Cintas Shares Richly Priced After a Strong 2023

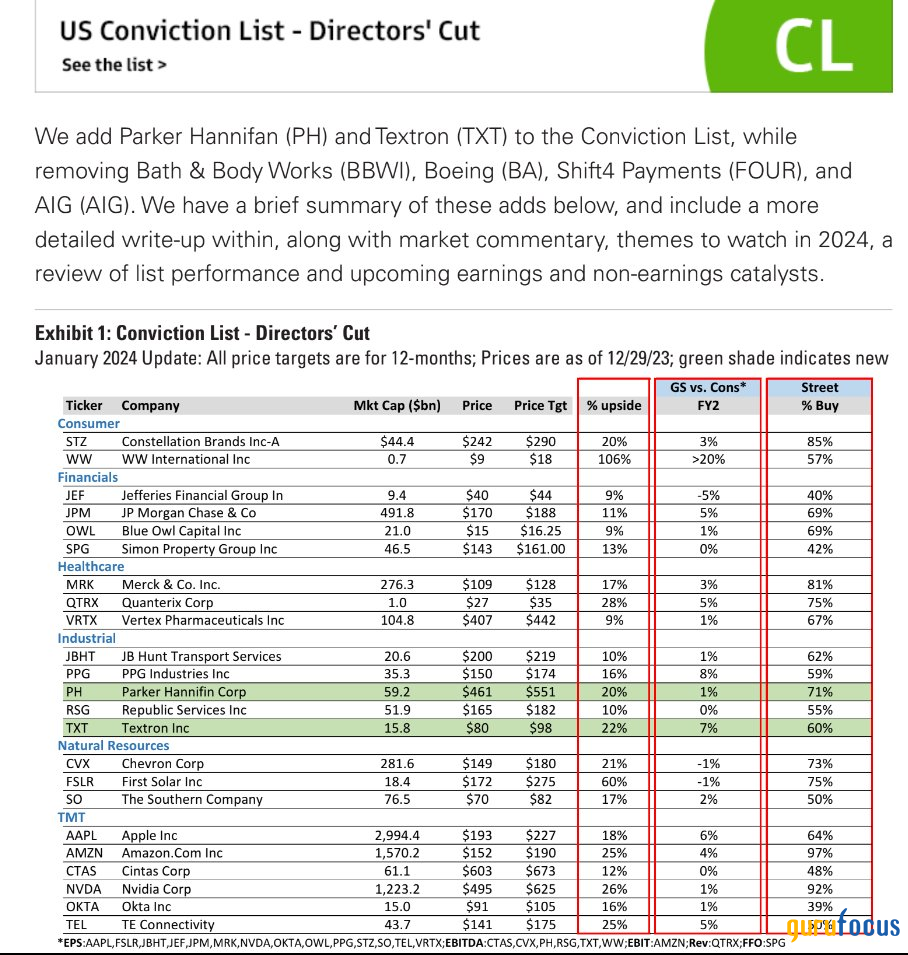

The start of the year means a slew of new analyst upgrades and downgrades. I pay particular attention to what the team at Goldman Sachs (NYSE:GS) puts out, namely their Conviction Buy List. The January update, published just a few days ago, reveals some newcomers, but also a handful of stocks that have remained on the list for several months. Cintas Corp. (NASDAQ:CTAS) is not a sexy tech company, but its share price performance over the last year has been stellar while its earnings per share growth trajectory is impressive.

While Goldman sees higher prices ahead, I take a different view. I see shares as fairly valued despite the company's healthy earnings per share growth outlook. What's more, the domestic employment situation is particularly important.

Goldman Sachs U.S. Conviction Buy List

Company description

For background, Cintas is the industry leader in corporate uniform rentals across North America. The company also provides restroom cleaning supplies, including mats, first aid kits and other safety products, along with fire protection products.

What makes the company strong from a profit perspective is that it operates through a recurring route-based service program. In 2022, the company generated $7.8 billion in total revenue through its 400-plus facilities across the U.S. and Canada, according to Bank of America Global Research.

