Cigna Group (CI) Posts Robust Q4 and Full-Year 2023 Earnings, Lifts 2024 EPS Forecast

Adjusted EPS Growth: Q4 adjusted EPS climbed to $6.79, full-year adjusted EPS reached $25.09.

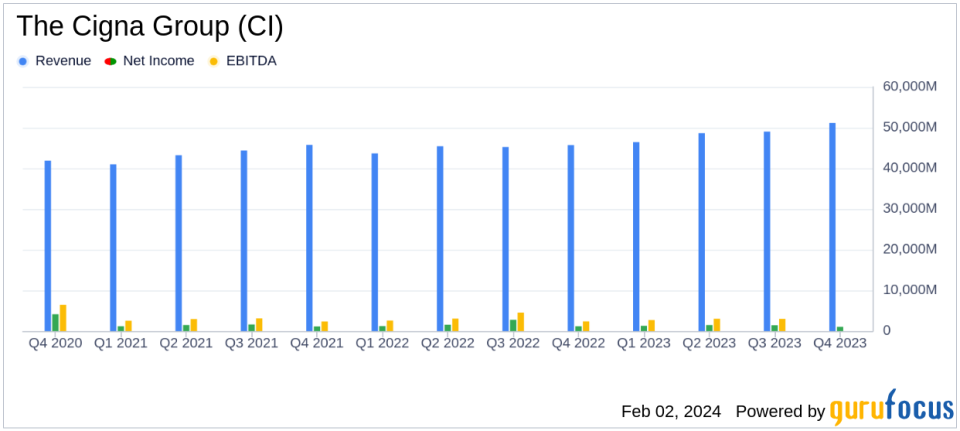

Revenue Expansion: Total 2023 revenues increased to $195.3 billion, up from $180.5 billion in 2022.

Customer Growth: Total medical customers rose to 19.78 million, a significant increase from 18 million in 2022.

Dividend Increase: The Cigna Group announces a dividend raise, reflecting confidence in financial strength.

2024 Outlook: Adjusted income from operations projected to be at least $8.025 billion, or at least $28.25 per share.

The Cigna Group (NYSE:CI) released its 8-K filing on February 2, 2024, disclosing a strong performance for the fourth quarter and the full year of 2023. The company, a leading provider of pharmacy benefit management and health insurance services, has reported significant growth in revenue and earnings, underscoring its sustained expansion and operational efficiency.

Cigna's diversified portfolio, which includes Evernorth Health Services and Cigna Healthcare, contributed to a robust fourth quarter with adjusted income from operations reaching $2.0 billion, or $6.79 per share, compared to $1.5 billion, or $5.02 per share, in the same quarter of the previous year. The full-year adjusted income from operations for 2023 was $7.4 billion, or $25.09 per share, compared to $7.3 billion, or $23.36 per share, in 2022.

Financial Performance Highlights

The company's total revenues for 2023 were $195.3 billion, a notable increase from $180.5 billion in 2022. The adjusted revenues, which exclude certain investment gains and losses, stood at $195.3 billion for the year, slightly above the reported total revenues. Shareholders net income for 2023 was $5.2 billion, or $17.39 per share, a decrease from $6.7 billion, or $21.41 per share, in 2022, primarily due to the loss on sale of businesses and charges for the organizational efficiency plan.

The Cigna Group's customer base also saw growth, with total medical customers increasing to 19.78 million by the end of 2023, up from 18 million in 2022. This growth is indicative of the company's expanding reach and the growing demand for its health services.

Segment Performance and 2024 Outlook

Evernorth Health Services, which offers a range of health services, reported adjusted revenues of $153.5 billion for 2023, while Cigna Healthcare, which includes U.S. Healthcare and International Health, reported adjusted revenues of $51.2 billion. The adjusted pre-tax income from operations for Evernorth and Cigna Healthcare were $6.4 billion and $4.5 billion, respectively.

Looking ahead, The Cigna Group has raised its 2024 adjusted EPS outlook to at least $28.25 per share, with adjusted revenues expected to surpass $235 billion. The company's forward-looking statements reflect its anticipation of continued growth and operational success.

David M. Cordani, chairman and CEO of The Cigna Group, commented on the results, stating, "2023 was another very strong year for our company with consistent execution and sustained growth. We will accelerate our momentum in 2024 as we lead in improving value, affordability and clinical outcomes, as well as with expanding access and choice."

The Cigna Group's financial strength and positive outlook have enabled it to increase its dividend, signaling confidence in its ability to generate cash and return value to shareholders. The company's strategic initiatives and operational focus are expected to drive further growth and performance improvements in the coming year.

For a detailed analysis of The Cigna Group's financial results and additional insights into the company's performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from The Cigna Group for further details.

This article first appeared on GuruFocus.