Citizens Financial Group Inc Reports Mixed Q4 Results Amid Economic Headwinds

Net Income: Q4 net income fell to $189 million, with EPS at $0.34.

Revenue: Total revenue decreased by 1% QoQ to $1.988 billion.

Efficiency Ratio: Underlying efficiency ratio worsened slightly to 63.8%.

Credit Quality: Provision for credit losses was $171 million, with NCO ratio at 0.46%.

Capital Strength: CET1 ratio improved to 10.6%, reflecting a robust balance sheet.

Dividend: Announced a quarterly common stock dividend of $0.42 per share.

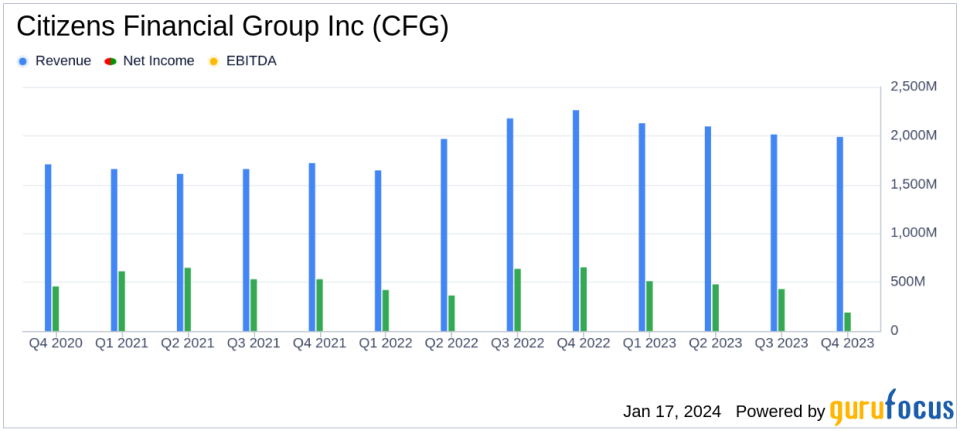

Citizens Financial Group Inc (NYSE:CFG) released its 8-K filing on January 17, 2024, detailing its financial performance for the fourth quarter of 2023. The bank reported a net income of $189 million, or $0.34 per diluted share, a significant decrease from the $653 million, or $1.25 per diluted share, reported in the same quarter of the previous year. The underlying net income stood at $426 million, or $0.85 per diluted share, compared to $685 million, or $1.32 per diluted share, in Q4 2022.

Citizens Financial Group, headquartered in Providence, Rhode Island, operates primarily in the Northeast with over 1,000 branches and more than $220 billion in total assets. The company's two main segments, consumer and commercial banking, offer a wide range of retail and commercial products, including capital markets and wealth management services.

Financial Performance Overview

The bank's total revenue for the quarter was $1.988 billion, a slight decrease from the $2.014 billion reported in the previous quarter and down from $2.200 billion year-over-year. The net interest income (NII) declined by 2% quarter-over-quarter, attributed to a lower net interest margin (NIM), which fell from 3.03% to 2.91%. This was partly offset by a modest increase in interest-earning assets. Noninterest income saw a 2% increase quarter-over-quarter, with improvements in Capital Markets and Wealth, although this was partly offset by lower Mortgage Banking fees.

On the expense side, noninterest expense was reported at $1.612 billion, stable quarter-over-quarter, including investments in the Private Bank start-up. The underlying efficiency ratio was 63.8%, or 61.9% excluding Private Bank start-up investment, indicating a slight increase in costs relative to revenue.

The provision for credit losses was $171 million, with the allowance for credit losses to loans ratio increasing by 4 basis points quarter-over-quarter to 1.59%. The period-end loans decreased by 3%, and average loans decreased by 2% due to balance sheet optimization, including Non-Core portfolio run-off.

Capital and Liquidity

Citizens Financial Group's capital ratios remained strong, with a CET1 ratio of 10.6%, up from 10.4% in the previous quarter. The tangible book value per share increased by 11% quarter-over-quarter to $30.91, reflecting a solid balance sheet and prudent capital management.

Management Commentary

We continue to execute well and posted solid performance in Q4, said Chairman and CEO Bruce Van Saun. Our balance sheet is very strong, as we bolstered CET1 to 10.6%, lowered our LDR to 82%, enhanced our liquidity profile, which now exceeds Category 1 bank LCR requirements, and reduced FHLB advances to $3.8 billion. We are seeing less pressure on deposit costs and NIM, fees are beginning to rebound, expenses remain well controlled, and credit costs are as expected. Key strategic initiatives like the Private Bank, NYC Metro, TOP 9 and Non-Core are all on track, positioning us well for medium-term growth and enhanced returns. I would like to thank our colleague base for their hard work and dedication in serving our customers well and building a great bank.

The bank also declared a quarterly common stock dividend of $0.42 per share, payable on February 14, 2024, to shareholders of record as of January 31, 2024. Notably, there were no share repurchases during the quarter due to the decision to pause to cover the impact of the industry-wide FDIC special assessment.

Looking Forward

Despite the challenges posed by economic headwinds, Citizens Financial Group's underlying financial strength and strategic initiatives suggest a resilient positioning for future growth. The bank's focus on optimizing its balance sheet and managing expenses, coupled with its robust capital and liquidity levels, provide a solid foundation as it navigates the evolving economic landscape.

Investors and stakeholders are encouraged to review the detailed financial tables and other information available on the Investor Relations portion of the company's website at www.citizensbank.com/about-us.

Explore the complete 8-K earnings release (here) from Citizens Financial Group Inc for further details.

This article first appeared on GuruFocus.