Citi Trends Inc: A Retail Powerhouse with Good Outperformance Potential

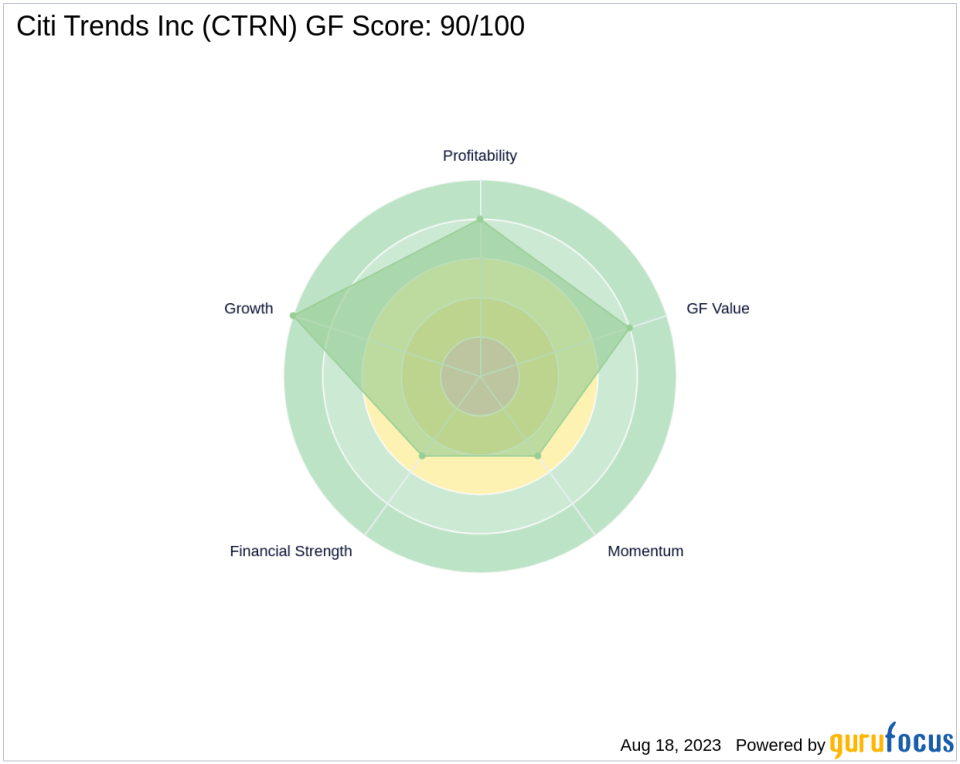

Citi Trends Inc (NASDAQ:CTRN) is a prominent player in the cyclical retail industry. As of August 18, 2023, the company's stock price stands at $21.97, reflecting a gain of 4.87% on the day and a 13.76% increase over the past four weeks. With a market capitalization of $182.635 million, Citi Trends Inc has a GF Score of 90 out of 100, indicating good outperformance potential. The GF Score is a comprehensive stock performance ranking system developed by GuruFocus, which considers five key aspects of a company's valuation: Financial Strength, Profitability Rank, Growth Rank, GF Value Rank, and Momentum Rank.

Financial Strength: A Closer Look

Citi Trends Inc's Financial Strength rank stands at 5 out of 10. This metric evaluates the robustness of a company's financial situation. Despite an interest coverage of 0.00, indicating a lack of data, the company's debt to revenue ratio is 0.34, suggesting a manageable debt burden. Furthermore, the company's Altman Z score of 2.87 indicates a moderate risk of financial distress.

Profitability Rank: A Strong Performer

The company's Profitability Rank is 8 out of 10, reflecting a high level of profitability. Despite a negative operating margin of -0.39%, the company's Piotroski F-Score of 5 suggests a stable financial situation. The company has also demonstrated consistent profitability over the past decade, with a profitability consistency score of 10.

Growth Rank: Stellar Growth Prospects

Citi Trends Inc's Growth Rank is a perfect 10 out of 10, indicating strong growth in terms of revenue and profitability. The company's 5-year revenue growth rate is an impressive 15.20%, and its 3-year revenue growth rate is 13.10%. Additionally, the company's 5-year EBITDA growth rate stands at a robust 35.80%.

GF Value Rank: Attractive Valuation

The company's GF Value Rank is 8 out of 10, suggesting that the stock is reasonably valued. This rank is determined by the price-to-GF-Value ratio, a proprietary metric that considers historical multiples and an adjustment factor based on past returns, growth, and future business performance estimates.

Momentum Rank: Moderate Momentum

Citi Trends Inc's Momentum Rank is 5 out of 10, indicating moderate momentum. This rank is determined using the standardized momentum ratio and other momentum indicators, reflecting the stock's performance over the past 12 months.

Competitor Analysis: Standing Tall Among Peers

When compared to its competitors in the same industry, Citi Trends Inc holds a strong position. The Cato Corp (NYSE:CATO) has a GF Score of 75, while Rent the Runway Inc (NASDAQ:RENT) and Lulus Fashion Lounge Holdings Inc (NASDAQ:LVLU) have GF Scores of 16 and 25, respectively. This comparison underscores Citi Trends Inc's superior performance potential. More details can be found on the competitors' page.

Conclusion: A Promising Investment Prospect

In conclusion, Citi Trends Inc's overall GF Score of 90 out of 100 suggests good outperformance potential. The company's strong profitability, impressive growth prospects, and reasonable valuation make it a promising investment prospect. However, investors should consider all aspects of the GF Score and conduct thorough research before making investment decisions.

This article first appeared on GuruFocus.