Cirrus Logic Inc (CRUS) Posts Record Revenue in Q3 FY24

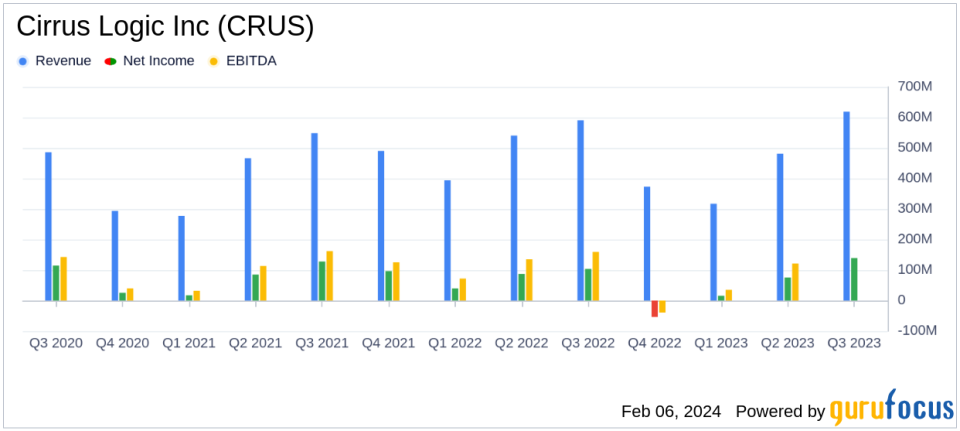

Revenue: Cirrus Logic Inc (NASDAQ:CRUS) reported a record revenue of $619.0 million for the fiscal third quarter.

Earnings Per Share (EPS): GAAP EPS was $2.50, while non-GAAP EPS reached $2.89.

Gross Margin: GAAP gross margin stood at 51.3%, with non-GAAP gross margin slightly higher at 51.4%.

Operating Expenses: GAAP operating expenses were $149.9 million, compared to non-GAAP operating expenses of $125.6 million.

Cash Position: The company ended the quarter with a strong cash and cash equivalents balance of $587.0 million.

Business Outlook: For the fourth quarter of FY24, revenue is expected to be between $290 million and $350 million with a GAAP gross margin between 49% and 51%.

On February 6, 2024, Cirrus Logic Inc (NASDAQ:CRUS) released its 8-K filing, announcing a record-breaking fiscal third quarter with revenue reaching $619.0 million. The company, a leading provider of integrated circuits for audio and voice signal processing applications, has seen its products gain traction in markets such as mobile devices, smart homes, and automotive applications, with a significant portion of its revenue generated in China.

Cirrus Logic's president and CEO, John Forsyth, expressed confidence in the company's performance and future, citing "record revenue and earnings per share" and advancements in product development and customer engagement. The company's focus on innovation and execution is expected to drive long-term shareholder value.

Financial Highlights and Performance Analysis

The company's financial achievements this quarter are particularly noteworthy in the semiconductor industry, which is characterized by high competition and rapid technological advancements. A strong gross margin indicates effective cost control and the ability to maintain profitable operations despite industry challenges. The reported increase in operating expenses on a GAAP basis reflects the company's strategic investments in research and development, which are essential for maintaining its competitive edge.

From the income statement, Cirrus Logic reported a net income of $138.7 million, with a basic earnings per share of $2.57 and diluted earnings per share of $2.50. The balance sheet shows a solid financial position with a total assets value of $2.2 billion and a total stockholders' equity of $1.8 billion, indicating the company's financial stability and potential for future growth.

The cash flow statement reveals a robust net cash provided by operating activities at $313.7 million, demonstrating the company's ability to generate cash from its core business operations. This is a critical metric for investors as it shows the company's operational efficiency and liquidity.

"Cirrus Logic delivered record revenue and earnings per share in the December quarter," said John Forsyth, Cirrus Logic president and chief executive officer. "With a compelling roadmap of products and an amazing track record of execution, we believe we are well-positioned to grow long-term shareholder value."

However, the company's business outlook for the fourth quarter of FY24 suggests a potential decrease in revenue, with expectations ranging between $290 million and $350 million. This forecast, coupled with an anticipated GAAP gross margin of 49-51%, may indicate upcoming challenges or market uncertainties that could impact Cirrus Logic's performance in the short term.

In conclusion, Cirrus Logic Inc (NASDAQ:CRUS) has demonstrated a strong fiscal performance in the third quarter of FY24, with record revenue and a solid cash position. While the company faces a dynamic and competitive market, its strategic focus on innovation and customer engagement positions it well for future growth. Investors and potential GuruFocus.com members should consider these factors when evaluating the company's long-term value proposition.

Explore the complete 8-K earnings release (here) from Cirrus Logic Inc for further details.

This article first appeared on GuruFocus.