Cincinnati Financial Corp Reports Strong Earnings Growth in Q4 and Full-Year 2023

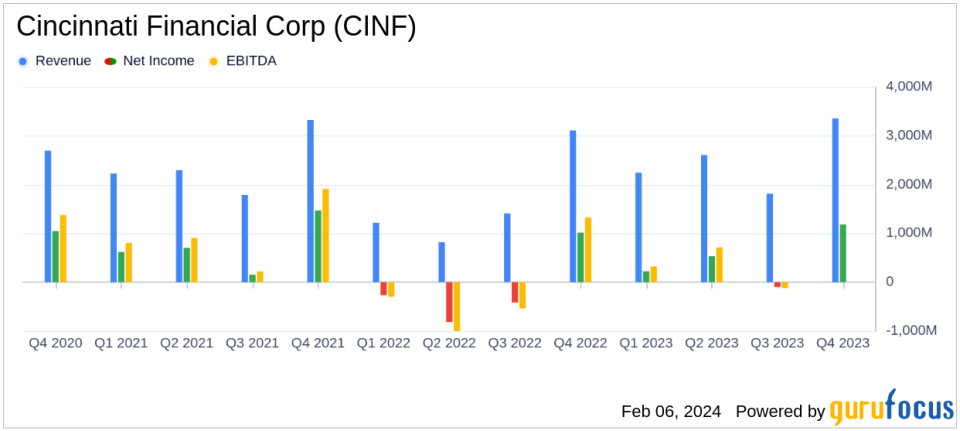

Net Income: Q4 net income increased to $1.183 billion, up 17% from Q4 2022, and full-year net income reached $1.843 billion compared to a net loss in 2022.

Non-GAAP Operating Income: Grew 78% in Q4 to $359 million and 42% for the full year to $952 million.

Combined Ratio: Improved to 87.5% in Q4 from 94.9% in Q4 2022, indicating strong underwriting performance.

Net Written Premiums: Increased by 10% for the full year, with Q4 growth at 13%.

Book Value Per Share: Rose to $77.06, a 15% increase since year-end 2022.

Value Creation Ratio: Stood at 19.5% for full-year 2023, a significant improvement from negative 14.6% in 2022.

Investment Portfolio: Fair value of total investments increased by 13% at year-end 2023.

On February 6, 2024, Cincinnati Financial Corp (NASDAQ:CINF) released its 8-K filing, detailing a robust financial performance for both the fourth quarter and the full year of 2023. The company, known for its property and casualty insurance offerings, also provides life insurance and investment services. The majority of its revenue stems from commercial lines, followed by personal lines.

Financial Performance and Challenges

Cincinnati Financial Corp's fourth-quarter net income rose to $1.183 billion, a 17% increase from the same period last year, largely due to an after-tax increase in the fair value of equity securities. Full-year net income turned around from a net loss in 2022 to $1.843 billion. The company's non-GAAP operating income also saw significant increases, with a 78% rise in the fourth quarter and a 42% increase for the full year. These figures are indicative of the company's strong underwriting performance and effective investment strategies.

Despite these achievements, the company operates in a competitive and complex market environment, where challenges such as catastrophic events, regulatory changes, and market volatility could potentially impact future performance. The importance of maintaining underwriting discipline and investment acumen cannot be understated, as these factors are critical to sustaining profitability and growth.

Insurance Operations and Investment Highlights

The company's insurance operations saw a marked improvement in the combined ratio, which measures underwriting profitability, indicating less money was spent on claims and expenses than was earned from premiums. The fourth-quarter property casualty combined ratio improved to 87.5%, down from 94.9% in the prior year's quarter. Net written premiums grew by 10% for the full year, reflecting the company's effective premium growth initiatives and pricing strategies.

Investment income, a key component of Cincinnati Financial's revenue, increased by 15% in the fourth quarter, driven by higher bond interest income and stock portfolio dividends. The fair value of the company's total investments also saw a healthy increase, highlighting the strength of its investment portfolio.

Executive Commentary

"Non-GAAP operating income finished the year strong, increasing 42% to $952 million, compared with full-year 2022. Net income continued its pattern of wide swings as the effects of a robust equity market in the fourth quarter pushed it to nearly $2 billion at the end of the year, compared with a net loss in 2022," said Steven J. Johnston, chairman and chief executive officer.

"Our full-year 2023 combined ratio improved 3.2 points to 94.9%, benefiting from sound underwriting judgment and lower catastrophe losses. Our 2023 core combined ratio on a current accident year before catastrophe loss basis was 1.8 points better than full-year 2022," Johnston added.

These comments underscore the company's successful management of its insurance operations and the positive impact of market conditions on its investment portfolio.

Looking Ahead

With a strong balance sheet, improved book value per share, and a robust value creation ratio, Cincinnati Financial Corp is well-positioned for the future. The company's focus on profitable growth, combined with its financial strength, sets a solid foundation for continued success in 2024 and beyond.

For more detailed information and to register for the company's conference call webcast, interested parties can visit cinfin.com/investors.

Value investors and potential GuruFocus.com members may find Cincinnati Financial Corp's strong financial performance and strategic focus appealing as they consider the company's potential for long-term value creation.

Explore the complete 8-K earnings release (here) from Cincinnati Financial Corp for further details.

This article first appeared on GuruFocus.