CINF or RE: Which P&C Insurance Stock is Better Positioned?

The Zacks Property and Casualty (P&C) Insurance industry has been benefiting from better pricing, prudent underwriting, increased exposure, an improving rate environment and a solid capital position. With the ongoing economic expansion, insurers remain well-poised for growth. However, catastrophe losses might have weighed on P&C insurers.

The industry has risen 16.4% in the past year, outperforming the Zacks S&P 500 composite’s growth of 11.4% and the Finance sector’s 3.7% increase.

Image Source: Zacks Investment Research

Here we focus on two property and casualty insurers, namely Cincinnati Financial Corporation CINF and Everest Re Group, Ltd. RE.

Cincinnati Financial, with a market capitalization of $15.4 billion, provides property casualty insurance products in the United States. Everest Re, with a market capitalization of $15.3 billion, provides reinsurance and insurance products in the United States, Bermuda and internationally. RE also offers commercial P&C insurance products. CINF and RE carry a Zacks Rank #3 (Hold) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Global commercial insurance prices rose for 22 straight quarters though the magnitude has slowed down, per Marsh Global Insurance Market Index. Improvement in pricing drives premiums and claims payment. Per Deloitte Insights, life insurance premiums are estimated to increase 1.9% in 2023, while non-life premiums are expected to rise 2.2%.

Price hikes, operational strength, higher retention, strong renewal and the appointment of retail agents should help write higher premiums.

The insurance industry remains exposed to catastrophe loss stemming from natural disasters, which drag down underwriting profit. Colorado State University predicted a near-average Atlantic hurricane season in 2023 with 15 named storms. These include seven hurricanes and three major hurricanes.

For 2022, Aon had estimated a global economic loss of $313 billion from natural disasters, while insured losses were estimated to be more than $130 billion. Per a report published in Insurance Journal, net underwriting loss increased seven-fold to $26.9 billion in 2022. Per Verisk and APCIA, the combined ratio deteriorated 310 basis points year over year to 102.7% in 2022.

Exposure growth, improved pricing, prudent underwriting, favorable reserve development and a sturdy capital position will help to absorb catastrophe losses. Also, frequent occurrences of natural disasters should accelerate the policy renewal rate.

With three rate hikes in 2023, investment income should improve further, as insurers are beneficiaries of a rising rate environment. As of now, Fed has held back the hiking cycle after 10 straight increases but expects two more rate hikes in future. An improving rate environment is favorable for long-tail insurers. Also, investment income is an important component of an insurer’s top line.

Consolidation in the P&C insurance industry is expected to continue, as insurers look to diversify their operations into new business lines and geographies. The solid capital level of the multiline insurers will fuel merger and acquisition activities to ramp up growth, and aid these insurers in engaging in shareholder-friendly moves.

Insurers have increased investment in emerging technologies in a bid to drive efficiency, enhance cybersecurity, upgrade policy administration and claims systems and expand automation capabilities across their organizations.

Let's delve deeper into specific parameters to ascertain which P&C insurer is better positioned at the moment.

Price Performance

Everest Re has gained 29.9% in the past year, outperforming the industry’s growth of 16.4%. Cincinnati Financial shares have declined 14.2% in the said time frame.

Image Source: Zacks Investment Research

Return on Equity (ROE)

Everest Re, with a ROE of 12.9%, exceeds Cincinnati Financial’s ROE of 5.4% and the industry average of 6.8%.

Image Source: Zacks Investment Research

Valuation

The price-to-book value is the best multiple used for valuing insurers. Compared with Everest Re’s P/B ratio of 1.73, Cincinnati Financial is cheaper, with a reading of 1.43. The P&C insurance industry’s P/B ratio is 1.43.

Image Source: Zacks Investment Research

Dividend Yield

Cincinnati Financial’s dividend yield of 3% is better than the Everest Re’s dividend yield of 1.8%. Thus, Cincinnati Financial has an advantage over Everest Re on this front.

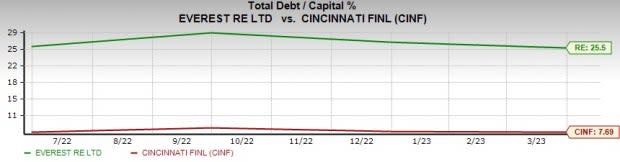

Debt-to-Capital

RE’s debt-to-capital ratio of 25.5 is higher than the industry average of 19.7 and CINF’s reading of 7.69.

Image Source: Zacks Investment Research

Earnings Surprise History

Cincinnati Financial has a solid record of beating earnings estimates in five of the last seven quarters, missing twice. Everest Re beat earnings estimates in three of the last seven quarters and missed on four occasions.

Hence, CINF has an edge in this regard over RE.

Growth Projection

The Zacks Consensus Estimate for 2023 earnings indicates 62.2% growth from the year-ago reported figure for Everest Re, while the same for Cincinnati Financial indicates an increase of 7.7%.

VGM Score

VGM Score rates each stock on its combined weighted styles, helping to identify those with the most attractive value, best growth and most promising momentum. Everest Re has a VGM Score of A, while Cincinnati Financial has a VGM Score of D. Thus, Everest Re is better placed.

Earnings Estimates

For 2023, the Zacks Consensus Estimate for CINF has moved 0.4% north to $4.57 in the past 60 days, while the same for RE has been revised 0.8% downward to $43.92. Therefore, CINF is in an advantageous position over RE on this front.

To Conclude

Our comparative analysis shows that Cincinnati Financial is better positioned than Everest Re with respect to dividend yield, valuation, leverage, earnings surprise history and earnings estimates. Meanwhile, Everest Re scores higher in terms of price, return on equity, growth projection and VGM Score. With the scale slightly tilted toward Cincinnati Financial, the stock appears to be better poised.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cincinnati Financial Corporation (CINF) : Free Stock Analysis Report

Everest Re Group, Ltd. (RE) : Free Stock Analysis Report