Cigna (CI) Q3 Earnings Beat on Membership Growth, '23 EPS View Up

The Cigna Group CI reported third-quarter 2023 adjusted earnings of $6.77 per share, which beat the Zacks Consensus Estimate by 1.7%. The bottom line improved 11.9% year over year.

Adjusted revenues of $49.1 billion advanced 8% year over year in the quarter under review on the back of solid contributions from Evernorth Health Services and Cigna Healthcare businesses. The top line outpaced the consensus mark by 2.3%.

However, the upside was partly offset by an elevated expense level resulting from higher pharmacy and other service costs, medical costs and other benefit expenses, and selling, general and administrative expenses.

CI’s medical customer base was 19.6 million as of Sep 30, 2023, which witnessed a 9% year-over-year increase and came higher than the Zacks Consensus Estimate of 19.5 million as well as our estimate of 19.4 million. Membership grew as a result of an increase in U.S. Commercial fee-based and Medicare Advantage customers.

Total benefits and expenses of $46.8 billion increased 9% year over year in the third quarter, higher than our estimate of $45.4 billion. The adjusted selling, general and administrative (SG&A) expense ratio deteriorated 40 basis points (bps) year over year to 7.3%.

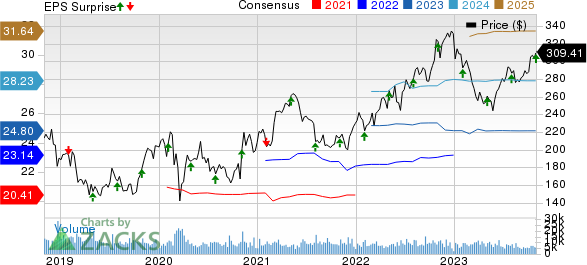

The Cigna Group Price, Consensus and EPS Surprise

The Cigna Group price-consensus-eps-surprise-chart | The Cigna Group Quote

Segmental Update

Evernorth Health Services: The segment generated adjusted revenues of $38.6 billion, which advanced 8% year over year and beat the Zacks Consensus Estimate of $38.4 billion and our estimate of $37.3 billion. Solid organic growth in specialty and, care delivery and management solutions benefited the unit’s quarterly results.

Adjusted operating income on a pretax basis rose 6% year over year to $1,716 million in the third quarter, attributable to specialty strength and consistent affordability improvements. However, the metric fell short of the consensus mark of $1,733 million and our estimate of $1,738.7 million. Adjusted pre-tax margin of 4.4% deteriorated 20 bps year over year.

Cigna Healthcare: The segment’s adjusted revenues climbed 14% year over year to $12.8 billion, aided by an expanding medical customer base and premium rate increases. The metric surpassed the Zacks Consensus Estimate of $12.3 billion and our estimate of $12.2 billion.

Pre-tax adjusted operating income of $1,222 million improved 16% year over year in the quarter under review and beat the consensus mark of $1,160 million and our estimate of $1,093.7 million. The year-over-year growth resulted from improved net investment income and lower U.S. Commercial medical care ratio (MCR).

The segment’s MCR improved 30 bps year over year to 80.5% at the third-quarter end, which came lower than the consensus mark of 82% and our estimate of 81.7%.

Financial Position (as of Sep 30, 2023)

Cigna exited the third quarter with cash and cash equivalents of $8,497 million, which surged 43.4% from the figure at 2022 end. Total assets of $149.6 billion increased 4% from the 2022-end level.

Long-term debt amounted to $28.1 billion, which declined marginally from the figure as of Dec 31, 2022. Short-term debt totaled $3,046 million.

Shareholders’ equity grew 2.3% from the 2022-end level to $45.7 billion.

CI generated cash flow from operations of $10.3 billion in the first nine months of 2023, which soared 57.8% from the prior-year comparable period.

Debt-to-capitalization ratio was 40.5% at the third-quarter end, which improved 70 bps year over year.

