Cintas Corp (CTAS) Earnings: Strong Growth Surpasses Analyst Expectations

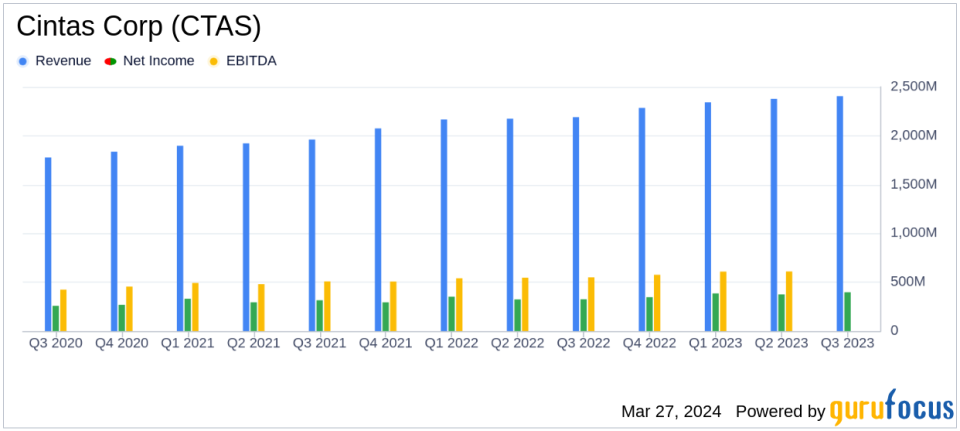

Revenue: $2.41 billion, up 9.9% from the previous year, exceeding estimates of $2.386 billion.

Gross Margin: Increased to 49.4%, up from 47.2% in the prior year's quarter.

Operating Income: Rose by 16.6% to $520.8 million.

Net Income: $397.6 million, a 22.0% increase, surpassing estimates of $370.65 million.

Diluted EPS: $3.84, a 22.3% increase, outperforming estimates of $3.5759.

Free Cash Flow: Reported at $1.079 billion for the nine months ended February 29, 2024.

Guidance: Raised annual revenue expectations to $9.57-$9.60 billion and EPS to $14.80-$15.00.

On March 27, 2024, Cintas Corp (NASDAQ:CTAS) released its 8-K filing, announcing impressive results for the fiscal third quarter ended February 29, 2024. The company, a leading provider of corporate uniforms and facility services, reported a significant increase in revenue and earnings per share (EPS), exceeding analyst expectations.

Cintas is known for its comprehensive approach to workplace services, offering products such as uniforms, entrance mats, mops, restroom supplies, first aid and safety products, fire extinguishers, and safety training. The company's success is built on its ability to serve as a one-stop shop for businesses looking to maintain a professional and safe environment.

The reported revenue of $2.41 billion represents a 9.9% increase over the previous year, with an organic growth rate of 7.7% when adjusted for acquisitions, currency fluctuations, and workday differences. This growth was reflected across both the uniform rental and facility services, as well as other business segments. The gross margin also saw a substantial rise to 49.4%, indicating efficient cost management and a stronger pricing strategy.

Operating income for the quarter grew to $520.8 million, a 16.6% increase year-over-year, while net income surged by 22.0% to $397.6 million, both indicative of Cintas's operational efficiency and market strength. The EPS of $3.84, a 22.3% increase from the prior year, signals strong profitability and shareholder value.

The company's financial achievements are particularly notable in the Business Services industry, where competitive differentiation and cost control are critical. Cintas's ability to expand its gross and operating margins while simultaneously growing revenue is a testament to its operational excellence and strategic focus.

Key financial highlights from the income statement, balance sheet, and cash flow statement include a robust free cash flow of $1.079 billion for the nine months ended February 29, 2024, which underscores the company's strong cash generation capabilities. The balance sheet remains solid, positioning Cintas for continued investment in growth opportunities.

Our third quarter results reflect the outstanding dedication and execution of our employees, whom we call partners. Each of our operating segments continue to execute at a high level, which led to robust revenue growth of 9.9%, record high gross margin of 49.4%, record high operating margin of 21.6% and diluted EPS growth of 22.3%," said Todd M. Schneider, Cintas' President and Chief Executive Officer.

Based on our third quarter results, we are increasing our full fiscal year financial guidance. We are raising our annual revenue expectations from a range of $9.48 billion to $9.56 billion to a range of $9.57 billion to $9.60 billion and our diluted EPS from a range of $14.35 to $14.65 to a range of $14.80 to $15.00," Mr. Schneider concluded.

The company's performance is a clear indicator of its ability to navigate the complexities of the market, delivering value to its customers and shareholders alike. With increased guidance for the full fiscal year, Cintas demonstrates confidence in its future prospects and operational strategy.

For a more detailed analysis and updates on Cintas Corp's performance, visit GuruFocus.com for comprehensive financial data and investment insights.

Explore the complete 8-K earnings release (here) from Cintas Corp for further details.

This article first appeared on GuruFocus.