Cincinnati Financial (CINF) Q3 Earnings Top on Higher Premiums

Cincinnati Financial Corporation CINF reported third-quarter 2023 operating income of $1.66 per share, which surpassed the Zacks Consensus Estimate by 55%. The bottom line more than doubled year over year.

The results benefited from higher premiums, net investment income and improved combined ratio as well as lower expenses.

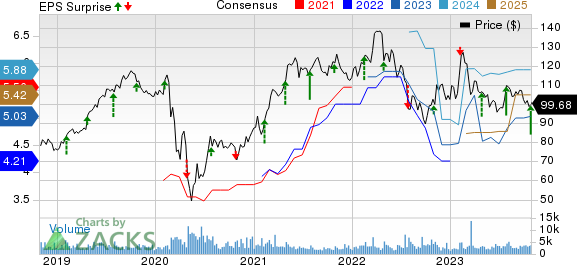

Cincinnati Financial Corporation Price, Consensus and EPS Surprise

Cincinnati Financial Corporation price-consensus-eps-surprise-chart | Cincinnati Financial Corporation Quote

Operational Update

Total operating revenues in the quarter under review were $2.3 billion, which improved 8.7% year over year. This improvement was driven by higher earned premiums, investment income and other revenues. Also, the top line beat the consensus mark by 1.2%.

Net written premiums climbed 12% year over year to $1.9 billion and matched our estimate. It was driven by premium growth initiatives, price increases and a higher level of insured exposures as well as contribution to growth from Cincinnati Re and Cincinnati Global.

Investment income, net of expenses increased 17% year over year to $225 million and beat our estimate of $210.8 million. The growth was driven by an increase in bond interest income and a rise in stock portfolio dividends. The Zacks Consensus Estimate was pegged at $216 million.

Total benefits and expenses of Cincinnati Financial decreased 1.4% year over year to $1.9 billion, primarily due to lower insurance losses and contract holders' benefits and interest expenses. Our estimate was $2 billion.

In its property & casualty (P&C) insurance business, CINF witnessed an underwriting income of $112 million against an underwriting loss of $66 million in the year-earlier period. Our estimate of underwriting income was pegged at $2.1 million.

The combined ratio — a measure of underwriting profitability — improved 950 basis points (bps) year over year to 94.4. Our estimate was pinned at 100. The Zacks Consensus Estimate was pegged at 99.

Quarterly Segment Update

Commercial Lines Insurance: Total revenues of $1 billion increased 3% year over year, which matched the Zacks Consensus Estimate. Our estimate was $1.1 billion. This upside was primarily driven by 3% premiums earned.

Underwriting income was $52 million, which surged nearly five-fold year over year. The combined ratio improved 380 bps year over year to 95.2. Our estimate was pegged at 92.9.

Personal Lines Insurance: Total revenues of $528 million increased 22% year over year on account of a 22% rise in premiums earned. Our estimate was $485 million, while the Zacks Consensus Estimate was pegged at $503 million.

Underwriting profit was $1 million against an underwriting loss of $18 million in the year-earlier period.

The combined ratio improved 460 bps year over year to 99.9. Our estimate was 103.2, while the Zacks Consensus Estimate was pegged at 103.

Excess and Surplus Lines Insurance: Total revenues of $136 million grew 8% year over year, aided by 8% higher earned premiums. Our estimate was $134.5 million, while the Zacks Consensus Estimate was pegged at $140 million.

Underwriting profit increased 56% year over year to $14 million. Our estimate was pinned at $7.3 million. The combined ratio improved 340 bps year over year to 90.5. Our estimate was 94.6.

Life Insurance: Total revenues were $125 million, up 5% year over year, driven by 1% higher earned premiums, 7% higher investment income, net of expenses and 50% higher fee revenues. The Zacks Consensus Estimate was pegged at $102 million. Our estimate was $76 million. Total benefits and expenses increased 2% year over year to $93 million due to higher contract holders’ benefits and underwriting expenses incurred.

Financial Update

As of Sep 30, 2023, Cincinnati Financial had total assets worth $30.9 billion, up 3.9% from the level at 2022 end.

Total debt was $815 million as of Sep 30, 2023, down 2.8% from the 2022-end level. The company’s debt-to-capital ratio was 7.1% as of Sep 30, 2023, which improved 30 bps from the end of 2022.

As of Sep 30, 2023, CINF’s book value per share was $67.72, up 0.7% from 2022 end.

Zacks Rank

Cincinnati Financial currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Performance of Some Other P&C Insurers

Chubb Limited CB reported third-quarter 2023 core operating income of $4.95 per share, which outpaced the Zacks Consensus Estimate by 17.6%. This outperformance was driven by higher premium revenues and improved net investment income. The bottom line improved 58.1% from the year-ago quarter.

Net premiums written improved 9.1% year over year to $13.1 billion in the quarter, which matched the Zacks Consensus Estimate, while our estimate was $13.5 billion. Net premiums earned rose 9.9% to $12.7 billion. Our estimate was $11.2 billion. Net investment income was $1.3 billion, up 34.2%. The Zacks Consensus estimate was pegged at $1.2 billion, while our estimate was pinned at $1 billion.

P&C underwriting income was $1.31 billion, which increased 83.8% from the year-ago quarter. Global P&C underwriting income, excluding Agriculture, was $1.2 billion, up 117.2%. Chubb incurred a pre-tax P&C catastrophe loss of $0.6 billion, narrower than the year-ago catastrophe loss of $1.16 billion. The P&C combined ratio improved 470 bps on a year-over-year basis to 88.4% in the quarter under review. The Zacks Consensus Estimate for the combined ratio was pegged at 90, while our estimate was 84.9.

The Travelers Companies, Inc. TRV reported its third-quarter 2023 core income of $1.95 per share, which missed the Zacks Consensus Estimate by 33.4%. The bottom line decreased 11.4% year over year, primarily attributable to higher catastrophe losses and net unfavorable prior-year reserve development. TRV’s total revenues increased 14% from the year-ago quarter to $10.6 billion, primarily driven by higher premiums. The top-line figure beat the Zacks Consensus Estimate by 1.3%.

Net written premiums increased 14% year over year to a record $10.4 billion, driven by strong growth across all three segments. The figure was higher than our estimate of $9.4 billion. TRV witnessed an underwriting gain of $868 million, up 43% year over year, driven by record net earned premiums of $9.7 billion and a consolidated underlying combined ratio, which improved by 90.6%.

RLI Corp. RLI reported third-quarter 2023 operating earnings of 61 cents per share, beating the Zacks Consensus Estimate by 510%. The bottom line improved 22% from the prior-year quarter. Operating revenues for the reported quarter were $350.4 million, up 12.1% year over year, driven by 9.2% higher net premiums earned and 50.3% higher net investment income. The top line, however, missed the Zacks Consensus Estimate by 7.2%.

Gross premiums written increased 11.3% year over year to $449.3 million. Underwriting income of $4.2 million decreased by 52.3%, primarily due to Hawaiian wildfire losses. The combined ratio deteriorated 170 bps year over year to 98.7. Our estimate was 90.8.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RLI Corp. (RLI) : Free Stock Analysis Report

The Travelers Companies, Inc. (TRV) : Free Stock Analysis Report

Chubb Limited (CB) : Free Stock Analysis Report

Cincinnati Financial Corporation (CINF) : Free Stock Analysis Report