Share Repurchase Update

This year, during the Jan 1-Nov 1 period, Cigna bought back 7.7 million shares for around $2.2 billion.

2023 Guidance Updated

Adjusted revenues are presently forecasted to be a minimum of $192 billion, up from the previous view of at least $190 billion. The updated outlook indicates minimum growth of 6.3% from the 2022 reported figure.

Adjusted operating income is still expected to be a minimum of $7,360 million.

Adjusted earnings per share (EPS) for 2023 are anticipated to be a minimum of $24.75, up from the prior projection of a minimum of $24.70. The revised outlook suggests a minimum improvement of 6.4% from the 2022 figure.

CI presently forecasts total medical customer growth to be a minimum of 1.6 million this year, up from the prior outlook of growth of at least 1.4 million.

MCR is currently estimated within the 81.5-82% band compared with the earlier guidance of 81.5-82.3%. The adjusted SG&A expense ratio is presently estimated to be roughly 7.4%.

Adjusted operating income, on a pretax basis, for the Evernorth Health Services and Cigna Healthcare segments is still expected to be a minimum of $6,400 million and $4,425 million, respectively.

Operating cash flow is presently forecasted to be a minimum of $10.5 billion. Earlier, capital expenditures were expected to be around $1,400 million.

Long-Term Targets Reaffirmed

Cigna expects to achieve average annual adjusted EPS growth within 10-13% in the long term.

Over the 2022-2026 period, management expects CI to generate operating cash flows of roughly $50 billion.

Zacks Rank

Cigna currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Medical Sector Releases

Of the Medical sector players that have reported third-quarter 2023 results so far, the bottom-line results of Molina Healthcare, Inc. MOH, The Ensign Group, Inc. ENSG and Universal Health Services, Inc. UHS beat the respective Zacks Consensus Estimate.

Molina Healthcare reported third-quarter 2023 adjusted EPS of $5.05, which outpaced the Zacks Consensus Estimate by 3.7%. The bottom line advanced 16% year over year. Total revenues rose 7.8% year over year to $8,548 million in the quarter under review. Also, the top line surpassed the consensus mark by 2.9%. MOH’s premium revenues amounted to $8,240 million, which grew 8% year over year. It reported an adjusted net income of $294 million, which advanced 15.7% year over year. The consolidated MCR (medical costs as a percentage of premium revenues) deteriorated 30 bps year over year to 88.7%. Total membership was around 5.2 million as of Sep 30, 2023, which inched up 1% year over year.

Ensign Group’s third-quarter 2023 adjusted EPS of $1.20 surpassed the Zacks Consensus Estimate by 1.7%. The bottom line improved 15.4% year over year. Operating revenues climbed 22.2% year over year to $940.8 million in the quarter under review. The top line beat the consensus mark by a whisker. ENSG’s adjusted net income of $69 million advanced 16.6% year over year in the third quarter. Same-store occupancy improved 290 bps year over year while transitioning occupancy expanded 270 bps year over year. The Skilled Services segment recorded revenues of $903 million, which grew 22.1% year over year in the third quarter. Segment income improved 15.8% year over year to $117.8 million.

Universal Health reported third-quarter 2023 adjusted EPS of $2.55, which beat the Zacks Consensus Estimate by 9%. The bottom line climbed a penny from the year-ago period. Net revenues amounted to $3.6 billion in the quarter under review, which rose from $3.3 billion a year ago. The top line outpaced the consensus mark by 0.9%. UHS’s adjusted EBITDA net of NCI declined 1.5% year over year to $421.5 million in the third quarter. In the quarter, adjusted admissions (adjusted for outpatient activity) in the Acute Care Hospital Services segment advanced 6.8% year over year on a same-facility basis. Adjusted patient days rose 3.8% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

Molina Healthcare, Inc (MOH) : Free Stock Analysis Report

Cigna Group (CI) : Free Stock Analysis Report

The Ensign Group, Inc. (ENSG) : Free Stock Analysis Report