Technologies 2023 EPS has improved 2.8% in the past 60 days to $8.00. Watts Water’s long-term earnings growth rate is 7.8%.

WTS’ earnings outpaced the Zacks Consensus Estimate in each of the last four quarters, the average earnings surprise being 11.8%. Shares of WTS have rallied 28.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ciena Corporation (CIEN) : Free Stock Analysis Report

Flex Ltd. (FLEX) : Free Stock Analysis Report

Watts Water Technologies, Inc. (WTS) : Free Stock Analysis Report

Pegasystems Inc. (PEGA) : Free Stock Analysis Report