Citi Trends Inc (CTRN) Reports Mixed Fiscal 2023 Results Amidst Economic Challenges

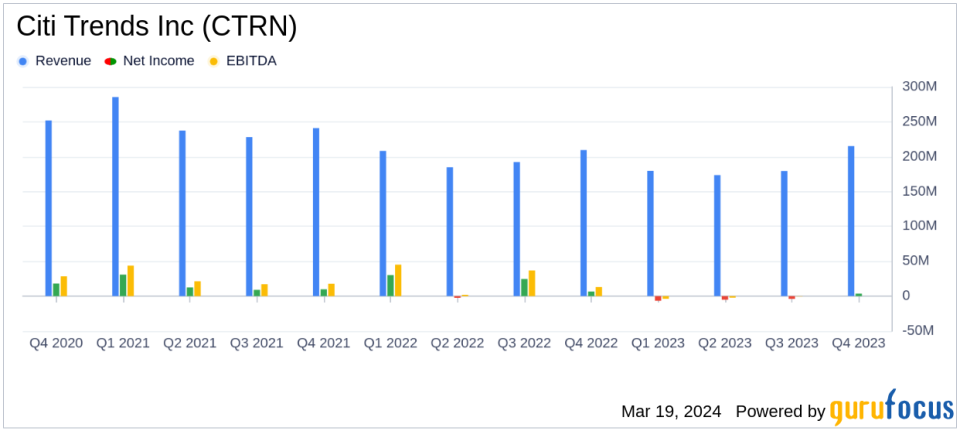

Total Sales: Reported a decrease of 5.9% in fiscal 2023, with Q4 sales up 2.7% year-over-year.

Comparable Store Sales: Decreased by 6.8% on a 52-week basis in fiscal 2023.

Gross Margin: Slight decrease to 38.1% in fiscal 2023 from 39.1% in the previous year.

Net Income/Loss: Posted a net loss of $12.0 million in fiscal 2023, compared to a net income of $58.9 million in 2022.

Liquidity: Ended fiscal 2023 with $155 million in liquidity, including $80 million in cash and no debt.

Store Count: Opened 5 new stores, remodeled 15, and closed 14, ending the year with 602 locations.

Fiscal 2024 Outlook: Expects mid-single digit comparable store sales growth and gross margin expansion.

On March 19, 2024, Citi Trends Inc (NASDAQ:CTRN), a leading retailer of urban fashion apparel and accessories, released its 8-K filing, announcing financial results for the fourth quarter and fiscal year 2023. The company, known for its value-oriented offerings primarily to African American and multicultural families, faced a challenging economic environment, reflected in its mixed financial performance.

Fiscal 2023 Performance Overview

Citi Trends reported total sales of $747.9 million for fiscal 2023, a decrease of 5.9% compared to the previous year. The company's comparable store sales also saw a decline of 6.8% on a 52-week to 52-week basis. Despite the sales downturn, Citi Trends maintained a strong liquidity position, ending the year with $155 million, including $80 million in cash and no outstanding debt.

The gross margin for the fiscal year slightly decreased to 38.1% from 39.1% in 2022. The company experienced an operating loss of $19.5 million, a significant shift from the operating income of $75.3 million reported in the prior year. Net loss for the year was reported at $12.0 million, compared to a net income of $58.9 million in 2022. This performance was attributed to various factors, including economic pressures such as inflation and shifts in consumer spending patterns.

Challenges and Strategic Initiatives

CEO David Makuen acknowledged the economic pressures faced by the company's core customers but expressed confidence in the strategic initiatives underway. Makuen highlighted the importance of rebuilding inventories, which drove improved comps in targeted product categories. He also emphasized leveraging analytics and operational improvements to advance assortment optimization and store experience upgrades.

We enter 2024 in a strong financial position with total liquidity of $155 million, including year-end cash of approximately $80 million. We are pleased to establish our 2024 outlook which represents healthy top line growth and improved profitability," said Makuen.

The company did not repurchase any shares in the fourth quarter of fiscal 2023, leaving $50.0 million available under its share repurchase program. For fiscal 2024, Citi Trends expects mid-single digit comparable store sales growth and a gross margin expansion of approximately 75 to 100 basis points, driven by ERP system benefits and freight expense leverage.

Investor Relations and Forward Outlook

Citi Trends plans to open up to 5 new stores, remodel approximately 40 stores, and close 10 to 15 underperforming stores as part of its ongoing fleet optimization. The company anticipates ending fiscal 2024 with approximately 595 stores and expects full-year capital expenditures to be around $20 million.

The company hosted a conference call to discuss the results and provide further insights into its strategies and outlook for the coming year. Investors and interested parties were invited to listen to the live broadcast or replay on the company's website.

As Citi Trends navigates the current retail landscape, it remains focused on delivering value to its customers and shareholders alike. The company's performance and strategic direction will continue to be closely monitored by investors seeking opportunities in the Retail - Cyclical sector.

Explore the complete 8-K earnings release (here) from Citi Trends Inc for further details.

This article first appeared on GuruFocus.