Citizens Community Bancorp Inc (CZWI) Reports Mixed Year-End Financial Results

Earnings Per Share (EPS): Q4 EPS rose to $0.35 from $0.24 in Q3, but annual EPS dropped from $1.69 to $1.25 year-over-year.

Net Interest Income: Decreased by $0.4 million in Q4 and $2.7 million from the same quarter last year.

Deposits: Grew by $46 million in Q4, showcasing robust deposit growth.

Book Value: Increased by 5% year-over-year, with tangible book value per share up 6% in Q4.

Dividend: Board of Directors increased annual dividend by 10% to $0.32 per share.

Asset Quality: Nonperforming assets slightly decreased, with improvements in asset quality.

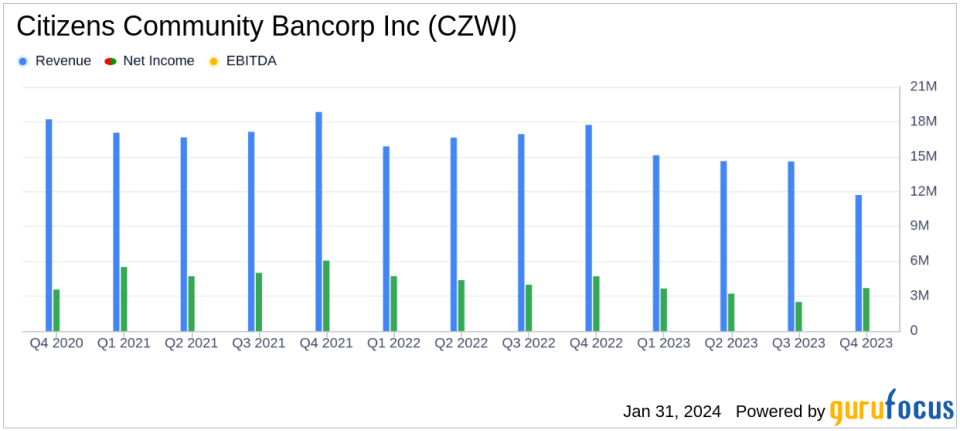

On January 29, 2024, Citizens Community Bancorp Inc (NASDAQ:CZWI) released its 8-K filing, detailing its financial performance for the fourth quarter and fiscal year ended December 31, 2023. The company, a bank holding entity that provides traditional community banking services, reported a mixed bag of financial results, with a notable increase in its quarterly earnings per share (EPS) to $0.35, up from $0.24 in the previous quarter. However, the annual EPS saw a decline from $1.69 to $1.25 when compared to the previous fiscal year.

The bank's net interest income experienced a downturn, decreasing by $0.4 million in the fourth quarter relative to the third quarter, and by $2.7 million from the fourth quarter of the previous year. Despite this, the bank's deposit growth was strong, with an increase of $46 million in the fourth quarter, reflecting the company's business priorities and its ability to attract and retain customer deposits.

Book value per share increased to $16.60, up from $15.80 at the end of the previous quarter, and from $16.03 year-over-year. The tangible book value per share also saw a significant increase, rising by 6% in the fourth quarter to $13.42. This increase was attributed to a combination of factors, including lower accumulated other comprehensive loss, net income, and intangible amortization.

In a statement by Stephen Bianchi, Chairman, President, and CEO, he highlighted the positive impacts of net interest margin stabilization, favorable credit events, and continued deposit growth. He also noted the increase in tangible book value per share and the tangible common equity to tangible asset ratio.

"The quarter was favorably impacted by stabilization in the net interest margin after removing the nonaccrual interest pick up in the linked quarter, and favorable credit events which included net recoveries in the quarter and for the year and negative provision expense. Deposit growth continued in the quarter reflecting our business priorities while expenses were managed lower in 2023 despite inflationary pressures. Tangible book value per share increased 6% to $13.42 per share and our tangible common equity to tangible asset ratio increased to 7.71%," stated Stephen Bianchi.

Asset quality showed slight improvement with nonperforming assets decreasing marginally to $15.4 million, or 0.83% of total assets, compared to $15.5 million or 0.85% at the end of the previous quarter. The bank's efficiency ratio worsened to 72% for the quarter ended December 31, 2023, compared to 67% for the previous quarter, mainly due to branch closure expenses and lower net interest income.

The Board of Directors declared an increased annual dividend of $0.32 per share, marking a 10% rise, which is payable to shareholders of record as of February 9, 2024. This decision reflects the company's commitment to returning value to its shareholders despite the challenges faced over the fiscal year.

Overall, Citizens Community Bancorp Inc (NASDAQ:CZWI) demonstrated resilience in a challenging environment, with strong deposit growth and an increased dividend payout signaling confidence in its business model and future prospects. However, the decline in annual earnings and net interest income suggests that the company is not immune to the broader economic pressures affecting the banking sector.

These financial results are preliminary until the Form 10-K is filed in March 2024. For more detailed financial information and analysis, investors are encouraged to review the full earnings report and subsequent SEC filings.

Explore the complete 8-K earnings release (here) from Citizens Community Bancorp Inc for further details.

This article first appeared on GuruFocus.