Cinemark Holdings Inc (CNK) Reports Robust Revenue Growth and Solid Profitability in FY 2023

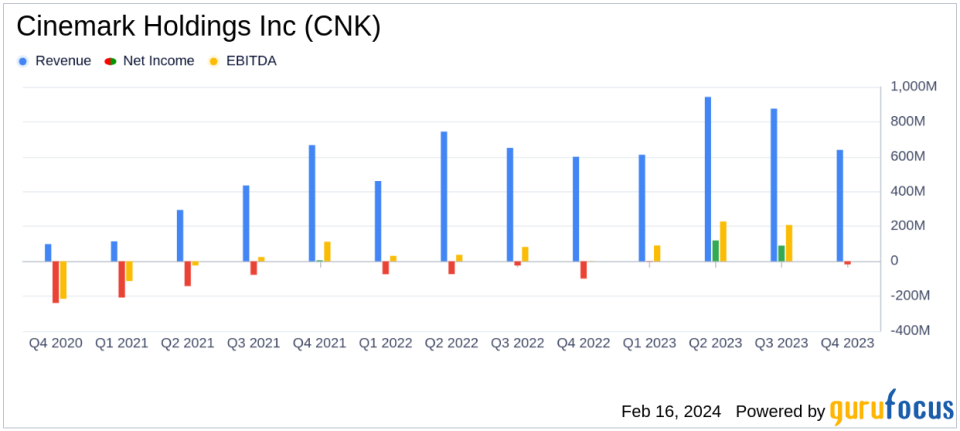

Revenue: Cinemark Holdings Inc (NYSE:CNK) reported a 25% increase in total revenue for FY 2023, amounting to $3.1 billion.

Net Income: The company's net income for FY 2023 was $191 million, with diluted earnings per share of $1.34.

Adjusted EBITDA: Adjusted EBITDA grew 77% to $594 million for FY 2023, reflecting a strong 19.4% margin.

Cash Flow: Cash from operating activities was $444 million, with free cash flow of $295 million for the year.

Attendance: Cinemark entertained over 210 million moviegoers in FY 2023, with a significant market share growth since the pandemic.

On February 16, 2024, Cinemark Holdings Inc (NYSE:CNK), a leading player in the motion picture exhibition industry, released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, which operates 518 theatres with 5,847 screens across the United States and Latin America, has shown a remarkable recovery with a 25% year-over-year increase in total revenue, reaching $3.1 billion for the fiscal year 2023.

Cinemark's strategic growth and productivity initiatives have been pivotal in driving this performance. The company has not only managed to surpass pre-pandemic attendance figures but also achieved record-high food & beverage per capita sales. The increase in net income to $191 million and a significant boost in Adjusted EBITDA to $594 million, with a margin of 19.4%, underscore the company's operational efficiency and financial discipline.

Despite a challenging quarter that saw a net loss of $18 million, the full-year results reflect a strong recovery, with a notable reduction in pandemic-related debt by over $100 million and an increase in the cash balance to $849 million at year-end. Cinemark's commitment to enhancing the moviegoing experience through initiatives like the Movie Club subscription program and Luxury Lounger recliners has contributed to its competitive edge in the market.

Financial Performance Analysis

The company's financial achievements are particularly significant in the context of the Media - Diversified industry. The 25% less attendance compared to FY 2019, yet a 3% increase in concession revenue, indicates a successful strategy in maximizing per-customer revenue. The growth in Adjusted EBITDA by 77% to $594 million for FY 2023 is a testament to Cinemark's ability to leverage box office opportunities and execute strategic initiatives effectively.

Key financial metrics from the Income Statement, Balance Sheet, and Cash Flow Statement highlight the company's robust financial health. The worldwide average ticket price stood at $7.41, and the concession revenue per patron reached an all-time high of $5.68. The company's balance sheet was further strengthened with a year-end cash balance of $849.1 million and a reduction in long-term debt to $2,399.1 million.

"2023 represented another year of meaningful progress for our industry and our company," stated Sean Gamble, Cinemarks President and CEO. "Our teams outstanding operational execution and financial discipline delivered outsized results across all of our key metrics, including Revenue, Adjusted EBITDA, and Free Cash Flow."

Cinemark's performance is a clear indicator of the company's resilience and adaptability in a post-pandemic environment. The company's strategy of focusing on customer experience and operational efficiency has paid off, positioning it well for continued growth and success in the coming years.

For detailed financial schedules and reconciliations of non-GAAP financial measures, investors and interested parties are encouraged to visit Cinemark's investor relations website at https://ir.cinemark.com.

Value investors and potential GuruFocus.com members seeking to understand the implications of Cinemark Holdings Inc (NYSE:CNK)'s financial results can find comprehensive insights and analysis on GuruFocus.com, where the focus is on providing valuable and trustworthy financial information.

Explore the complete 8-K earnings release (here) from Cinemark Holdings Inc for further details.

This article first appeared on GuruFocus.