City Holding Co Reports Record Annual Earnings for 2023

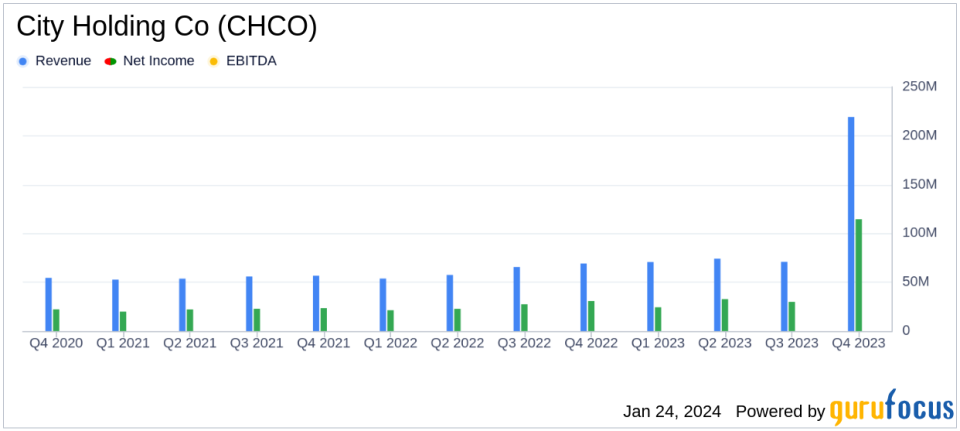

Net Income: Record $114.4 million for the year ended December 31, 2023.

Diluted Earnings Per Share: Record high of $7.61, reflecting robust profitability.

Net Interest Income: Increased by 21.5% to $219.2 million for the year.

Asset Quality: Nonperforming assets to total loans ratio slightly increased to 0.21%.

Loan Growth: Excluding acquisitions, loans grew by 6.2% over the year.

Capital and Liquidity: Tangible equity ratio improved to 8.6%, with strong capitalization levels.

Dividends: Quarterly cash dividend of $0.715 per share declared, payable January 31, 2024.

On January 24, 2024, City Holding Co (NASDAQ:CHCO) released its 8-K filing, announcing record net income and diluted earnings per share for the year ended December 31, 2023. The company, a financial holding entity, operates through a network of banking offices in West Virginia, Virginia, Ohio, and Kentucky, offering a range of financial products and services.

Despite a challenging year for the banking industry, CHCO's President and CEO Charles Hageboeck highlighted the company's strong performance, attributing it to a deep customer base and conservative operating principles. The acquisition of Citizens Commerce Bancshares, Inc. bolstered CHCO's market position in central Kentucky, contributing to a 6% loan growth, excluding loans acquired from Citizens.

Financial Performance and Challenges

CHCO's net interest income saw a significant increase, driven by higher loan yields and the acquisition of Citizens. The company's net interest margin improved from 3.33% in 2022 to 4.01% in 2023. However, the cost of deposits also rose, reflecting the impact of market rate increases. Asset quality remained strong, with a modest increase in nonperforming assets ratio from 0.17% to 0.21%. The company's credit quality metrics indicate a well-managed loan portfolio, although the slight uptick in nonperforming assets warrants monitoring.

Financial Achievements

CHCO's record earnings are a testament to its financial resilience and strategic growth initiatives. The company's ability to maintain a strong asset quality and achieve loan growth in a challenging environment underscores its operational strength. The increase in net interest income and the improved tangible equity ratio highlight CHCO's robust financial position, which is crucial for sustaining growth and shareholder returns in the competitive banking industry.

Key Financial Metrics

The company's financial achievements are reflected in several key metrics:

"During 2023, City completed the acquisition of Citizens Commerce Bancshares, Inc., and its subsidiary, Citizens Commerce Bank ('Citizens') of Versailles, Kentucky, that enhanced our market position in central Kentucky."

This strategic move contributed to the company's loan portfolio expansion and reinforced its market presence. Additionally, CHCO's disciplined approach to share repurchases, repurchasing all shares issued for the acquisition of Citizens, demonstrates a commitment to shareholder value.

Analysis of Company's Performance

CHCO's performance in 2023 reflects a well-executed strategy in a challenging economic landscape. The company's focus on maintaining a strong balance sheet, prudent risk management, and strategic acquisitions has paid off, resulting in record earnings. The growth in checking accounts and the ability to navigate the rising cost of deposits are indicative of CHCO's competitive edge and customer-centric approach.

The company's capital and liquidity positions remain robust, with a strong loan to deposit ratio and high regulatory capital ratios, ensuring CHCO is well-positioned for future growth. The planned branch closure in Lexington, Kentucky, is a strategic decision to optimize the branch network and enhance operational efficiency.

City Holding Co's record earnings for 2023 demonstrate the company's resilience and strategic acumen, positioning it well for continued success in the banking sector.

Explore the complete 8-K earnings release (here) from City Holding Co for further details.

This article first appeared on GuruFocus.