CIFI Holdings (Group) And Other Top Growth Stocks

Want to add more growth to your portfolio but not sure where to look? Companies such as CIFI Holdings (Group) and Xin Point Holdings are deemed high-growth by the market, with a positive outlook in all areas – returns, profitability and cash flows. If a buoyant growth prospect is what you’re after in your next investment, I’ve put together a list of high-growth stocks you may be interested in, based on the latest financial data from each company.

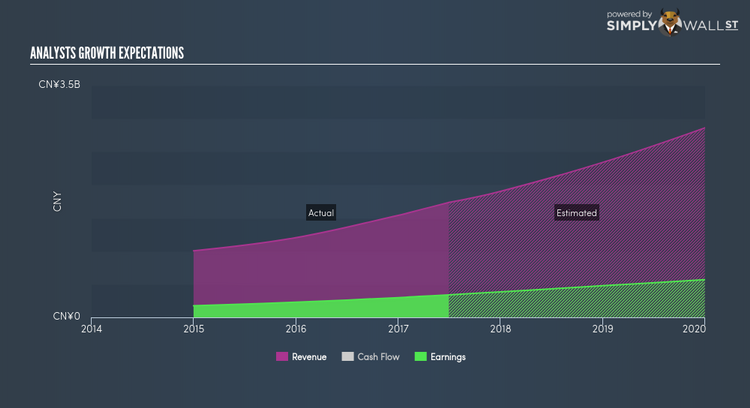

CIFI Holdings (Group) Co. Ltd. (SEHK:884)

CIFI Holdings (Group) Co. Ltd., an investment holding company, invests in, develops, and manages properties in the People’s Republic of China. Founded in 2000, and currently lead by Feng Lin, the company employs 6,900 people and with the stock’s market cap sitting at HKD HK$52.91B, it comes under the large-cap group.

884’s projected future profit growth is a robust 23.67%, with an underlying 70.09% growth from its revenues expected over the upcoming years. An affirming signal is when net income increase is supported by top-line growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 23.43%. 884’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Could this stock be your next pick? Check out its fundamental factors here.

Xin Point Holdings Limited (SEHK:1571)

Xin Point Holdings Limited manufactures, sells, and supplies automotive plastic electroplated components in the People’s Republic of China, North America, Europe, and internationally. Established in 2002, and now led by CEO Xiaoming Ma, the company size now stands at 4,448 people and with the company’s market cap sitting at HKD HK$6.44B, it falls under the mid-cap stocks category.

Extreme optimism for 1571, as market analysts projected an outstanding earnings growth rate of 20.78% for the stock, supported by a double-digit sales growth of 49.79%. It appears that 1571’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 23.28%. 1571’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. Thinking of investing in 1571? Have a browse through its key fundamentals here.

Greentown Service Group Co. Ltd. (SEHK:2869)

Greentown Service Group Co. Ltd. provides residential property management services in the People’s Republic of China. Started in 1998, and now led by CEO Zhangfa Yang, the company size now stands at 20,283 people and has a market cap of HKD HK$16.75B, putting it in the large-cap category.

2869’s projected future profit growth is a robust 29.29%, with an underlying 67.65% growth from its revenues expected over the upcoming years. It appears that 2869’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 25.76%. 2869’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. A potential addition to your portfolio? I recommend researching its fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.