Ciena Corp (CIEN) Reports Mixed Fiscal Q1 2024 Results Amid Inventory Challenges

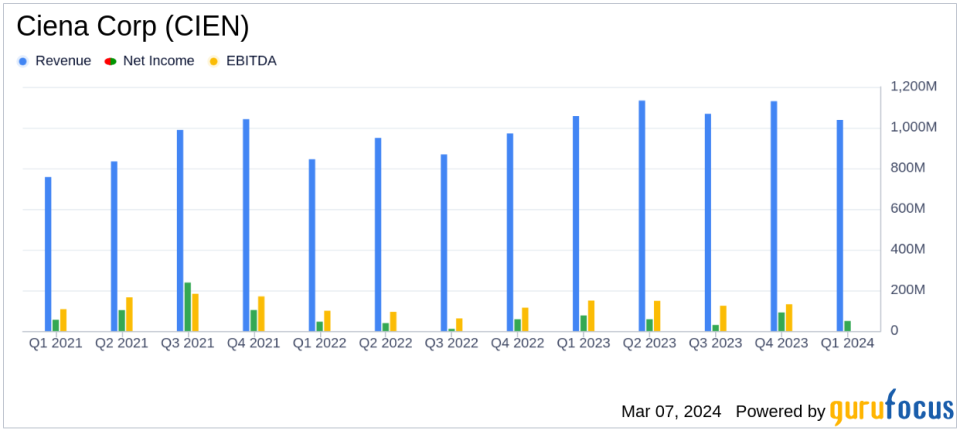

Revenue: Q1 revenue declined slightly to $1.04 billion from $1.06 billion year-over-year.

Net Income: GAAP net income was $49.5 million ($0.34 per share), down from $76.2 million ($0.51 per share) in Q1 2023.

Adjusted Net Income: Non-GAAP adjusted net income increased marginally to $96.8 million ($0.66 per share) from $95.6 million ($0.64 per share).

Gross Margin: GAAP gross margin improved to 45.0% from 43.2%, and non-GAAP adjusted gross margin increased to 45.7% from 43.7%.

Operating Margin: GAAP operating margin remained stable at 8.2%, while non-GAAP adjusted operating margin rose to 13.2% from 12.6%.

Cash Flow: Cash flow from operations was robust at $266.1 million.

Share Repurchases: Ciena repurchased approximately 691 thousand shares for $32.0 million during the quarter.

On March 7, 2024, Ciena Corp (NYSE:CIEN), a leading network systems, services, and software company, released its 8-K filing, detailing the financial results for its fiscal first quarter ended January 27, 2024. The company, which serves a global clientele with a focus on the Americas, reported a slight year-over-year decline in revenue but demonstrated improved profitability metrics.

Ciena Corp operates through segments including Networking Platforms; Platform Software and Services; Blue Planet Automation Software, and Global Services. The company's broad geographic footprint spans the United States, Canada, the Caribbean, Latin America, Europe, the Middle East, Africa, the Asia Pacific, Japan, and India, with the Americas being its largest market.

Financial Performance and Challenges

The company's revenue for the quarter was $1.04 billion, a slight decrease from $1.06 billion in the same period last year. This dip in revenue is attributed to service providers working through high levels of inventory, which has taken longer than expected, according to Gary Smith, president and CEO of Ciena. Despite this challenge, the company's profitability metrics, such as gross margin and operating margin, have seen improvements. GAAP gross margin increased to 45.0% from 43.2%, while non-GAAP adjusted gross margin rose to 45.7% from 43.7%. Operating margins also showed positive movement, with GAAP operating margin holding steady at 8.2% and non-GAAP adjusted operating margin increasing to 13.2% from 12.6%.

These profitability improvements are significant for Ciena and the hardware industry because they reflect the company's ability to manage costs and improve efficiency in delivering its products and services. In an industry where margins can be thin, any improvement can have a substantial impact on the bottom line.

Key Financial Metrics

The company's net income on a GAAP basis was $49.5 million, or $0.34 per diluted share, compared to $76.2 million, or $0.51 per diluted share, in the first quarter of fiscal 2023. On a non-GAAP adjusted basis, net income for the quarter was slightly higher at $96.8 million, or $0.66 per diluted share, compared to $95.6 million, or $0.64 per diluted share, in the prior year. The company also reported strong cash flow from operations totaling $266.1 million and ended the quarter with $1.48 billion in cash and investments.

These financial metrics are important as they provide insights into the company's profitability, liquidity, and overall financial health. Strong cash flow from operations, in particular, is crucial for Ciena's ability to invest in research and development, fund acquisitions, and return value to shareholders through share repurchases.

"We delivered solid fiscal first quarter results, including strong profitability, as we continue to expand our relationships and gain share with cloud providers," said Gary Smith, president and CEO of Ciena. "While we remain very confident in the strength and durability of bandwidth demand as a long-term driver of our business, it is taking longer than expected for service providers to work through high levels of inventory."

Analysis of Company's Performance

Ciena's mixed fiscal Q1 results reflect a resilient business model capable of improving profitability despite a slight revenue setback. The company's strategic focus on cloud providers and confidence in the long-term demand for bandwidth suggest a positive outlook, even as it navigates short-term inventory challenges. The share repurchase activity also signals management's belief in the company's intrinsic value and commitment to shareholder returns.

For value investors, Ciena's ability to maintain and improve margins, coupled with a strong cash position, may present a compelling investment opportunity. The company's performance in the face of industry-wide challenges underscores its operational strength and potential for long-term growth.

For more detailed financial analysis and up-to-date information on Ciena Corp (NYSE:CIEN) and other investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Ciena Corp for further details.

This article first appeared on GuruFocus.