Key data

With a $61 billion market cap, the Ohio-based diversified support services company within the industrials sector trades at a high 41.3 forward 12-month non-GAAP pric-earnings ratio and pays a low 0.9% forward dividend yield as of Jan. 2. While earnings are not due out until March, shares trade with a low 15% implied volatility percentage. Short interest on the stock is modest at just 1.7%.

Color on the quarter

In December, Cintas reported a strong second-quarter GAAP earnings beat. Earnings per share verified at $3.61, topping estimates by 13 cents, while revenue of $2.4 billion, up more than 9% from year-ago levels, was about in line with the Wall Street consensus. What was particularly bullish was the management team raised its full-year earnings guidance from a midpoint of $14.23 to $14.50 on a diluted basis. The stock reacted very positively, rising to fresh all-time highs.

Cintas has not missed on earnings in at least three years and there have already been a slew of analyst upgrades of the company since the last report. Bulls can also point to margin expansion along with top-line growth, a recipe for big profits. The company expects continued growth in the First Aid & Safety and Fire Protection Services segments, too.

Peer comparison

Compared to its peers, Cintas features a premium valuation, but is also among the best earnings growth trajectories. Additionally, its profitability metrics are best in class while share price momentum is very high based on technical factors. Finally, its earnings revisions are relatively healthy given its earnings per share beat rate history.

Risks

Key risks for Cintas include its exposure to the broad economy sales are dependent on a strong labor market with increased capital investments from other industries. Acquisition risk may also be significant as Cintas expands its presence. With elevated operating leverage, any company-specific issues could result in a substantial bottom-line impact.

Valuation

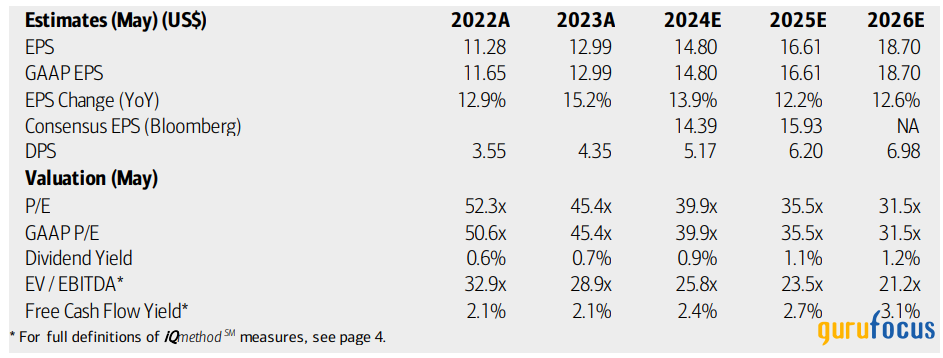

On valuation, analysts at Bank of America see earnings rising nearly 14% in the current fiscal year (2024) with continued double-digit earnings per share growth through 2025 and 2026. The current consensus estimate calls for more than $16 in operating per-share profits next year and $17.59 in 2026. Sales growth is forecast to be less stellar, with revenue rising between 7% and 9% over the out years. Dividends, meanwhile, are expected to climb at a sharp pace over the coming quarters as the company is free cash flow positive, though I am not all that impressed by its current free cash flow yield.

Cintas trades more than twice its sector median non-GAAP forward price-earnings ratio. Moreover, the stock is about 20% above its five-year average earnings multiple. In this case, if we take a PEG ratio approach, then we also find that the stock is no bargain even when incorporating the strong profitability trends. If we assign a high 3 PEG, then here is how the valuation looks: A 12% normalized earnings per share growth rate would mean a price-earnings ratio of 36. Assuming $16 of earnings per share on a 36 multiple, then the stock should be near $576, making Cintas mildly overvalued today.

