CION Invt Corp (CION) Reports Solid Q4 and Year-End 2023 Financial Results

Net Asset Value (NAV): Increased to $16.23 per share from $15.80 in the previous quarter.

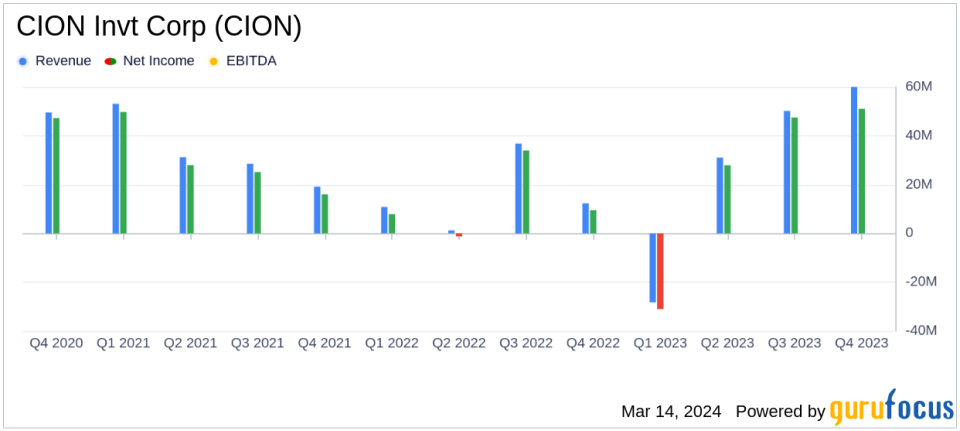

Total Investment Income: Decreased to $60.0 million in Q4 from $67.5 million in Q3.

Net Investment Income (NII): Reported at $21.8 million for Q4, with NII per share at $0.40.

Net Increase in Net Assets: Resulted in operations of $51.0 million for Q4.

Distributions: Declared Q4 distributions of $0.54 per share and announced Q1 2024 base distribution of $0.34 per share.

Debt-to-Equity Ratio: Stood at 1.24x as of December 31, 2023.

Portfolio Health: Non-accrual investments represented only 0.9% of the total investment portfolio at fair value.

On March 14, 2024, CION Invt Corp (NYSE:CION) released its 8-K filing, announcing its financial results for the fourth quarter and year ended December 31, 2023. As an externally managed, non-diversified, closed-end management investment company, CION focuses on investments in senior secured debt and, to a lesser extent, unsecured debt and equity of private and thinly-traded U.S. middle-market companies.

Financial Performance and Portfolio Highlights

CION reported a robust financial performance for the fourth quarter, with a net asset value (NAV) per share increase to $16.23, up from $15.80 in the previous quarter. This growth in NAV reflects the company's ability to maintain a strong balance sheet and deliver value to shareholders. The total investment income for the quarter was $60.0 million, a decrease from the $67.5 million reported in the previous quarter, primarily due to a make-whole payment received and additional investment income from restructuring activity in Q3.

Operating expenses for Q4 were slightly higher at $38.2 million compared to $37.6 million in Q3, mainly due to increased interest expense from higher total debt outstanding. Despite this, the company managed to report a net investment income after taxes of $21.8 million for the quarter, translating to $0.40 per share.

The company's portfolio continued to show strength, with non-accruals improving to 0.90% of fair value at year-end. This is indicative of CION's disciplined investment and underwriting approach. The company's portfolio activity for the quarter included new investment commitments across 5 new and 15 existing portfolio companies, with the total number of portfolio companies increasing to 111 by year-end.

Liquidity and Capital Resources

As of December 31, 2023, CION had $1,092 million in total debt outstanding, with a weighted average interest rate of 8.5% for the quarter. The company also reported having $122 million in cash and short-term investments and $153 million available under its financing arrangements, positioning it well for future investment opportunities.

Looking Forward

Michael A. Reisner, co-Chief Executive Officer of CION, expressed optimism about the company's pipeline and the broader middle market lending landscape for 2024. The company's strategic positioning is expected to yield excellent risk-adjusted returns for shareholders.

CION has scheduled an earnings conference call to discuss the Q4 and year-end financial results, further demonstrating its commitment to transparency and shareholder communication.

For value investors and potential GuruFocus.com members, CION's latest earnings report underscores the company's financial resilience and strategic focus on delivering shareholder value. The company's disciplined investment approach and robust portfolio performance, coupled with a solid balance sheet, make CION a noteworthy consideration for those interested in the asset management industry.

For detailed financial tables and further information, please refer to the full 8-K filing.

Investors and analysts seeking more information can contact CION's Investor Relations or attend the upcoming earnings conference call.

Explore the complete 8-K earnings release (here) from CION Invt Corp for further details.

This article first appeared on GuruFocus.