Cintas (CTAS) Q1 Earnings & Revenues Top Estimates, Increase Y/Y

Cintas Corporation CTAS reported first-quarter fiscal 2024 (ended Aug 31, 2023) earnings of $3.70 per share, which beat the Zacks Consensus Estimate of $3.65. The bottom line increased 9.1% year over year despite high costs.

Total revenues of $2,342.3 million outperformed the Zacks Consensus Estimate of $2,324.8 million. The top line climbed 8.1% year over year due to higher segmental revenues. Organic sales were also up 8.1% year over year.

Segmental Results

The company has two reportable segments - Uniform Rental and Facility Services and First Aid and Safety Services. Other businesses like Uniform Direct Sale and Fire Protection Services are included in All Other. Quarterly sales data is briefly discussed below.

Revenues from the Uniform Rental and Facility Services segment (representing 78% of the reported quarter’s net sales) totaled $1,826.83 million, up 7.6% year over year. Our estimate for segmental revenues was $1,814.3 million.

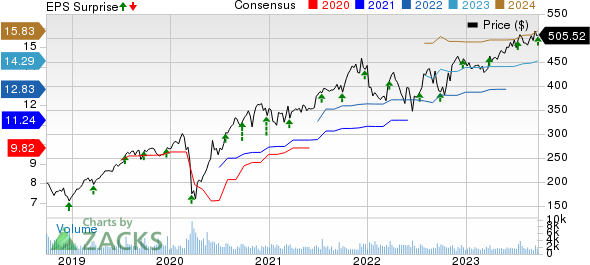

Cintas Corporation Price, Consensus and EPS Surprise

Cintas Corporation price-consensus-eps-surprise-chart | Cintas Corporation Quote

Revenues from the First Aid and Safety Services segment (representing 11.1% of the reported quarter’s net sales) totaled $260.69 million, up 11.3% year over year. Our estimate for segmental revenues was $247 million.

Revenues from All Other business (representing 11.4% of the reported quarter’s net sales) totaled $254.81 million, up 8.6% year over year. Our estimate for segmental revenues was $251 million.

Margin Profile

In the quarter under review, Cintas’ cost of sales (comprising costs related to uniform rental and facility services and others) increased 5.4% year over year to $1.20 billion. It represented approximately 51.3% of net sales. Gross profit increased 11% to $1.14 billion. The gross margin was 48.7% in the reported quarter compared with 47.5% in the year-ago period.

Selling and administrative expenses totaled $641.02 million, reflecting a 9% increase from the year-ago figure. It represented 27.4% of net sales. The operating margin in the reported quarter was 21.4% compared with 20.3% in the year-ago quarter. Interest expenses decreased 11.5% to $24.54 million.

Balance Sheet and Cash Flow

Exiting the fiscal first quarter, Cintas had cash and cash equivalents of $88.13 million compared with $124.15 million at the end of fiscal 2023. Long-term debt was $2.48 billion compared with $2.49 billion at the end of fiscal 2023.

At the end of the fiscal first quarter, CTAS generated net cash of $336.95 million from operating activities, up 13% from the year-ago period. Capital expenditure totaled $106.70 million, up 52.4% year over year. Free cash flow inched up nearly 1% year over year to $230.25 million.

In the first quarter of fiscal 2024, the company repurchased shares worth $73.28 million compared with $320.33 million in the year-ago period. In the reported quarter, dividend payments totaled $117.57 million, up approximately 20.4% year over year.

Fiscal 2024 Guidance Improved

For fiscal 2024, Cintas now expects revenues of $9.40-$9.52 billion compared with $9.35-$9.50 billion anticipated earlier. The mid-point of the guided range — $9.46 billion — lies above the Zacks Consensus Estimate of $9.45 billion. Earnings per share are estimated to be in the range of $14.00-$14.45 compared with $13.85-$14.35. The mid-point of the guided range — $14.23 — lies below the Zacks Consensus Estimate of $14.29.

Cintas predicts interest expense of approximately $98 million in fiscal 2024. This compares with interest expense of $109.5 million recorded in fiscal 2023. The effective tax rate is expected to be 21.3% compared with 20.4% recorded in fiscal 2023.

Zacks Rank & Other Stocks to Consider

Cintas carries a Zacks Rank #2 (Buy).

Some other top-ranked companies within the broader Industrial Products sector are as follows:

Flowserve Corporation FLS presently sports a Zacks Rank #1 (Strong Buy). The company pulled off a trailing four-quarter earnings surprise of 6.2%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

Flowserve has an estimated earnings growth rate of 79.1% for the current year. The stock has jumped 27.9% so far this year.

Graham Corporation GHM currently flaunts a Zacks Rank #1. The company pulled off a trailing four-quarter earnings surprise of 243.1%, on average.

Graham has an estimated earnings growth rate of 400% for the current fiscal year. The stock has rallied 67.4% so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Flowserve Corporation (FLS) : Free Stock Analysis Report

Cintas Corporation (CTAS) : Free Stock Analysis Report

Graham Corporation (GHM) : Free Stock Analysis Report