Cintas: Earnings, valuation, dividend yield and free cash flow forecasts

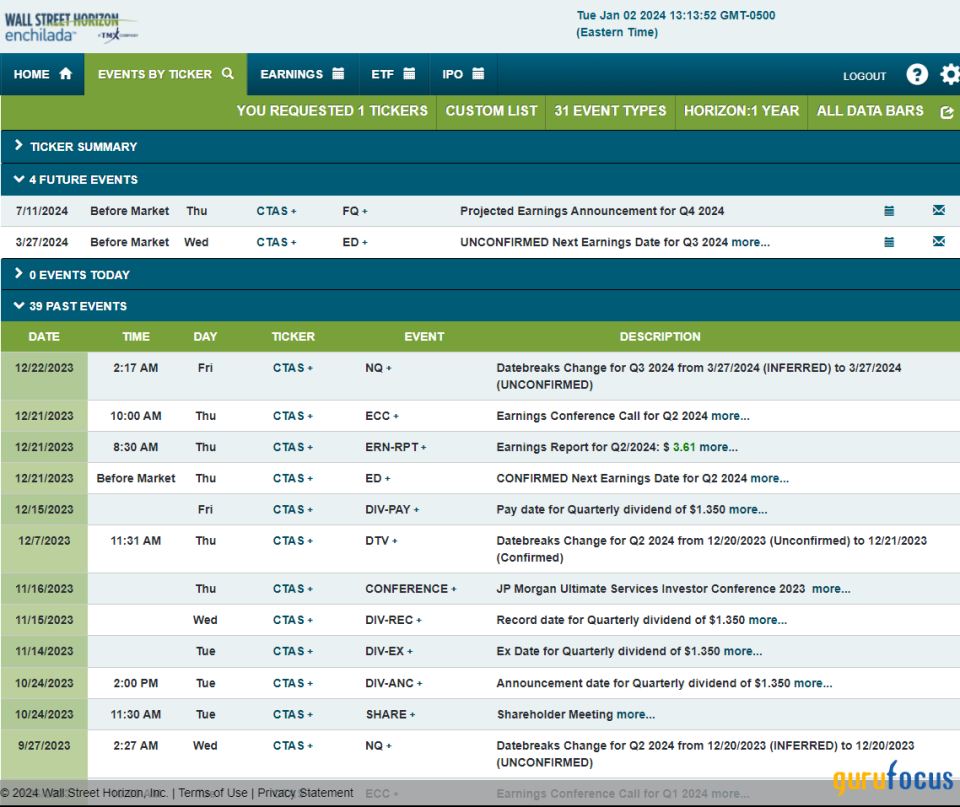

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed third-quarter 2024 earnings date of Wednesday, March 27. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

The technical take

While I assert Cintas is a bit overvalued fundamentally, it is hard to argue with the strength of the stock's powerful long-term uptrend. Notice in the chart below that the stock has rallied from under $350 in the middle of 2022 to above $600 toward the end of last year. Following a strong response to a solid second-quarter 2024 earnings report, shares surged from the mid-$500s on elevated volume and a burst in the relative strength index momentum oscillator. With the stock pulling back, there is the risk that December's cheery advance was a blow-off top, but more time and price action confirmation is needed before we can make that call.

Take a look at the overall pattern from late 2021 through mid-2023. There was a bullish cup and handle pattern with a base at $344 and a resistance line near $460. We can come to a price target based on the breakout - $465 less $344 equals $121. Add that difference to the $465 breakout point, and we get a target near $585. The stock jumped above that target, but the point is the upside move has been made and I would expect at least a pause here. With the stock stretched about 20% above its rising 200-day moving average and a possible negative RSI divergence, there are signs that a pullback may be just getting started.

Overall, Cintas has been in a strong uptrend, but there are signs that a pause in its bull run could be underway. The $518 to $525 is possible support and would mark a decent spot to eye a long position.

Bullish cup and handle target acheived, expecting a pullback to the low $500s

The bottom line

Cintas has robust earnings momentum and its general price trend has been powerful. Still, I see the company near to slightly above fair value.

This article first appeared on GuruFocus.